- The Wall Street Rollup

- Posts

- What You Need To Know For July 24th

What You Need To Know For July 24th

Google's Mad Capex Rush, Middle Market PE is Being Left Behind

The Week Ahead Of Us 🔍

Welcome back!

Is it 2021 again? We have “crappier” companies that are once again starting to see reddit induced short squeezes. I guess this isn’t a low rates thing and is just part of investment cycles now. We’ll talk about what companies in a bit.

The march towards tariffs going effective on Friday, August 1st nears closer, the administration said to expect a slew of deals to come, with straight tariffs ranging from 15-50% depending on the country and how well Trump’s ”been getting along with those countries”. But earnings season is in full force - and we have a breakdown of big names like Google below.

Let’s get into it.

Earnings Corner 📈 📉

Big Telco Roundup The top three wireless carriers all beat expectations in 2Q as strong subscriber growth and improving cash flow trends offset lingering concerns around competition and churn. T-Mobile $TMUS ( ▲ 4.19% ) led the group with record postpaid net adds and raised its full-year outlook, leaning on 5G leadership and broadband momentum to drive both financial and subscriber growth. Verizon $VZ ( ▲ 11.83% ) surprised with solid wireless service revenue and boosted its free cash flow guidance, signaling greater confidence in margin recovery and customer retention. AT&T $T ( ▲ 4.3% ) delivered steady fiber and mobility results, with broadband ARPU continuing to trend higher and operational discipline supporting earnings upside. All three carriers reiterated or raised full-year targets, reflecting stable demand and a more constructive setup for the rest of the year despite ongoing pricing pressure and capex intensity.

Defense Contractor Roundup Defense names turned in a mixed slate as strong demand met sharply different execution. Northrop Grumman $NOC ( ▼ 0.44% ) beat across the board with a revenue of $10.35B and EPS of $8.15 vs. $6.84 est., lifting full year sales and FCF guidance on strength in mission and international systems. General Dynamics $GD ( ▲ 0.33% ) also beat on both lines, with $28.3B in new orders pushing backlog to a record high. Raytheon $RXT ( ▼ 3.2% ) beat on both revenue and EPS but trimmed full year earnings guidance to $5.80 to $5.95 from $6.00 to $6.15 due to tariff headwinds, even as it raised its top-line outlook. Lockheed Martin $LMT ( ▲ 1.88% ) missed with sales down 2.7% and an EPS miss by $5.11 after $1.6B in charges tied to program delays and cost overruns.

Alphabet $GOOGL ( ▼ 0.07% ) Beat on both revenue and EPS, helped by 32% growth in Cloud and steady ad momentum. But the real story was the surprise $10B jump in capital spending, now expected to hit $85B this year, with more likely in 2026. Management pointed to accelerating AI infrastructure demand and a major new OpenAI deal as key drivers. While the capex surge briefly spooked investors, confidence rebounded on the call as management framed the spend as necessary to stay ahead in the AI arms race.

Tesla $TSLA ( ▲ 3.33% ) Missed on both revenue and EPS. Auto revenue dropped 16% y/y, and earnings fell 23% as margins weakened and regulatory credit income was cut in half. Management flagged potential “rough quarters ahead” amid tariffs, tax credit rollbacks, and delivery constraints, and withdrew volume guidance entirely. Supercharging was a bright spot, up 17% y/y, but core EV momentum stalled as the call confirmed demand uncertainty for the first time in years, driven by macro headwinds and a shrinking U.S. vehicle supply.

Chipotle $CMG ( ▼ 0.59% ) The chain missed on revenue, while EPS was in line. Same-store sales fell 4% as traffic declined nearly 5%, marking a second straight quarter of negative comps. Management cut full-year comp guidance to flat, down from a projected gain, citing a consumer pullback that began in the spring. While June trends improved with summer promos, investor confidence is fading as the broader growth story shows signs of strain. Shares dropped 9.8% after hours.

Domino’s $DPZ ( ▲ 0.8% ) The Pizza chain missed on both revenue and EPS, but comps bounced back. U.S. same-store sales turned positive after a dip last quarter, and international trends improved too. Management cited strong performance in delivery and carryout, plus value-driven promos that helped the brand gain share. Guidance stayed constructive despite margin headwinds from a onetime China franchise investment loss and higher taxes.

General Motors $GM ( ▼ 2.62% ) Revenue missed and EPS beat, but the quarter was overshadowed by a $1.1B tariff hit that dragged down profits. GM kept its full-year guidance unchanged but warned the impact from tariffs will worsen in 3Q, sparking disappointment. Strong truck and SUV demand helped, and China swung back to a profit, but EBIT still fell sharply. Management said it’s holding the line on pricing and working to shift production, but the tariff overhang is growing.

GE Vernova $GEV ( ▲ 1.25% ) Beat on revenue and EPS, driven by strength across its power and electrification segments. Power profit rose 27% as demand surged from AI and crypto-linked data centers, and management called out “unprecedented investments” in energy production globally. Guidance was lifted, with management now expecting revenue near the top of the $36–37B range.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Today’s Headlines 🍿

The US and Japan have struck a trade deal, with 15% tariffs on Japanese goods. $550B in U.S. investments are also included in the agreement, although it is not yet clear what this will look like. The deal pushed the S&P 500 to another all time high

Shitco Summer: Some of the worst companies in the market are stopping to pop - with Opendoor $OPEN ( ▼ 7.71% ) , Kohl’s $KSS ( ▲ 3.37% ) and others riding recent short squeezes to nice pops. It’s not quite a GameStop era moment though, as prices have retreated off early morning highs, but right now a ton of “left for dead” stocks are getting a second wind

Sydney Sweeney’s American Eagle campaign causes a rally: The actress posed in all denim for AE’s “Sydney Sweeney Has Great Jeans” campaign and the stock soared, jumping 22% after hours

Wendy’s partners with Netflix: The company launched a limited time “Meal of Misfortune” that coincides with the Netflix series “Wednesday” and its season two premiere. The stock was also caught up in this morning’s buying frenzy, as short interest was at 11.1%, and ended the day with a gain of over 4%

Trump will promote data center growth: Trump signed a set of executive orders to fast track building AI infrastructure and pledged to slash any red tape that inhibits the development of AI

Columbia settles with Trump: The university is agreeing to pay more than $220mm to the federal government, resolving the allegations that it had violated antidiscrimination laws. The deal means they will avoid federal funding cuts, with Trump agreeing to restore the research grants he had previously pulled

Meanwhile, Harvard is appearing in federal court to argue that the Trump administration illegally cut $2.6B in funding. They got hit with an additional investigation on Wednesday, with the State Department announcing they will be looking into the school’s visa program

Citi will require Investment Banking Analysts to disclose whether they've accepted a job offer from another firm. The move follows Goldman and JP Morgan’s efforts to clamp down on Private Equity recruiting

Jamie Dimon says interest rate hikes are on the table: Dimon says the market is underestimating the possibility, putting the chance of another increase at 40-50% and calling it “a cause for concern.” He stated that price pressures - driven by tariffs, immigration policy, and the budget deficit - were his reasoning

Middle Market PE is being left behind: Bloomberg did a deep dive piece on how Trilantic, a $8B PE fund, was only able to raise 1/6 of its target fund, having to shift focus to a continuation fund, and seeing several material deal team exits. Onex, Crestview, Vestar, and Madison Dearborn were also called out as struggling to fundraise

Bezos eyes CNBC: The Amazon founder is evaluating buying CNBC, potentially adding a “neutral voice” to his media portfolio, which includes The Washington Post

Apollo is moving workers to Zurich: Over 3-5 years, Apollo is planning to move a group of staffers from London and other European areas over to Zurich, potentially due in part to UK tax changes that impact wealthy foreigners

Glendon Capital Sees Opportunities in 'Unraveling' of Private Equity Boom: The distressed shop said “We see opportunities in the near-and-medium-term arising from an unprecedented backlog of PE related maturities that have to be worked out, particularly from the 2019 through 2022 vintages.”

Their $1.7B 3rd fund had a net IRR of 22.1%, with trades such as Frontier Communications, Talen Energy, Revlon and Intelsat. Their $2.5B fund II had a net IRR of 16.4% as of March

A Refi out of Private Credit: Vista portfolio company KnowBe4 is refinancing nearly $1.5B of private debt into the leveraged loan market, looking to price at S+375 @ 99.75, vs private credit paper of S+775

A MasOrange exit: Cinven, KKR, and Providence are looking for an exit - evaluating selling their collective 50% stake in the Spanish telco venture, seeking a $5.9B+ valuation

Las Vegas foot traffic remains ugly: Hotel occupancies have significantly decreased, with a drop in international tourists being a main cause. With gambling going online, the casino in the desert has lost some of its prior appeal

MLS Owners are voting on a switch to a fall-to-spring schedule that would align with the rest of European leagues, a move that could bring in better talent and increase viewership by shifting the MLS playoffs away from the NFL’s season. The switch would happen no earlier than 2027

Dating red flag app gains in popularity: Tea, a women-only app to anonymously share info and warnings about men, is the current number one app in the U.S. app store. Obviously, this app sounds like it could get out of hand, very quickly

Access our Market Data with Koyfin: Hey guys - our market data is sourced from Koyfin, the best free financial analysis and visualization platform out there in our opinion. If you need premium analytics, Koyfin is offering Wall Street Rollup readers 15% off on any new sign-ups. Check it out on us.

M&A Transactions💭

L Catterton led an investment group acquiring a 20% stake in private-jet leader Flexjet via an $800.0M investment valuing the company at ~$4.0B.

Blackstone is making a majority growth investment in NetBrain Technologies, a network automation and AI platform. The deal values NetBrain Technologies at $750.0M

ZimVie (NAS: ZIMV), focused on the dental and spine markets, has entered into a definitive agreement to be acquired for $762.86M by ARCHIMED. EV/EBITDA was 26.89x and EV/Revenue was 1.72x. Centerview Partners advised on the sale.

The Finance, Risk, and Regulatory Reporting Unit of Wolters Kluwer has entered into a definitive agreement to be acquired for EUR 450.0M by Regnology.

Vacco Industries, manufacturer of specialty metal products, was acquired for $275.0M by RBC Bearings (NYS: RBC). EV/Revenue was 2.33x. Philpott Ball & Werner advised on the sale.

US Synthetic, developer and producer of polycrystalline diamond cutters, was acquired for $300.0M by LongRange Capital.

The Reject Shop (ASX: TRS), a discount variety retailer, was acquired for AUD 259.0M by Dollarama (TSE: DOL). UBS Securities Australia advised on the sale.

Subsplash, developer of mobile engagement platform, has reached a definitive agreement to be acquired for $800.0M by Roper Technologies (NAS: ROP).

Samhwa, manufacturer of packaging materials, has entered into a definitive agreement to be acquired for Kohlberg Kravis Roberts for KRW 900.0M. EV/EBITDA was 14.82x and EV/Revenue was 3.2x.

Mydentist, provider of dental care services, has entered into a definitive agreement to be acquired for GBP 775.0M by Bridgepoint Group. Morgan Stanley advised on the sale.

Jiabao Food Supermarket, operator of food retail chains, was acquired for HKD 4.0B by JD.com (HKG: 09618).

Insignia Financial (ASX: IFL), provides wealth-management advice and products, has entered into a definitive agreement to be acquired by CC Capital and One Investment Management for AUD 3.3B.

Herb Chambers Companies, operator of the automobile dealership, was acquired Asbury Automotive Group (NYS: ABG) for $1.34B. Stephens advised on the sale.

The Six Solar Parks in Dominican Republic of Global Dominion Access were acquired for $375.0M by JMMB Group and Colorado Springs Pioneer Fund.

FARO Technologies, a technologies company, was acquired for $937.434M by AMETEK (NYS: AME). EV/EBITDA was 33.93x and EV/Revenue was 2.75x. Equiniti Group, Mackenzie Partners, and Robert W. Baird & Co. advised on the sale.

Damas, retailer of jewelry, was acquired for $283.0M by Titan Company (NSE: TITAN).

Calastone, developer of global funds network, has reached a definitive agreement to be acquired for GBP 766.0M by SS&C Technologies Holdings (NAS: SSNC). Barclays advised on the sale.

Aveo Group, operator of a network, was acquired by Scape, Charter Hall Group, AustraliaSuper, and National Pension Services for $3.85B. Morgan Stanley advised on the sale.

Apax Global Alpha (LON: APAX), a closed-ended investment company, has entered into definitive agreement to be acquired by Apax Partners for EUR 916.5M. Jefferies and Winterflood Securities advised on the sale.

Adevinta Spain, operator of a network of online classified platforms, has entered into a definitive agreement to be acquired for EUR 2.0 EQT. LionTree and Goldman Sachs advised on the sale.

Protect AI, developer of aa security platform, was acquired for $700.0M by Palo Alto Networks (NAS PAANW).

Probelte, manufacturer of organic agrochemicals, was acquired for EUR 200.0M by Ambienta.

Linx, developer of business management software, was acquired for BRL 3.41B by Totvs (VMF: TOTS3). Banco Itau BBA advised on the sale.

Karl Hedin Sagverk, producer of small logs, has reached a definitive agreement to be acquired for $164.0M by Karl Hedin.

Health-Ade, producer of kombucha beverage, has entered into a definitive agreement to be acquired for $500.0M by Generous Brands. Lazard advised on the sale.

Click, operator of a digital payment and mobile banking platform, a 49% stake in the company was acquired by Halyk Savings Bank (XKAZ: HSBL) for $176.4M.

Private Placement Transactions💭

Xelix, developer of enterprise software, raised $160.0M of Series B venture funding led by Insight Partners.

Sunsave, operator of a subscription based planform, raised GBP 12.14M of Series A venture funding led by IPGL and Norrsken VC at a pre-money valuation of GBP 45.15M.

Farizon, developer of an electric commercial van, raised $200.0M of venture funding from Hangzhou Hi-Tech Financial Investment Group and Xiangtan Electrochemical Scientific.

BrioHealth Solutions, raised $100.0M of Series E venture funding from Hongshan Capital Group, China Growth Capital, and Neovision Capital.

Reka, developer of generative AI large language models, raised $110.0M of venture fundiig from Nvidia, Snowflake, and other investors at a pre-money valuation of $890.0M.

Nudge, developer of an ultrasound phased array device, raised $100.0M of Series A venture led by Thrive Capital and Greenoaks Capital Partners.

Vanta, developer of a compliance management platform, raised $150.0M of Series D venture funding led by Wellington Managements at a pre-money valuation $4.0B.

Aidoc, developer of a decision support platform, raised $150.0M of venture funding led by Square Peg Capital and General Catalyst.

Odds of the Day 🍒

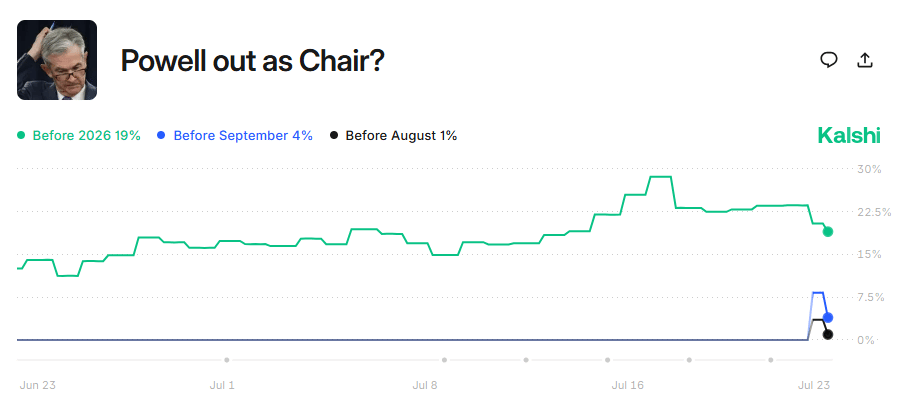

The pressure is on Jay Powell - but Kalshi traders are pricing in a slim 19% chance of him getting the boot in 2025.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

Meme Cleanser 😆

If you run marketing for your company, hire Sydney Sweeney for your ads. Go into debt if you have to

AEO stock +10% after this announcement

— Boring_Business (@BoringBiz_)

10:07 PM • Jul 23, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Autopilot Portfolio Update: High Yield Harry recently launched 4 portfolios on Autopilot including The Golden Age of Private Credit portfolio and the Tariff Trade portfolio. You can autopilot my trades and strategies by signing up here.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Finance Merch Referrals ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.

Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.