- The Wall Street Rollup

- Posts

- What You Need to Know for September 25th

What You Need to Know for September 25th

OpenAI's Circular Deal and Cov Lite Datapoints

Together with CreditSights

Welcome back!

First, we have to victory lap - we put out a WSR Investing Club piece on Kingstone Companies on Tuesday. On Wednesday, $KINS ( ▲ 0.38% ) raised guidance. This speaks to the hard work the WSR Investing Club team is doing to find good, value stock ideas. Join the WSR Investing Club here.

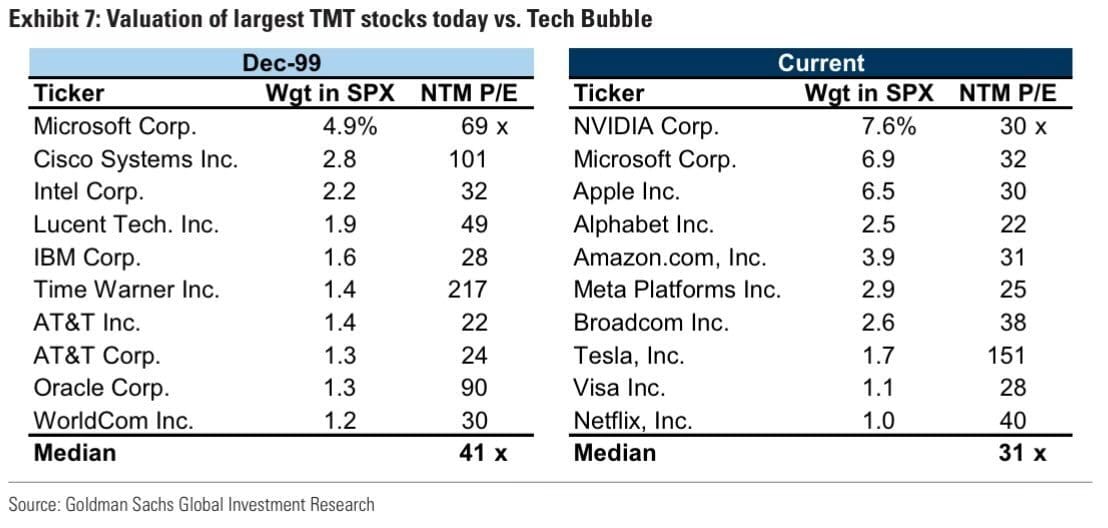

Stocks have hit a bit of a snag the past few days as Powell called the market “fairly highly valued” and there’s been some AI-related sluggishness. NVIDIA’s $100B deal with OpenAI drew criticism from a lot of market participants as “circular” where the deal props up Nvidia’s ecosystem and adds questions about the concentration risk and ROI related to these massive outlays. With OpenAI projected to spend up to $850B on nuclear plants, Ackman has defended his company’s efforts and said “This is what it takes to deliver AI.”

I can’t help but have today’s meme of the day right at the top…

Let’s get into it.

Earnings Corner 📈 📉

AutoZone $AZO ( ▲ 0.08% ) Miss on both revenue and EPS as margins were hit by an $80M LIFO charge and heavier SG&A from record store openings. DIY visits edged lower, but strong commercial sales and international comps helped offset. Management flagged ongoing tariff-driven cost inflation and further LIFO pressure near term, though Hub/MegaHub expansion remains a key growth driver.

Micron $MU ( ▲ 2.59% ) Reported a strong Q4 top and bottom line beat. Revenue came in at $11.3B and EPS of $3.03, driven by record $2B HBM sales and AI-fueled DRAM demand. Gross margins hit 45.7% and they issued guidance of $12.5B which topped estimates. Shares sank initially as investors weren’t impressed after the stock’s huge run this year and questions lingered on how long AI-driven demand can hold. The pullback later reversed as big banks including Deutsche Bank (PT $200) and TD Cowen ($180) raised targets, citing tight HBM supply, durable pricing, and Micron’s share gains versus SK Hynix.

KB Homes $KBH ( ▲ 0.76% ) Revenue had a slight beat coming in at $1.62B vs. $1.59B and EPS also beat. Deliveries fell 7% and gross margins slipped to 18.2% on pricing pressure and higher land costs, though management pointed to better build times and cost disciplines. Full year guidance calls for $6.1-$6.2B in housing revenue and margins near 19%, with buybacks continuing to support EPS. The stock is up after hours.

For deeper, stock market research upgrade to the WSR Investing Club

Tight spreads and rising refinancing risk demand a clear plan. Drawing on 25 years of independent research, we lay out practical moves to capture higher-quality carry, navigate refinancing calendars, and safeguard liquidity across cycles. What’s inside:

• 5 actionable portfolio strategies

• Where opportunities are today (by sector and quality)

• How data and AI are reshaping credit research and execution

Today’s Headlines 🍿

OpenAI’s and NVIDIA’s circular deal: Like we previewed, the companies announced a new partnership, with NVIDIA agreeing to invest $100B into OpenAI to build out data centers - that will be equipped with NVIDIA chips. The chipmaker is on pace to complete over 50 venture deals such as this one in 2025, fueling concerns about whether it is investing to prop up the market and keep companies spending on its products

Alibaba to boost AI spend beyond its original $50B target: CEO Eddie Wu predicts worldwide AI investment will reach $4 trillion over the next five years, and Alibaba must increase their spending to keep pace. The company has plans to invest in both services and infrastructure, including chips and three new data centers in Brazil, France, and the Netherlands this year

Government shutdown latest: Healthcare funding is the main holdup as the October 1st deadline nears. Trump has refused to meet with Senate Democrats to discuss Medicaid changes and extending Affordable Care Act credits, saying the meeting would be unproductive. 60 votes are needed in the senate to extend funding

The U.S. is working to stabilize Argentina: The U.S. plans to extend a $20B swap line and is prepared to buy the country’s bonds, offering financial support to President Milei as he tries to regain investor confidence and stabilize the plunging peso

Powell’s comments on Tuesday call out a weakening labor market, stating that increased downside risks to employment now outweigh the upside risks to inflation, signaling future rate cuts. He reiterated that uncertainty around inflation remains high, and that the Fed will make sure the one-time price increase from tariffs does not become an ongoing problem

Powell also spoke on the market, saying that “ equity prices are fairly highly valued” - a comment that pushed stocks into the red Tuesday

Chicago Fed President warns of over-agression: FOMC member Austan Goolsbee stated that inflation that has remained above the Fed’s target for years calls for a more careful approach. He supports lowering rates at a gradual pace, but only after they can “get this stagflationary dust out of the air”

Kimmel blackout map: Disney restored “Jimmy Kimmel Live!”, reaching 6.26mm viewers, but Sinclair and Nexstar are still pre-empting it across more than a quarter of ABC affiliates, blacking out big markets like D.C., Seattle and Salt Lake City. Their stations reach about 23% of U.S. households and say the blackout will continue while talks with ABC proceed amid FCC Chair Brendan Carr’s warnings and a broader free-speech fight

Disney hikes streaming prices again: Starting Oct 21, Disney+ with ads will jump to $11.99 a month and the ad-free tier to $18.99, with bundles including Hulu, ESPN and HBO Max also rising

First Brands is set to file - the troubled car parts supplier is in talks with lenders for a $1.25 DIP financing and could file as soon as next week

Wall Street can’t get enough of private credit CLOs: Blackstone, Apollo, and others are bundling record volumes of loans into bonds, with 2025 issuance on track to hit $50B—even as yields over traditional CLOs shrink to historic lows amid surging demand

Moody’s warns about weaker recovery rates: Moody’s reported that recoveries on cov-lite first-lien loans have fallen to 57% from a historical 64%, while loans with maintenance covenants are at 66%, down from 75%. The findings were based on 31 bankruptcies and 48 exchanges from 2023 through mid-2025

Private Equity in your hospital: An Internal Medicine study found that patient deaths in emergency departments rose by 13% after a hospital was acquired by PE firms. This research examined outcomes over a 10-year period and appears to be due to reduced staffing levels

A buyout boom may be brewing: Marathon’s Bruce Richards says lower borrowing costs under the next Fed chair will fuel a rebound in LBOs and private credit, boosting cash flows and deal activity while unlocking trillions for data centers, real estate, and mid-sized companies

Home sales defy expectations: New U.S. home sales surged 20.5% to 800k (beating 650k estimated) in August to their highest in three years, despite mortgage rates still above 6.6%. Analysts credit heavy builder incentives, though some caution the spike may be overstated and subject to revisions

Jaguar Land Rover hit hard by cyber attack: With no cyber insurance in place, the automaker faces billions in potential losses after a September 1 breach forced it to shut UK factories and halt production for months. The disruption has rippled across its 200,000-worker supply chain, prompting UK officials to consider emergency support for struggling suppliers while JLR absorbs the full financial blow

Intel is reportedly seeking an investment from Apple: The two tech companies have discussed how to work together, sending shares of $INTC ( ▼ 1.14% ) higher after hours, and following the report that NVIDIA would invest $5B into Intel

Return-to-office push is stalling: Despite tougher mandates at companies like Microsoft, Paramount and NBCUniversal, average U.S. office attendance has barely risen as compliance drops on 3-plus-day requirements and many managers hesitate to enforce them

Twin Peaks owner faces debt squeeze: FAT Brands and its creditors have hired advisers to renegotiate $1.2B in whole-business securitization debt, as the Fatburger and Johnny Rockets parent struggles with repayments despite steady restaurant performance

Btw - make sure you check out the Seizing Opportunities in the Credit Markets report - on me. Access here.

M&A Transactions💭

The ODP (NAS: ODP), operates an integrated B2B distribution platform, has reached a definitive agreement to be acquired for $1.78B by Atlas Holdings. EV/EBITDA was 9.13x and EV/Revenue was 0.27x.

SpartanNash, a food solutions company, was acquired for $2.025B by C&S Wholesale Grocers. EV/EBITDA was 13.57x and EV/Revenue was 0.21x. Solomon Partners advised on the sale.

Semler Scientific (NAS: SMLR), a company engaged in providing technology solutions, has reached a definitive agreement to be acquired for $675.0M by Strive. EV/EBITDA was 14.45x and EV/Revenue was 15.71x. LionTree advised on the sale.

Royal Camp Services, provider of lodging and catering services, has reached a definitive agreement to be acquired for $165.0M by Black Diamond Group (TSE: BDI).

Regal London, provider of real estate development services, was acquired for AED 2.5B by Arada Developments. Rothschild & Co advised on the sale.

PROS Holdings (NYS: PRO), provides software solutions, has entered into a definitive agreement to be acquired for $1.2B by Thoma Bravo. EV/Revenue was 3.5x. Qatalyst Partners advised on the sale.

PrizePicks, developer of a daily fantasy betting platform, has entered into a definitive agreement to be acquired for $1.6B by Allwyn. EV/EBITDA was 7.58x. Moelis & Company advised on the sale.

Premier (NAS: PINC), technology based healthcare improvement company, has reached a definitive agreement to be acquired for $2.62B by Patient Square Capital. EV/EBITDA was 11.23x and EV/Revenue was 2.58x. Bank of America and Goldman Sachs advised on the sale.

Nubis Communications, developer of cloud-native data infrastructure, has reached a definitive agreement to be acquired for $270.0M by Ciena (NYS: CIEN).

MultiChoice Group (JSE: MCG), an entertainment company, was acquired for $2.0B by Canal+ Group (LON: CAN). EV/EBITDA was 4.03x and EV/Revenue was 0.72x. Citigroup and Morgan Stanley advised on the sale.

Metasera (NAS: MTSR), a clinical-stage biotechnology company, has reached a definitive agreement to be acquired for $4.983B by Pfizer (NYS: PFE). EV/Cash Flow was 11.06x. Allen & Company, Bank of America, Guggenheim Securities, and Goldman Sachs advised on the sale.

Eco Material Technologies, manufacturer of near-zero carbon cement material, was acquired for $2.1B by CRH (NYS: CRH). Jefferies advised on the sale.

Anywhere Real Estate (NYS: HOUS), operates in residential real estate, was acquired for $10.0B by Compass (NYS: COMP). EV/EBITDA was 0.05x and EV/Cash Flow was 0.07x.

Sempra Infrastructure, developer of natural gas liquefaction export facilities, has entered into a definitive agreement to be acquired for $10.0B by Kohlberg Kravis Roberts. Bank of America advised on the sale.

The Advanced Drainage Systems (NYS: WMS) reached a definitive agreement to acquire The Water Management Business of Norma Group (ETF: NOEJ) for $1.0B. Centerview Partners and Jefferies advised on the sale.

National Diversified Sales, manufacturer of stormwater management and drainage products, has reached a definitive agreement to be acquired for $875.0M by Advanced Drainage Systems (NYS: WMS). EV/Revenue was 2.8x. Centerview Partners and Jefferies advised on the sale.

Center for Research in Security Prices, provider of financial and market research data, has reached a definitive agreement to be acquired for $375.0M by Morningstar (NAS: MORN). EV/Revenue was 6.82x. William Blair & Company advised on the sale.

Another Snus Factory Stockholm, manufacturer of tobacco-free chewing nicotine products, has reached a definitive agreement to be acquired for KRW 262.4B by KT&G (KRX: 033780).

Private Placement Transactions💭

Distyl AI, developer of a generative AI platform, raised $175.0M of Series B venture funding led by Lightspeed Venture Partners and Khosla Ventures at a pre-money valuation of $1.63B.

AppZen, developer of an autonomous and compliance management software, raised $180.0M of Series D venture funding led by Riverwood Capital.

ZeroHash, developer of a crypto and stablecoin infrastructure platform, raised $104.0M of Series D2 venture funding led by Interactive Brokers at a pre-money valuation of $900.0M.

Quo, developer of a business communication platform, raised $105.0M of venture funding led by General Catalyst.

Paar Autonomy, developer of multi-sensor, gyrostabilized camera systems, raised $3.5B of pre-seed funding led by Venture Catalysts.

Fnality, developer of a distributed ledger technology-based payment system, raised GBP 99.7M of Series C venture funding led by Tradeweb Markets, Citigroup, Temasek Holdings, Bank of America, KBC Group, and WisdomTree.

Charts of the Day

Via JPM's Michael Cembalest, AI-related stocks have driven:

- 75% of S&P 500 returns since ChatGPT’s launch in November 2022

- 80% of earnings growth over the same period

- 90% of capital spending growth

- Data centers are now eclipsing office construction spending.

- In the PJM— James Pethokoukis ⏩️⤴️ (@JimPethokoukis)

1:42 PM • Sep 24, 2025

Odds of the Day 🍒

Kalshi traders are pricing in a 64% chance of a government shutdown next week.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Until next time!

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.