- The Wall Street Rollup

- Posts

- What you need to know for October 9th

What you need to know for October 9th

First Brands Chaos and Carlyle is the Government now

Welcome back!

Well, on Sunday we talked about how 2025 is the year of AI buildout and quickly after some massive AI deals were announced (recapping that below). Despite a bearish The Information article posted on Tuesday, tech stocks quickly recovered after dismissing the bias of the article, sending the S&P and Nasdaq to all time highs. The strength in U.S. companies isn’t correlating to strength in the U.S. as an economy though - Gold and Bitcoin are continuing its meteoric rises. Bitcoin briefly traded above $125k, and Gold is continuing to rise higher and GS says gold will hit $4,900 in a year. So the “everything’s computer” trade marches on in conjunction with fiat hedges trading up.

Let’s get into the full piece below after a word from our Partner, Pegasus Insights.

Liquidity Management for the PE Backed CFO

In an LBO, Cash is king.

Pegasus Insights is a next-gen liquidity management platform purpose-built by Finance experts for Finance Leaders, Deal, PE-backed CFOs, Deal Teams, and Operating Partners.

Pegasus delivers:

Lighting fast cash and liquidity forecasting

Real-time visibility into cash

Seamless collaboration

Actionable levers to improve your Cash conversion cycle

Model faster, decide easier, and stay ahead.

Now live → Book a demo and see it in action.

Earnings Corner 📈 📉

Constellation Brands $STZ ( ▲ 0.41% ) Top and bottom line beat. Revenue came in $2.48B which is a slight beat, while EPS of $3.63 topped expectations of $3.38. Beer sales fell 7% as weaker consumer demand and aluminum tariffs pressured margins and wine & spirits plunged 65% due to the divestiture of svedka vodka, with organic wine & spirits sales down 19% when netting that out. The slowdown was driven by rising prices and growing economic anxiety. Management reaffirmed its lowered FY26 outlook, calling for EPS of $11.30–$11.60 and organic sales down 4–6%.

Earnings are quiet until the Banks kick off 3Q earnings - we’ll have more for you soon after the next week.

Remember - for deeper, stock market research upgrade to the WSR Investing Club

Today’s Headlines 🍿

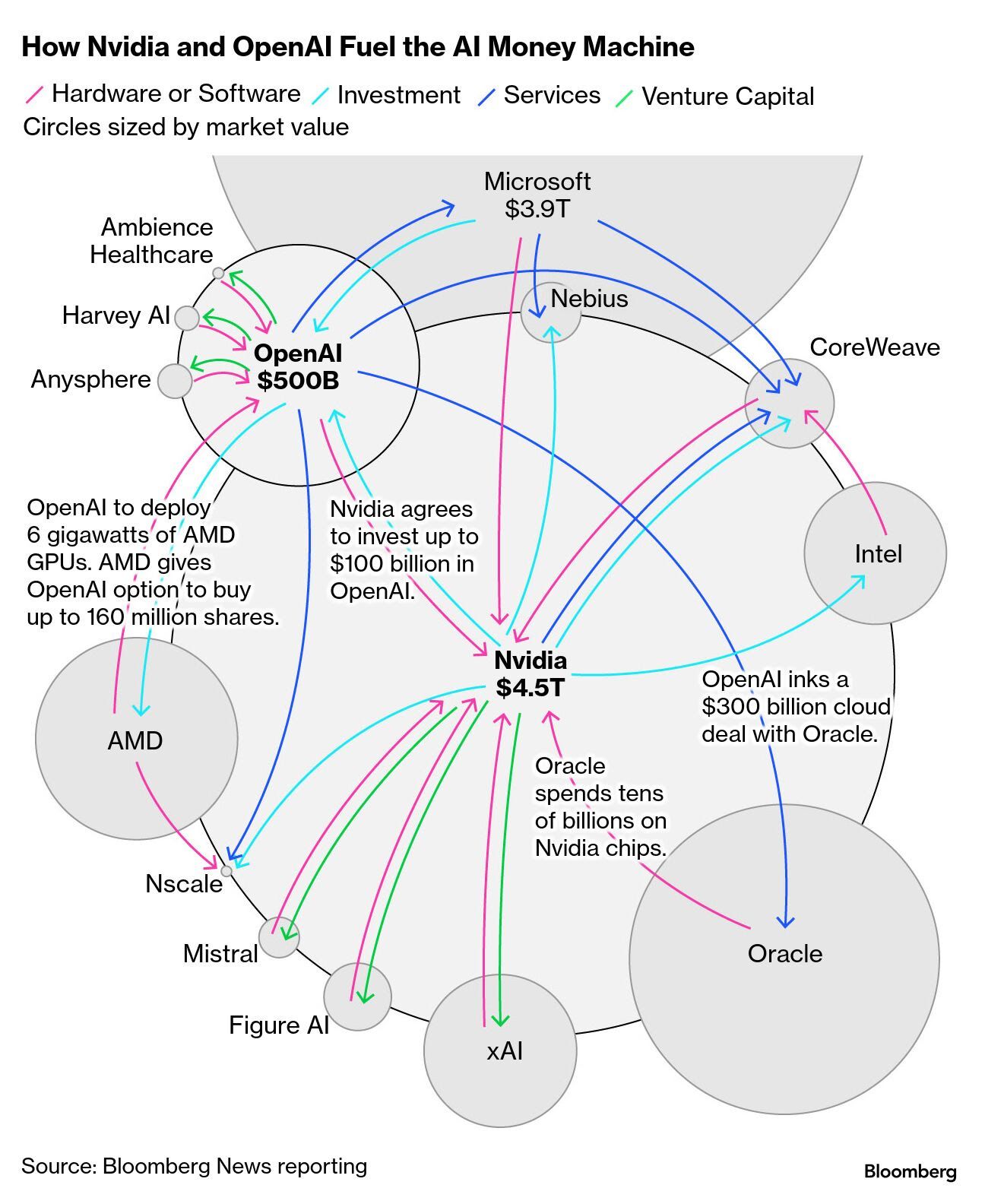

Jensen Huang comments on OpenAI’s AMD deal: Nvidia’s CEO was surprised AMD offered such a large stake of the company to OpenAI, although he did say “it’s clever, I guess.” Huang noted that the investment is “very different” from Nvidia’s own deal with OpenAI, and also mentioned that he’s “super excited” about Nvidia’s financing opportunity with Elon’s xAI

AMD & OpenAI’s partnership: $AMD ( ▲ 8.77% ) is up 43% on the week after landing a blockbuster deal with OpenAI to build AI infrastructure - and showing that they can compete with Nvidia’s technology. OpenAI will deploy 6 gigawatts of compute capacity from AMD, a purchase that is worth billions in revenue. In return, OpenAI will receive stock warrants for up to 160 million AMD shares, which will vest as certain milestones are achieved. If fully exercised, the warrants could be worth roughly a 10% stake in AMD. Obviously, there’s criticism among some finance folks about the industry becoming even more increasingly circular

X and Nvidia: Elon Musk’s startup xAI is raising more than initially planned, tapping backers including Nvidia to lift its ongoing funding round to $20B. This round includes $7.5B in equity - including up to $2B from Nvidia - and $12.5B in debt as part of a special purchase vehicle that will buy Nvidia processors and rent them to xAI. Tapping the sign again regarding circularity…

Fed Officials Are Split on whether there should be one or two more reductions this year, with a slight 10-9 majority favoring quarter-point cuts at each of the two remaining meetings this year. The minutes revealed that rising downside risks to employment drove the change in policy, although tariffs and inflation remain a concern

Jamie Dimon’s AI usage is netting out: JP Morgan’s CEO has called out that the firm is spending $2B a year on AI development, but is only saving $2B annually as a result. However, Dimon says it’s only “the tip of the iceberg” and these savings will only grow as the bank continues to identify more use cases for the technology

IG Debt is increasingly tied to AI lending: AI companies now make up 14% of the high-grade bond market, according to JPM, with the cohort trading at a 74bps spread, 10bps tighter than the index

Orlando Bravo calls AI a bubble: The founder of the PE giant, Thoma Bravo, compared AI valuations to the dot-com bubble, saying that generating enough free cash flow for investors will be a tall order, even if the products are successful. Bravo also criticized multiples, saying there’s no way $50mm ARR companies can justify a $10B valuation. Bravo is talking his software book - but he’s a firm believer in AI being a tailwind for strong, category-leading software companies

Carlyle is now tracking the US Labor Market (instead of the government): With the government shut down, Wall Street is focusing on its own alternative measures to try to figure out where the economy is going. Carlyle reported that the US created just 17k jobs in September, lower than the 22k gain that the BLS reported for August. Carlyle is using portfolio data to make estimates like GDP as of September running at 2.7%. Here’s their press release on the matter.

First Brands latest: We talked about the First Brands DIP and how there’s irregularity-related questions, including about whether receivables have been factored more than once. Now we’re starting to get a sense of what banks are exposed to First Brands. Yesterday, First Brands caused a lot of turmoil in the market. $JEF ( ▼ 0.08% ) had a rough day as Jefferies stated in a press release that their Point Bonita Capital division is tied to $715mm of First Brands receivables exposure and Jefferies is directly tied to $161mm of direct exposure (Jefferies has a $113mm equity stake in the Point Bonita Capital fund and $48mm in CLO exposure, via its 50% stake in Apex Credit Partners)

BlackRock is among the investors who are reportedly looking to partially redeem funds invested in Point Bonita

UBS is tied in here too, as UBS was selling to O’Connor hedge fund unit to Cantor Fitzgerald, but now Cantor is looking for a new deal after it was revealed O’Connor had a $116mm claim on First Brands receivables. UBS in total has an aggregate of $500mm+ of exposure through various strategies - including a $233mm unsecured supply chain related claim.

Raistone is alleging that as much as $2.3B “simply vanished” - the short-term financing creditor is demanding an appointment with an independent examiner to determine where an estimated ~$1.9B in financing went

Blackstone is pushing Private Credit into India: The PE giant has hired Apurva Shah to lead its newly launched India division, with Shah being the firm’s first credit hire for India

Private Credit blues: With Private Credit manager stocks trading down, there’s some worries among equity investors that some high-profile failures such as First Brands and Tricolor, as well high PIK exposure, will stress on managers such as Blue Owl. Shares of BDCs are trading at a 15% discount to NAV and ~20% of BDC interest income came from PIKs in 2024

The U.S. is taking a stake in Trilogy Metals: Trump announced that the U.S. has invested $35.6mm for a 10% stake in the Canadian mining company, with warrants for a potential additional 7.5% stake. Trump also signed an executive order permitting the construction of an access road to Alaska’s Ambler Mining District, aiming to secure critical energy for mining projects in the area. Trilogy, which has mining claims in remote areas of Alaska, saw its stock gain 211% on Tuesday after the deal

AST SpaceMobile’s big Verizon deal: Verizon reached a deal to provide cellular service from space, utilizing AST SpaceMobile’s premium low-band spectrum to strengthen Verizon’s coverage across U.S.

Joby’s equity raise: Shares of Joby Aviation fell after the electric air-taxi maker sold 30.5 million shares at $16.85 per share, a 10.9% discount to the stock’s previous close. Joby plans to use the $514mm in proceeds to fund aircraft certification and manufacturing efforts

Fifth Third’s $11B Comerica deal could spark more consolidation: The move had long been expected, and could mark the end of a blockade for large M&A deals. With a regulatory regime that’s more friendly under Trump, eyes now move to identify other takeover targets in the banking industry

Applovin Tumbles on SEC Investigation: Shares fell after reports that the SEC is investigating the ad-tech firm’s data practices due to a whistleblower complaint

Nvidia will still sponsor H-1B visas: CEO Jensen Huang says the chipmaker will continue to cover all associated costs for employees, including the new $100k application fee that Trump recently imposed. Nvidia currently sponsors 1,400 visas. Huang offered strong support for immigration, saying that Nvidia’s success “would not be possible without immigration”

Salesforce shakedown: Salesforce is refusing to pay hackers ransom money, even after the group threatened to publish client data that it claims to have stolen earlier this year in a breach of Salesloft’s Drift app. The data is mostly basic IT and customer contact information, but it may also contain sensitive information like access tokens

M&A Transactions💭

Urbint, developer of a field risk management platform, has reached a definitive agreement to be acquired for $325.0M by Itron (NAS: ITRI).

Simmonds Precision Products, a subsidiary of Goodrich Corporation and a manufacturer of fuel and proximity sensing and structural health monitoring solutions, was acquired for $765.0M by TransDigm Group (NYS: TDG). EV/Revenue was 2.19x.

SilverEdge Government Solutions, provider of cyber security, information technology, intelligence analysis, and a software suite, has reached a definitive agreement to be acquired for $205.0M by Science Applications International (NAS: SAIC). KippsDeSanto & Company advised on the sale.

Press Ganey Associates, provider of strategic advisory services, has reached a definitive agreement to be acquired for $6.7B by Qualtrics. EV/Revenue was 20.61x. Barclays and Moelis & Company advised on the sale.

Mercury Systems (NAS: MRCY), a commercial technology company, has reached a definitive agreement to be acquired for $3.6B by Advent International. EV/EBITDA was 58.61x and EV/Revenue was 3.95x.

Heidrick & Struggles International (NAS: HSII), a leadership advisory firm providing executive search and consulting services, has entered into a definitive agreement to be acquired for $1.41B by Advent International, Corvex Management, and Other Investors. EV/EBITDA was 22.36x and EV/Revenue was 1.2x. Bank of America advised on the sale.

Forsta, developer of feedback and analytics software, has reached a definitive agreement to be acquired for $6.75B by Qualtrics. Barclays and Moelis & Company advised on the sale.

Fisdom, developer of a wealth management platform, was acquired for $150.0M by Groww.

Energia Group NI Holdings, operator of an integrated energy utility company, was acquired for EUR 2.5B by Ardian. Barclays, Morgan Stanley, Santander UK, and Goldman Sachs advised on the sale.

Comercia (NYS: CMA), a relationship-based commercial bank, has reached a definitive agreement to be acquired for $10.9B by Fifth Third Bancorp (NAS: FITB). EV/Net Income was 15.75x and EV/Revenue was 3.29x. J.P. Morgan and Keefe, Bruyette & Woods advised on the sale.

Air Water (TKS: 4088) reached a definitive agreement to acquire 40.36% of CI Medical (TKS: 3540) for $204.58M. The company engages in the development, manufacturing, and sales of dental care products. After the transaction, Air Water will own a 78.65% stake in the company. EV/EBITDA was 6.32x and EV/Revenue was 0.85x. Mizuho Securities and SMBC Nikko Securities advised on the sale.

Verona Pharma (GREY: VNAPF), operator of a clinical-stage biopharmaceutical company, was acquired for $10.244B by Merck & Co. (NYS: MRK). EV/Revenue was 46.21x. Centerview Partners advised on the sale.

Vector Atomic, manufacturer of quantum precision hardware, was acquired for $390.0M by IonQ (NYS: IONQ).

The Free Press, operator of news and media platform, was acquired for $150.0M by Paramount Skydance (NAS: PSKY).

Telefonica Moviles del Uruguay, provider of telecommunication and mobile network services, was acquired for $440.0M by Millicom International Cellular (NAS: TIGO).

Platinum Equity has entered into a definitive agreement to acquire The Products and Healthcare Services Business Segment of Owens & Minor for $375.0M. The transaction values the company at an estimated $394.74M. Citigroup and Wells Fargo advised on the sale.

Private Placement Transactions💭

Swimlane, developer of a security operations automation and orchestration platform, raised $162.0M of Series C2 venture funding through a combination of equity and debt. $143.0M of Series C2 was led by Energy Impact Partners and Activate Capital Partners. $18.8M of debt was provided by undisclosed lenders.

Raise Fintech Ventures, provider of financial services, raised $120.0M of Series B venture funding led by Hornbill Capital and ChrysCapital at a pre-money valuation of $1.08B.

AiRWA Exchange, operator of a cryptocurrency exchange, was formed as a joint venture between Connexa Sports Technology (NAS: YYAI) and JuCoin for $500.0M.

Polymarket, operator of an information markets platform, raised $2.0B of venture funding from Intercontinental Exchange at a pre-money valuation of $7.0B.

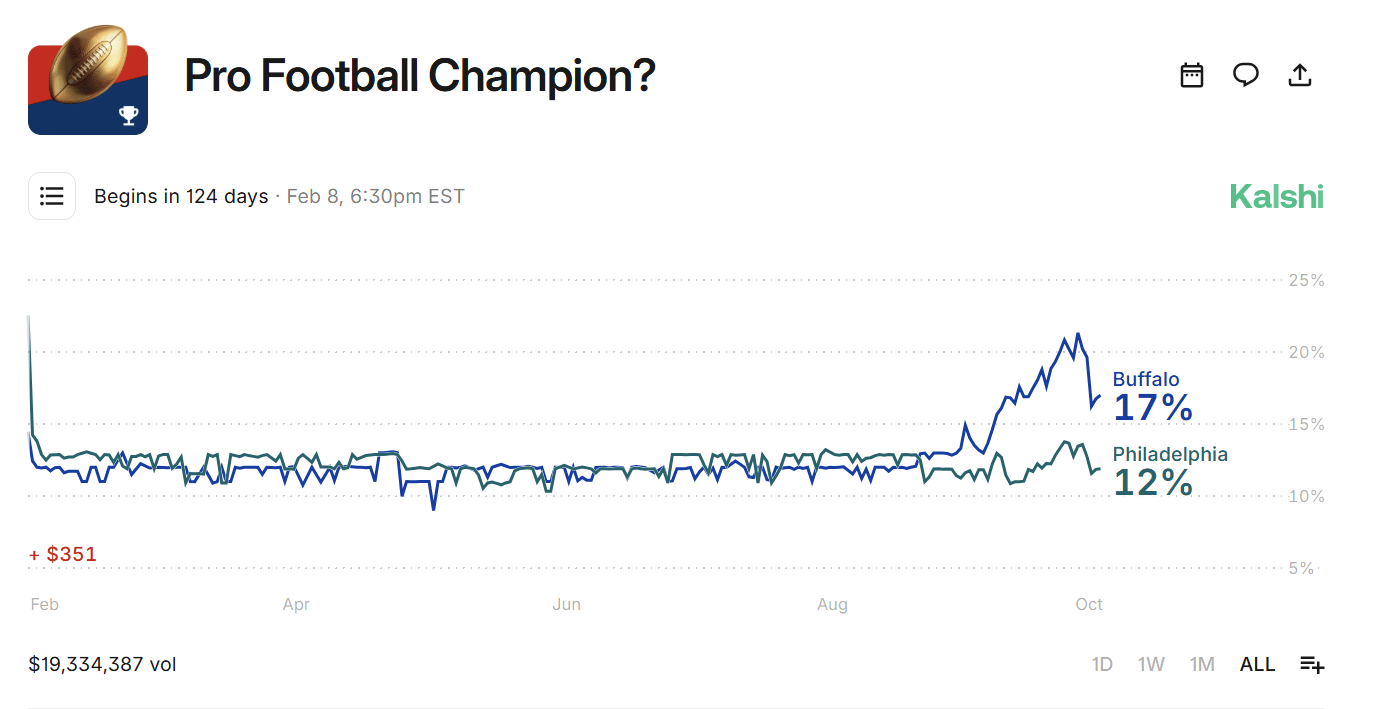

Odds of the Day 🍒

Kalshi traders are pricing in a 17% chance of the Buffalo Bills winning the Super Bowl.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

A chart from Bloomberg showing how interconnected the AI economy is

Meme Cleanser 😆

Average quantum computing company HQ

— High Yield Harry (@HighyieldHarry)

6:11 PM • Oct 4, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.