- The Wall Street Rollup

- Posts

- What You Need To Know For July 17th

What You Need To Know For July 17th

Banking Earnings are in full swing

Welcome back! It’s been a busy week.

Earnings season is off to a hot start, we’ve got some mixed inflation numbers, Trump said (and then didn’t say) he would fire Powell, and there continues to be a massive amount of AI-related spend. The market initially panicked on the “firing Powell” news but tbh it seems highly unlikely to happen at this point, with Trump admitting he’ll most likely wait Powell out. On the trade front, it sounds like a deal is “close” with India and “possible” with the EU.

Let’s get into it.

Earnings Corner 📈 📉

Big Bank Roundup: Wall Street’s top six banks all beat expectations in 2Q as strong trading performance helped offset softness in other areas. Goldman $GS ( ▼ 7.47% ) and Morgan Stanley $MS ( ▼ 6.19% ) led on equities and fixed income desks, benefiting from higher market volatility and renewed client activity. JPMorgan $JPM ( ▼ 1.9% ) raised its full-year net interest income guidance and launched a major buyback program while warning of persistent macro risks including tariffs, deficits, and elevated asset prices. Citigroup $C ( ▼ 5.16% ) posted one of its strongest quarters in years, with CEO Jane Fraser calling volatility a long-term advantage for the firm. Bank of America $BAC ( ▼ 4.72% ) delivered solid trading results but lagged in investment banking, where fees declined more than at peers. Wells Fargo’s $WFC ( ▼ 5.62% ) results were clean and stable, and the long-awaited removal of its asset cap opens a path to future growth despite lowered margin expectations. Credit quality was a bright spot across the group, with lower loan-loss provisions and healthy consumer behavior. Capital return ramped up with dividend hikes and share repurchases following the Fed’s latest stress test results. Overall, the banks leaned on resilient balance sheets and strong client engagement to deliver upside in a quarter marked by policy shifts and global uncertainty.

ASML Holding NV $ASML ( ▼ 0.9% ) Shares declined yesterday after the Dutch chip-equipment maker cut their outlook, warning that they may not be able to grow earnings in 2026 due to tariff worries. This came despite a beat on second quarter revenue and profit, helped by strong EUV demand and better than expected bookings.

BlackRock $BLK ( ▼ 2.48% ) BlackRock reported revenue of $5.4 billion, slightly below expectations, while EPS beat on strong margins. Net inflows reached $68 billion but were dragged down by a $52 billion redemption from a single low-fee institutional client. Management pointed to continued momentum in Asia and reaffirmed its focus on growing private markets and Aladdin, as analysts viewed the outflow as a one-off.

United Airlines $UAL ( ▼ 8.7% ) United Airlines posted second-quarter revenue of $15.24 billion, slightly below expectations, while adjusted EPS of $3.87 beat estimates. The company lowered its full-year earnings forecast, citing ongoing margin pressure at its Newark hub and softer domestic pricing. Management noted improving demand trends in July, particularly for international and premium cabin travel, and expressed confidence in a stronger second half of the year.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Today’s Headlines 🍿

Jay Powell vs. Trump (Again): Rumors of Jay Powell being fired, reported by CBS and a White House official, were quelled after the President himself admitted that he’ll wait out Powell’s term ending in the next 6 months. The President floated it to republican congress members who gleefully told him to fire Powell

Trump didn’t 100% rule it out - though saying that he won’t “unless there’s fraud”, alluding to the Federal Reserve building cost overruns that Powell has recently taken heat for

Inflation grew at a 2.7% annual rate in June, 0.3% on a monthly basis - in line with expectations and up from a 2.4% annual rate in May. Core inflation also came in at consensus, rising 0.2% on the month, an annualized rate of 2.9%

Inflation remains stable, but growth in toys and furniture pricing shows that tariffs are starting to make its way into prices. Notable monthly increases include 1% for household furnishings, 0.4% for apparel, and 0.7% for footwear

Meanwhile, PPI was cooler than expectations - unchanged m/m vs expectations of a 0.2% increase

Indonesia’s trade deal: Tariffs on Indonesian goods will drop to 19% from 32%, while tariffs on products from the U.S. will drop to zero. Indonesia also agreed to make several large purchases as part of the deal - buying $15B worth of energy, $4.5B in agricultural products, and 50 Boeing jets from the U.S.

Nvidia shares are up this week after cooled Chinese export restrictions: The chipmaker gets another big win after White House officials ruled they can resume selling their H20 chip to China. This comes after CEO Jensen Huang met with Trump last week to emphasize Nvidia’s onshoring efforts

Claude is rolling out a Financial Analysis Solution: Anthropic is now leveraging data from financial KPI leaders such as Daloopa, FactSet, Morningstar, PitchBook, and S&P Global

Additionally, there are rumors that Anthropic is looking to raise at a $100B+ valuation, as ARR has recently surpassed $4B

CoreWeave is building a $6B AI data center in Lancaster, Pennsylvania: The 100 megawatt data center will be scalable to 300 megawatts, and will provide the infrastructure and computational power needed for training AI models

Meanwhile, Google is committing $28B to power AI. The company will invest $25B in data center and AI infrastructure across the U.S. within the next two years, and $3B to modernize two hydropower plants in PA to help meet rising AI power needs in the region

Blue Owl’s Packer sees a “continued secular shift to private credit” - the Head of Credit at the large credit manager said there is also “trillions of dollars” of opportunity in IG private debt as well

The Leveraged Loan market is hot - with $24B of deals launching earlier this week. This includes 19 deals that include Walgreens Boots Alliance debt and a repricing of autorepair company Belron

Distressed Debt Exchanges might have higher recoveries than Bankruptcies: According to Fitch, exchanges from 2024 through 1Q25 have ranged from 78% to 93%, higher than “the blended weighted avg. recovery of liability management exchanges” that saw 56% recovery rates in 1Q25

Private Equity is heading to your 401ks: Trump is reportedly set to sign an executive order that would make private-market investments available for retirement accounts

CalPERS acquired $550mm of Yale PE assets for 90 cents on the dollar, boosting returns for the pension giant. With Yale’s $41B endowment forced to sell billions of PE stakes, the state-employee pension captured some discount, while also investing in a General Catalyst venture fund that held a large stake in Circle, a position that quickly resulted in $100mm+ of gains for CalPERS

Grayscale has filed for an IPO: the crypto asset manager has over $50B in AUM and would strike while the iron is hot - with stablecoin issuer Circle recently having a gangbusters IPO

The Deal is off: Couche-Tard dropped their $47B bid to acquire Seven & i Holdings, the parent of 7-Eleven due to “lack of constructive engagement”

Elliott’s latest stake: The activist hedge fund has acquired a stake in Global Payments $GPN ( ▼ 1.79% ) - sending the stock higher

MP Materials announced a $500mm investment from Apple, marking another big win for the company after recently securing $400mm from the U.S. Department of Defense. The deal will provide rare earth magnets for Apple, expanding its domestic production capacity

NPR and PBS are set to lose federal funding, following the Senate passing $9B of DOGE related cuts

No more Toymakers for the King: Schleich, a toymaker backed by Partners Group, is set to be handed over to creditors following a restructuring agreement

Cooper’s Hawk Winery & Restaurants is seeking a private credit solution, looking for $400mm of S+550 unitranche debt, refinancing S+650 paper ahead of a potential IPO

Chuck E. Cheese Equity: The restaurant brand’s owner is looking to its equity holders for $600mm in equity after a failed HY bond deal

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered every Monday to your inbox before the market opens.

If you don’t want to get the same watered down regurgitated stock picks like other mainstream services, then this is the newsletter for you.

Join 9,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our unique and specific trade ideas.

M&A Transactions💭

Cognition is buying the remaining Windsurf Asset, following the bulk of the team moving to Google.

ACO Hud Nordic, manufacturer of cosmetic and medical skincare products, has entered into a definitive agreement to be acquired for EUR 210.0M by Kohlberg Kravis Roberts.

Veritex Community Bank (NAS: VBTX), engaged in the provision of commercial banking products, has reached a definitive agreement to be acquired for $1.9B Huntington National Bank (NAS: HBAN). EV/Net Income was 16.94x and EV/Revenue was 4.36x. Keefe, Bruyette & Woods advised on the sale.

RCD Espanyol De Barcelona, operator of a football club, has reached a definitive agreement to be acquired for EUR 130.0M by ALK Capital.

Kohlberg Kravis Roberts has entered into a definitive agreement to acquire The Derma Cosmetics Business of Perrigo Company for EUR 327.0M. Greenhill & Company advised on the sale.

Green.ch, provider of telecommunication and data center services, has entered into a definitive agreement to be acquired for $1.1B by IFM Investors. J.P. Morgan advised on the sale.

Daytona International, retailer of specialty apparel, was acquired for JPY 28.3B by TSI Holdings (TKS: 3608).

BD, operator of biosciences and diagnostic solutions business of Becton, Dickinson and Company (NS: BDX), has reached a definitive agreement to be acquired for $17.5B by Waters (NYS: WAT). Barclays, Citigroup, and Evercore Group advised on the sale.

23andME (PINX: MEHCQ), a consumer facing healthcare technology company, was acquired for $368.428M by TTAM Research Institute. EVV/Revenue was 1.94x. Moelis & Company advised on the sale.

American Homestar, provider of construction services, has reached a definitive agreement to be acquired for $190.0M by Cavco Industries (NAS: CVCO).

WIA Machine Tools, manufacturer of precision machine tools and a subsidiary of Hyundai Wia, was acquired for KRW 340.0B by Smec (KKRX: 0999440) and Rylson Private Equity.

Vitaldent, operator of dental clinics, has entered into a definitive agreement to be acquired for EUR 1.0B by Ontario Teachers’ Pension Plan and its management. J.P. Morgan and RBC Ventures advised on the sale.

National Express, provider of school bus transportation, was acquired for $608.0M by I Squared Capital. The transaction includes proceeds of $70.0M, which Mobico Group will receive based on certain milestones. Bank of America, HSBC Bank Canada, and Goldman Sachs advised on the sale.

Fie Logistics Properties Located in Belgium of Weerts Logistics Parks was acquired for EUR 300.0M by Intervest Offices & Warehouses.

Drivenets, developer of a cloud-based networking software, was acquired for $650.0M by AT&T (NYS: T).

ChampionX (NAS: CHX), provides chemical solutions and equipment, was acquired for $9.04B by SLB (NYS: SLB). EV/EBITDA was 12.75x and EV/Revenue was 2.53x. Centerview Partners and Joele Frank advised on the sale.

Private Placement Transactions💭

Thinking Machines Lab, Mira Murati’s AI startup, has raised $2B in a seed round and is now valued at $12.0B.

The Chainsmokers’ VC fund, Mantis, raised a $100.0M third fund.

Tala Health, developer of personalized healthcare technology, raised $100.0M of seed funding from Dr. P. Roy Vagelos and Sofreh Capital at a pre-money valuation of $1.1B.

OpenEvidence, developer of an AI-powered information platform, raised $210.0M of Series B venture funding led by GV and Kleiner Perkins at a pre-money valuation of $3.29B.

MiniMax AI, developer of multimodal AI foundation models, raised $300.0M of venture funding from State-owned Assets Supervision and Administration Commission at a pre-money valuation of $3.7B.

Baraya Extended Care, operator of an extended care agency, rased$124.0M of Series B venture funding from SVC Second Venture Capital, TVM Capital Healthcare Partners, and Olayan Financing Company.

Numan, operator of a digital healthcare platform, raised GBP 74.7M of venture funding through a combination of debt and equity at a pre-money valuation of GBP 105.06M. GBP 60.0M of Series B venture funding was led by Big Pi Ventures. GBP 14.7M of debt financing in the form of loan was provided by Kreos Capital.

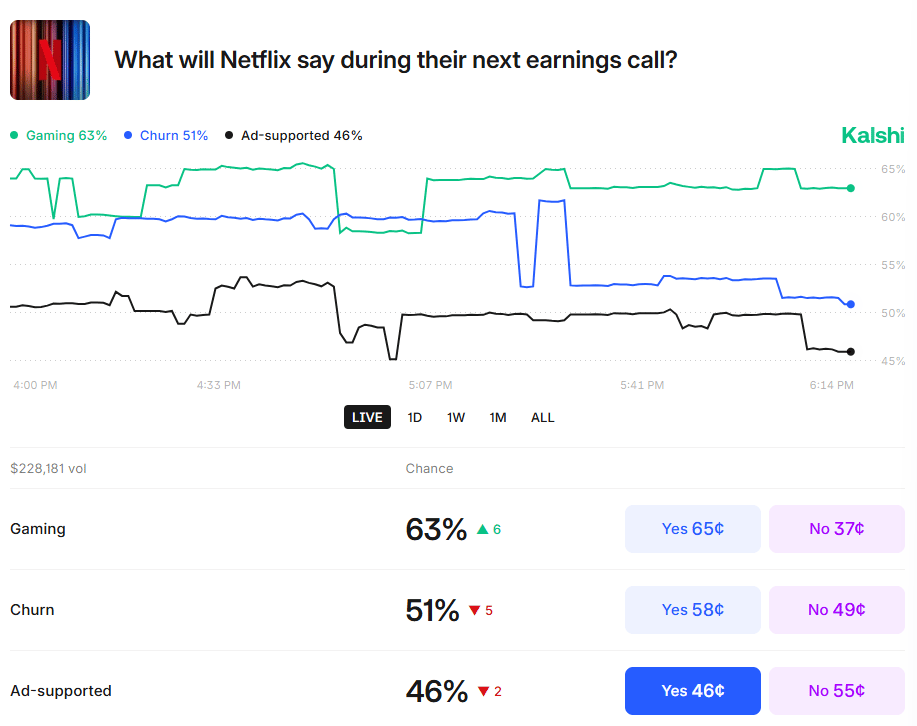

Odds of the Day 🍒

You can predict what is said on Earnings Calls - Kalshi traders are pricing in a 63% chance of “Gaming” being said on Netflix’s upcoming earnings call.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

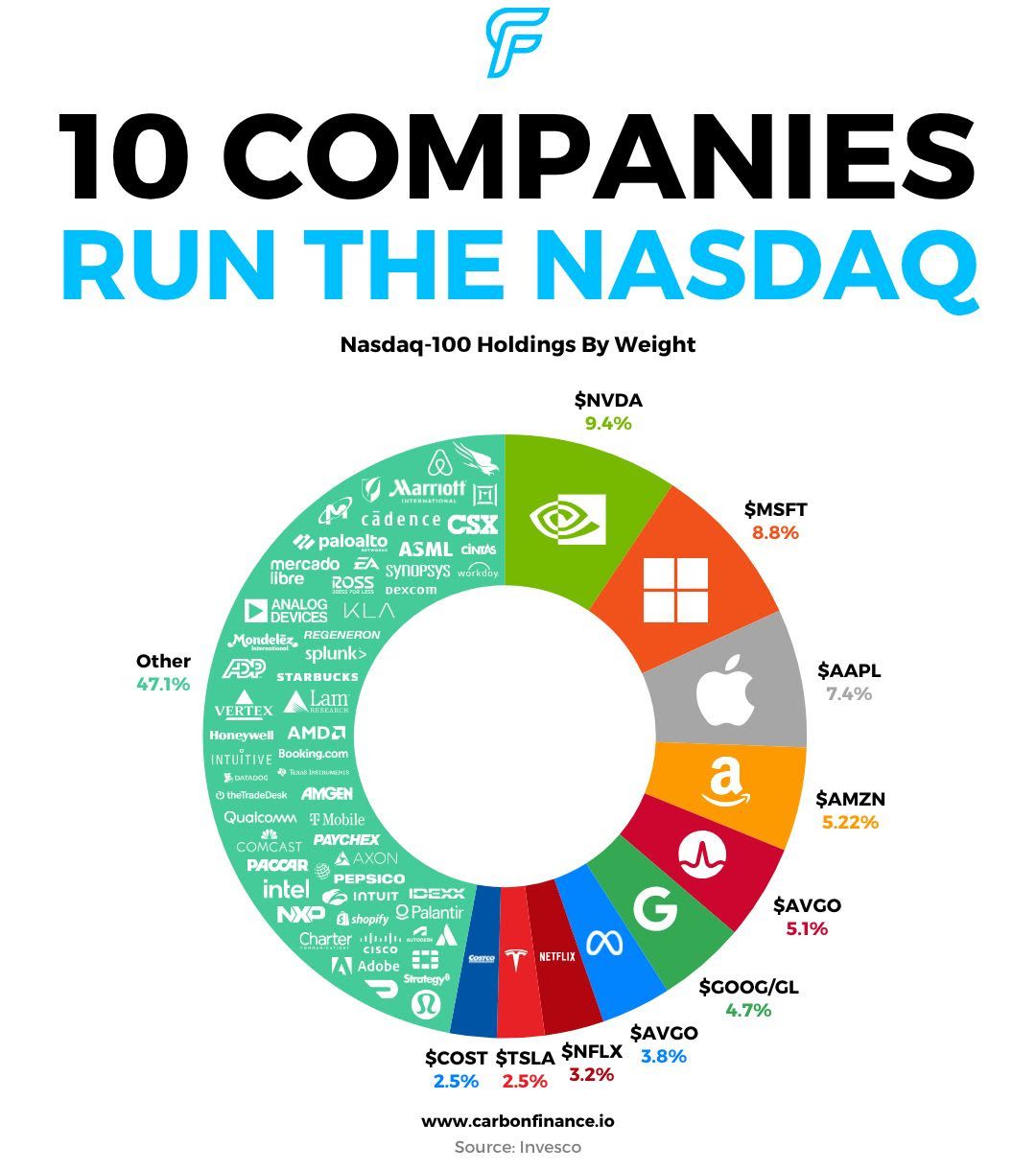

Noteworthy Chart 🧭

Meme Cleanser 😆 (We have two videos this week)

Private Equity Sponsors seeing they can now get exit liquidity from 401k investors

— High Yield Harry (@HighyieldHarry)

11:59 PM • Jul 15, 2025

On my way to my white collar finance job where all I do is say “nothing from my end” three times a day

— Finance Guy (@GuyInFinance)

2:29 PM • Jul 16, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Access our Market Data: Our market data is sponsored by Koyfin, the best free financial analysis and visualization platform out there. Need premium analytics? Koyfin is offering Wall Street Rollup readers 15% off on any new sign-ups.

Autopilot Portfolio Update: High Yield Harry recently launched 4 portfolios on Autopilot including The Golden Age of Private Credit portfolio and the Tariff Trade portfolio. You can autopilot my trades and strategies by signing up here.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Finance Merch Referrals ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.

Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.