- The Wall Street Rollup

- Posts

- What You Need To Know For November 6th

What You Need To Know For November 6th

OpenAI wants a handout and The Big Short Part II

Welcome back. Well the AI news never ends.

OpenAI’s CFO Sarah Friar floated the idea of the government backstopping their AI chip and data center investments. Friar called out how federal loan guarantees could really lower cost of financing and increase LTV. Friar also said “markets aren’t exuberant enough about AI” and said they’re not ready for an IPO quite yet. This comes after Sam Altman’s freakout last week when asked how OpenAI would finance its $1.4T in spending commitments, and as Sam recently stated in an interview that the federal government is “the insurer of last resort”.

Obviously, if the government does subsize OpenAI and other AI investment this would be quite bullish, but the flip side draws a genuine question - why the hell is OpenAI’s CFO fishing for a government handout? The initial reaction from the public is naturally quite negative and we should see a bunch of headlines on this today as people continue to question why OpenAI would need their losses subsidized.

On Tuesday, we put out our WSR Investing Club note on $XPEL ( ▲ 0.97% ) which had overall solid results yesterday, with CEO Ryan Pape estimating 1,000 basis point improvement in margin by end of ‘28 after investments into manufacturing. You can upgrade to WSR Investing Club here.

Two important housekeeping notes:

Students - listen up: We are adding to our bench at The Wall Street Rollup. Ideally a ‘28 grad but ‘27 and ‘29 students will be considered. Reply to our email to apply.

Access to our M&A data: As you saw, we’re aggregating our M&A transaction datapoints into one easy to navigate dashboard. For access for ‘25 YTD data, Upgrade here.

Let’s get into it.

Earnings Corner 📈 📉

Palantir $PLTR ( ▲ 4.53% ) Top and bottom line beat, with revenue up 63% to $1.18B and EPS of $0.21 topping estimates by $0.04, driven by strong AI adoption and booming U.S. government demand. Commercial sales more than doubled as new deals with Snowflake, Lumen, and Nvidia added momentum. The company raised Q4 and full year guidance.

Uber $UBER ( ▼ 0.59% ) Revenue beat estimates, rising 20% to $13.47B, while EPS of $3.11 beat largely by a one time tax and investment gains. Trips hit a record 3.5B and bookings grew 21%, underscoring solid demand across mobility and delivery. The company guided to higher Q4 bookings and steady margins, but shares slipped as investors focused on slower profit growth and long-term autonomous vehicle investments.

Shopify $SHOP ( ▲ 0.73% ) Results missed on profit despite strong sales and GMV growth, underscoring resilient e-commerce demand but ongoing margin pressure as tariffs and competition weigh.

Spotify $SPOT ( ▲ 2.39% ) Topped forecasts as subscriber growth fueled strong revenue gains, even as ad sales softened. The results highlight streaming’s shift toward paid subscriptions over ads as competition and pricing pressures reshape the industry.

Norwegian Cruise Line $NCLH ( ▲ 7.47% ) Posted record bookings and revenue but shares slipped as more family travelers pressured pricing and yields. Cruise lines are seeing booming demand but thinner margins in a more promotional leisure market.

AMD $AMD ( ▲ 8.28% ) Strong AI and gaming driven growth, but margin guidance only came in line. A new OpenAI partnership and strong data center momentum highlights AMD’s push to close the gap with Nvidia’s AI lead.

Marriott $MAR ( ▲ 2.08% ) Hotel revenue growth stayed modest, with luxury and overseas strength balancing weaker U.S. travel. Record pipelines point to solid expansion ahead.

Cava $CAVA ( ▲ 8.38% ) Cut its outlook again as visits from younger diners slowed down, citing higher unemployment, student loan repayments, and tariff uncertainty. Despite steady demand and new openings, margins narrowed as costs outpaced sales, signaling pressure across the fast casual space.

Qualcomm $QCOM ( ▲ 0.76% ) Reported better then expected sales and profit as chip demand stayed solid, though a one time $5.7B tax charge tied to Trump’s new law left a paper loss. Upbeat guidance and new AI chips underscored its push to challenge Nvidia and AMD.

Mcdonald’s $MCD ( ▲ 1.14% ) Lower income traffic fell nearly double digits, even as sales rose on higher prices, a sign fast food’s “value” push is not winning back budget diners.

Novo Nordisk $NVO ( ▲ 9.92% ) Growth stayed strong but pricing pressure and competition in GLP-1 drugs is pressuring the business.

Robinhood $HOOD ( ▲ 13.95% ) Revenue doubled as crypto trading surged 300% and new ventures like banking and prediction markets took off, showing Robinhood’s push to become a full service finance platform is gaining traction.

Snapchat $SNAP ( ▲ 1.95% ) Stock soared 25% on earnings beat and $500M buyback, with a $400M AI deal signaling Snap’s push to monetize beyond ads even as user rules tighten.

For deeper, stock market research upgrade to the WSR Investing Club for 50% for a limited time

CTV ads made easy: Black Friday edition

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting — plus creative upscaling tools that transform existing assets into CTV-ready video ads. Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Today’s Headlines 🍿

Wall Street bonuses are set to rise, with the expectation of equity sales and trading comp rising up to 25% y/y

Remember, Buyside Hub is the largest database of wall street bonus data out there - access for free here.

Supreme Court questions Trump’s tariff powers under emergency law: Justices from both sides pressed Trump’s lawyer on whether using a 1977 emergency law to impose sweeping tariffs violated Congress’s constitutional authority over taxes and trade. Chief Justice Roberts and others cited the “major questions” doctrine, suggesting such actions require clear congressional approval. Trump’s team argued the tariffs, imposed under the International Emergency Economic Powers Act, were justified by economic threats - as of now, it looks like tariffs are going to get rolled back by the Supreme Court, a big driver in yesterday’s market rally. Kalshi odds have Trump’s odds of winning at only 30%

Elon’s Pay Package is up for a vote today: Tesla shareholders will decide if the CEO deserves a new pay package worth up to $1 trillion over the next decade. The company would need to hit several major milestones for Musk to receive the full award, including reaching a market cap of $8.5 trillion

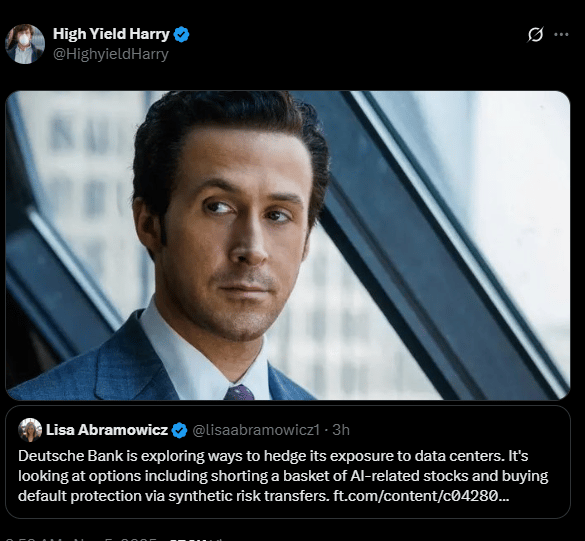

Deutsche Bank’s AI Data Center “Big Short” play: Welcome back Ryan Gosling. DB is evaluating shorting a basket of AI stocks or buying default protection to hedge their data center exposure:

Deutsche Bank eyes hedges for billions in data center debt amid AI/cloud surge:

- shorting AI stocks basket or

- SRT derivatives for default protection

1. Identify a diversified pool (e.g., $1B+ loans to firms like EcoDataCenter/5C).

2. Structure tranches: Investors absorb— Saemin Ahn - seldom malice, full commit - Max.ΔV (@Saemin4655)

5:23 AM • Nov 5, 2025

‘Big Short’ Burry bets against AI giants: DB and Burry both shorting the same thing? Welcome back, The Big Short. Scion Asset Management revealed bearish bets on Nvidia ($187.6M in puts) and Palantir ($912M in puts). The famed 2008 crash predictor recently returned to X, warning of market bubbles. Despite strong earnings, analysts say valuations look stretched, while Alex Karp called Burry’s short “batsh*t crazy”

AI sell-off hits Japan’s Nikkei: Markets appear to be recovering, but yesterday, Asian markets fell sharply, led by a 2.5% drop in Japan’s Nikkei 225 amid steep losses in AI-linked stocks like SoftBank, down over 10%. South Korea’s Kospi slid nearly 3% as Samsung and SK Hynix weakened

Amazon surges after OpenAI cloud deal: Amazon signed a $38B agreement to host OpenAI’s workloads on AWS, signaling a turnaround in its AI strategy after losing cloud share to Microsoft and Google. Analysts say the deal could boost AWS’s backlog by 20% in Q4, helping justify Amazon’s $125B in annual AI infrastructure spending

Zohran Mamdani elected NYC’s first Muslim Mayor: The 34-year-old democratic socialist defeated Andrew Cuomo. In his victory speech, Mamdani named antitrust advocate Lina Khan to his transition team. The President vowed to take on Mamdani, warning that he may withhold federal funds and tighten voting rules

First Brands sues Patrick James over lavish spending: The bankrupt auto-parts supplier accused founder of diverting millions for personal luxuries, including $500K on a private chef, $3M for a townhouse, and $100M in transfers to his own accounts. The lawsuit alleges fraudulent financing tied to fake invoices and double-pledged collateral

Top financiers warn of private credit risks: TCW CEO Katie Koch said she’s “very nervous” about parts of the $1.7T market, while Davidson Kempner’s Tony Yoseloff called it a “race to the bottom” on loan covenants. Apollo’s Marc Rowan and PAG’s Chris Gradel cited risks from offshore jurisdictions, liquidity mismatches, and open-ended funds, urging tighter oversight

EQT’s warning for private equity: EQT chief Per Franzen cautioned the industry against chasing money from individual investors, warning that an aggressive fundraising approach could damage credibility. Franzen is concerned that asset growth may be prioritized over substance, and recommends that firms apply the same underwriting standards when pursuing retail cash as they do when conducting due diligence for institutional clients

Apollo backed out of a deal to acquire Papa John’s: The PE firm pulled its bid to take Papa John’s private at $64 a share, causing the pizza maker’s stock to drop 21% ahead of its Q3 earnings report on Thursday

In other pizza land news, Pizza Hut is up for sale. Parent company Yum Brands has initiated a strategic review of the chain, and stated that helping the brand reach its full value “may be better executed outside of Yum Brands.” The chain has struggled to compete in a crowded pizza market, with U.S. sales down 7% YTD

Data center worries: Investors continue to pour billions into data centers, but a lack of visibility around the long-term demand for computational power points to distress ahead for some players. AlixPartners polled 400 senior executives in the data center industry, and 61% anticipate distress driven by rising energy costs, competition, and technology disruption

Flight Cuts are coming: The government shutdown is officially the longest in U.S. History, and the FAA announced plans to reduce air traffic by 10% at 40 high-traffic areas across the country starting Friday morning. The move was deemed appropriate to ensure safety and to take the pressure off of air traffic controllers who are set to miss their 2nd consecutive paycheck

PE’s mobile home game: Large-scale buyouts by PE firms are driving up rents at mobile home parks, leading to a rise in evictions for many low-income residents

BNP Paribas shakes up its UK coverage team: The French lender named new leaders to the group in hopes of boosting its standing in the country

iHeart’s big rally: Shares are up over 50% this week on news that Netflix is in talks to license video podcasts distributed by iHeart

M&A Transactions💭

Starbucks (NAS: SBUX) and Boyu Capital announce Joint Venture for the next chapter of growth in China. Under the agreement, Boyu and Starbucks will operate a joint venture with Boyu holding up to 60% interest in Starbucks retail operations in China. Starbucks will retain a 40% interest in the JV and will continue to own and license the Starbucks brand and IP to the new entity. Boyu will acquire its interest based on a cash-free, debt-free enterprise value of approximately $4.0B.

Caulipower, the cauliflower pizza crust maker, was acquired by Urban Farmer, via its financial sponsor Paine Schwartz Partners, for an undisclosed amount.

Xanadu, operator of a quantum photonic platform, has reached a definitive agreement to be acquired through a $500.0M reverse merger by Crane Harbor Acquisition. Resulting in the combined entity trading on the Toronto Stock Exchange and Nasdaq. Cohen & Company Capital Markets and Morgan Stanley advised on the transaction.

Westfield Bank, provider of comprehensive banking services, was acquired for $325.0M by First Financial Bank (NAS: FFBC). Stifel Financial and Keefe, Bruyette & Woods advised on the sale.

Tompkins Insurance Agencies, provider of insurance and risk management solutions, was acquired for $223.0M by Arthur J. Gallagher & Company (NYS: AJG). Piper Sandler advised on the sale.

Solaris Health, operator of a healthcare platform, was acquired for $1.9B by Cardinal Health (NYS: CAH). Centerview Partners advised on the sale.

PRS REIT (LON: PRSR), a real estate investment trust, has entered into a definitive agreement to be acquired for GBP 628.86M by Waypoint Asset Management. EV/Net Income was 8.42x and EV/Revenue was 6.05x. Singer Capital Markets and UBS Group advised on the sale.

Peak Mining, developer of a financial platform, has reached a definitive agreement to be acquired for $200.0M by an undisclosed investor. The proposed deal includes $50.0M in up-front proceeds and up to $150.0M in deferred consideration related to a profit share pursuant to mining operations.

Apollo Global Management has reached a definitive agreement to acquire a stake in the Hornsea 3 Wind Farm for DKK 39.0B.

New Gold (TSE: NGD), participates in the development and operation of intermediate mining properties, has reached a definitive agreement to be acquired for CAD 7.0B by Coeur Mining (NYS: CDE). EV/EBITDA was 9.12x and EV/Revenue was 4.25x. CIBC Capital Markets and National Bank Capital Markets advised on the sale.

Kenvue (NYS: KVUE), the world’s largest pure-play consumer health company, has reached a definitive agreement to be acquired for $49.059B by Kimberly-Clark (NAS: KMB). EV/EBITDA was 17.14x and EV/Revenue was 3.27x. Goldman Sachs advised on the sale.

IMG Arena US, operator of a sports data platform, was acquired for $225.0M by Sportradar Group (NAS: SRAD). The Raine Group advised on the sale.

Denny’s (NAS: DENN), America’s franchised full-service restaurant chains, has entered into a definitive agreement to be acquired for $620.0M by Yadav Enterprises, TriArtisan Capital Advisors, and Treville Capital Group. EV/EBITDA was 12.52x and EV/Revenue was 1.36x. Truist Securities advised on the sale.

Burgundy Asset Management, operator of an asset management firm, was acquired for CAD 625.0M by BMO Financial Group (TSE: BMO). PJT Partners and Origin Merchant Partners advised on the sale.

Sixth Street Partners has entered into a definitive agreement to acquire The US Onshore Pipeline Assets of BP through a $1.5B LBO.

Eaton (NYS: ETN) has reached a definitive agreement to acquire The Thermal Management Solutions Business of Boyd for approximately $9.5B. J.P. Morgan and Goldman Sachs advised on the sale.

The Private Credit Business of Affiliated Managers Group (NYS: AMG) was acquired for $937.5M by Manulife Financial (TSE: MFC). Bank of America advised on the sale.

TriMas Aerospace, manufacturer of precision-engineered aerospace specialty products, has entered into a definitive agreement to be acquired for $1.45B by Blackstone and Tinicum. EV/Revenue was 3.88x. Bank of America and PJT Partners advised on the sale.

Pearce Services, provider of maintenance, repair, installation, and engineering services focused on telecom, was acquired for $1.2B by CBRE Group.

Lanteris Space Systems, provider of space technology, has reached a definitive agreement to be acquired for $800.0M by Intuitive Machines (NAS: LUNR). EV/Revenue was 1.27x.

Kinetic Group Services, provider of public transportation services, has entered into a definitive agreement to be acquired for AUD 2.8B by TPG. Macquarie Group advised on the sale.

Hanley Energy, operator of a critical power and energy management company, has reached a definitive agreement to be acquired for $783.0M by Jabil (NYS: JBL).

Delta Agribusiness, provider of agronomy advisory services, was acquired for $4475.0M by Elders (ASX: ELD). EV/Revenue was 7.01x. UBS Group advised on the sale.

Better Medical, operator of general practice medical clinics, has reached a definitive agreement to be acquired for AUD 159.0M by Medibank Private (ASX: MPL). EV/Revenue was 11.29x.

Aspy Global Services, provider of occupational risk prevention and regulatory compliance services, has reached a definitive agreement to be acquired for EUR 145.0M by Laboratorio Echevarne.

Usinas Siderurgucas de Minas Gerais (BVMF: USIM3), a Brazil-based company engaged in producing and distributing flat steel products, has reached a definitive agreement to be acquired for $315.386M by Ternium (BVMF: TXSA34). EV/EBIDTA was 8.78x and EV/Revenue was 0.07x.

Borusan Tedarik, provider of supply chain and transportation services, was acquired for $383.2M by Borusan Holding.

Private Placement Transactions💭

Sidewalk Infrastructure Partners, operator of an investment holding company, raised $100.0M of venture funding from undisclosed investors.

Hippocratic AI, developer of a healthcare platform, raised $141.0M of Series B venture funding led by Kleiner Perkins at a pre-money valuation of $1.5B.

EXUGlobal, developer of cryptocurrency trading platform, raised $120.0M of Series B venture funding led by Sequoia Capital, YZi Labs, The Goldman Sachs Group, and Granite Asia at a pre-money valuation of $1.08B.

Aavantarde, developer of a gene therapy biotechnology company, raised $143.0M of Series B venture funding led by Schroders.

Beacon Software, developer of an AI-powered software engineering agent technology, raised $250.0M of Series B venture funding led by General Catalyst, Lightspeed Venture Partners, and D1 Capital Partners at a pre-money valuation of $750.0M.

MoEngage, developer of a marketing customer engagement platform, raised $100.0M of Series F venture funding led by Goldman Sachs Growth Equity and A91 Partners.

Mind Robotics, manufacturer of AI-driven robotic systems, raised $115.0M of seed funding led by Eclipse Ventures.

Braveheart Bio, developer of a cardiac myosin inhibitor, raised $185.0M of Series A venture funding led by OrbiMed, Forbion, and Andreessen Horowitz.

Armis, developer of an asset intelligence cybersecurity platform, raised $435.0M of venture funding led by The Goldman Sachs Group at a pre-money valuation of $5.67B.

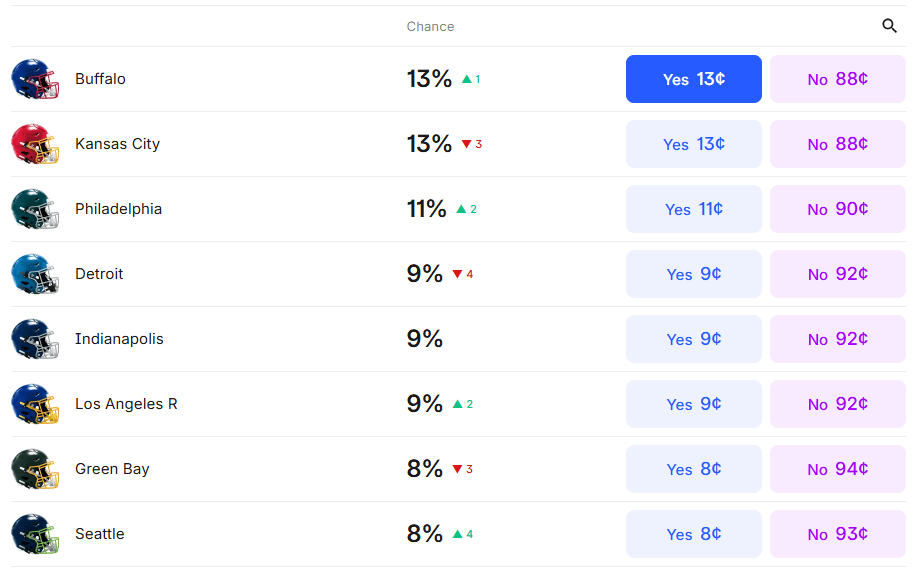

Odds of the Day 🍒

Kalshi traders don’t have a clear frontrunner for whoever is going to win the Super Bowl.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc

WSR Investing Club Disclaimers:

Disclosures: I, the sole owner of High Yield Harry LLC, do not own an equity position in $XPEL ( ▲ 0.97% ) at this time. The part-time writer of this piece on $XPEL ( ▲ 0.97% ) holds a position in the name.

This publication is for informational and educational purposes only and should not be construed as investment, legal, tax, or financial advice. We are not registered investment advisers or broker-dealers, and this newsletter is distributed under the “publisher’s exclusion” of the Investment Advisers Act of 1940. The content provided is impersonal and general in nature; it does not take into account your individual objectives, financial situation, or needs. Investing in securities involves risk, including the possible loss of principal, and past performance is not indicative of future results. You should consult with a qualified financial professional before making any investment decisions.

While we strive for accuracy, all information is provided “as is” without warranty of any kind. We may hold positions in securities mentioned and may trade in or out of such positions without notice. Opinions are subject to change without notice, and certain statements may include forward-looking information that is inherently uncertain. Neither the authors nor any affiliated parties accept liability for any losses or damages arising from the use of this publication.