- The Wall Street Rollup

- Posts

- What You Need To Know For January 8th

What You Need To Know For January 8th

Trump is making noise around Housing and Defense Contractors

Welcome back,

It’s been a crazy start to the year. There’s been a lot of noise yesterday with Trump seeking a ban on large institutions from buying homes in the U.S. AND the possibility that he won’t permit dividends and stock buybacks for defense contractors until they meet a certain PP&E investment threshold. $LMT ( ▲ 0.36% ) $GD ( ▼ 0.69% ) and $NOC ( ▲ 0.57% ) traded off yesterday but look up pre-market. Meanwhile, $BX ( ▼ 6.23% ) $AMH ( ▼ 0.34% ) and $INVH ( ▲ 1.42% ) all traded off sharply following Trump’s housing market announcement, with housing and homebuilding material companies also off as well.

Semis were on the move this week too. Semiconductor stocks have been rallying to start off 2026 and the action has been most intense in memory & storage. Sandisk surged 27.6%, while Micron jumped about 10%, and Western Digital and Seagate each climbed double digits, after management commentary from Nvidia at CES, reinforced how critical memory is becoming for AI training and inference. More on that below and how HVAC companies are being viewed as post-conference losers.

Let’s get into it.

Earnings Corner 📈 📉

Constellation Brands $STZ ( ▲ 1.92% ) Results were better than feared, but growth still remains pressured as lower demand from Hispanic consumers plus weaker construction activity have sent beer sales lower.

Our best offer to join WSR Investing Club expires Tonight.

For deeper, stock market research upgrade to the WSR Investing Club for a rate <$7 a month, for 7 months. Join before the clock strikes midnight.

Sam Altman: "Enterprise Will Be a Major Priority for OpenAI in 2026"

In an interview, Altman said 2025 was the year OpenAI's enterprise growth outpaced consumer for the first time. "The models were not robust and skilled enough for most enterprise uses," he said. "Now they're getting there."

GPT-5.2 now scores 68% on junior IB tasks.

Wall Street is reacting fast. Firms are adopting AI tools for modelling like Endex - OpenAI's Excel agent - to shift analysts from manual spreadsheet work to AI-driven modeling.

Today’s Headlines 🍿

Nvidia’s big rollout: Nvidia CEO Jensen Huang said the company’s highly anticipated Rubin data center processors are now in production, with customer deployments expected in the second half of the year. The new chips are 3.5x faster at training and 5x faster at inference than Blackwell, and are cheaper to run despite rising AI workloads. Notably too, the chips can be liquid-cooled which lowers traditional data center HVAC demand and caused a sell-off in HVAC names this week.

Onset Financial Sued: Onset Financial, a major financier to bankrupt auto-parts supplier First Brands Group, was accused of orchestrating a kickback scheme with the founder’s brother that loaded the company with expensive short-term debt. Court filings allege the loans generated IRRs exceeding 300%, with Onset advancing no more than $2.5bn but already collecting $2.9b and seeking another $1.9bn through bankruptcy claims. The creditors’ committee calls Onset’s conduct a “fundamental cause” of the bankruptcy, while Onset denies allegations. Onset recently sold a majority interest in its claims to Silver Point Capital.

PE recruiting quietly resumes: Top private equity firms, including Blackstone, Apollo, TPG, and Warburg Pincus, held a rapid round of interviews on Monday, restarting graduate recruiting after pausing last summer amid pushback from major investment banks. The reset followed criticism from JPMorgan CEO Jamie Dimon over accelerated hiring timelines, prompting firms to delay 2027 associate recruiting until 2026. Despite the pause, first-year banking analysts reported completing interviews and receiving offers within a single day.

Venezuela latest: Trump announced that Venezuela will relinquish as much as 50 million barrels of oil to the U.S, which the U.S. will pay for at the fair market price of about $2.8B. According to Trump, Venezuela will use this money for “purchasing ONLY American Made Products.” Energy Secretary Chris Wright said the U.S. will be controlling Venezuela’s oil sales indefinitely, with funds from any sales being deposited into U.S. controlled accounts.

Trump is weighing his options for Greenland: Trump has shifted his gaze back to Greenland after the Venezuela raid, with an interest in the land for both national security purposes and the critical minerals it holds; U.S. control of Greenland would deter Russian and Chinese expansion in the Arctic region, and also give the U.S. access to 36-42 million metric tons of rare earth oxides. The White House is considering a range of options to acquire it, including using military force, which prompted NATO allies to speak out in support of Denmark.

JPM cuts proxy advisory firms: The bank’s asset management division has fully parted ways with proxy advisory firms and has launched an AI-powered proxy platform as a replacement. Named Proxy IQ, the tool will use AI to manage the votes and analyze data from company meetings to provide recommendations for portfolio managers. Proxy advisory firms have recently drawn heavy criticism, with many (Jamie Dimon included) stating that their influence is unnecessary and can create conflicts of interest. JPM has been an aggressive spender in AI, so its ability to start recognizing AI-related cost savings may signal more efforts ahead.

Oracle’s AI debt unlikely to trigger HY downgrade: Oracle is unlikely to lose its investment-grade credit rating despite heavy borrowing to fund its AI data-center buildout, according to UBS. Oracle has roughly $95bn of debt outstanding and sold $18bn of bonds last year. While Oracle could be cut one notch to the lowest investment-grade tier, UBS said credit raters are likely to remain patient and investors have already priced in much of the risk.

In Other News 📖 🍿

Trump pledges to stop institutional investors from buying single-family homes, causing both Blackstone and Invitation Homes to sell off.

Trump says he won’t permit defense companies to issue dividends or repurchase shares until they speed up their production of military equipment.

Anthropic is raising $10bn at a $350bn valuation, nearly doubling its valuation from ~$183bn in September.

Private equity management fees fell to a record low of 1.61% in 2025, driven by fundraising pressure and capital concentration in larger funds.

Private Equity might need to consolidate, as firms continue to struggle amid a rough exit environment. Rather than be acquired, many underperforming buyout firms are opting to wait it out in hopes that better market conditions are near.

US investment-grade bond sales surged to $88.4bn this week, the biggest weekly total since May 2020 and far above dealer estimates of $70bn.

$7bn in debt backing Blackstone and TPG’s acquisition of Hologic has been offered to investors, with 1L leverage of 5.8x and total leverage around 7x, the $5B U.S. TL being offered at price talk of S+275-300 at an OID of 99.5

Charter sold $3B of HY bonds at 7 3/8 as it looks to pay off near-term debt and repurchase equity ahead of its planned merger with Cox.

Blue Owl has allowed for 17% redemptions following investor exit requests, up from the previously set 5% quarterly limit.

Monroe Capital has closed its latest fund at $6.1B, which will continue the firms’ focus on senior secured financing for LMM companies.

Hunterbrook Capital posted a 23% gain last year, beating hedge-fund benchmarks as it uses investigative journalism not only to short alleged corporate wrongdoings but also to make profitable bullish bets.

Michael Burry doubled down on Valero, saying a potential revival of Venezuelan oil exports could boost margins for heavy-crude refiners.

Fed’s Kashkari warns that AI is causing a hiring slowdown, and that businesses are starting to see real productivity gains because of the technology.

Kashkari also says that rates are “pretty close to neutral right now,” and that the economy has been much more resilient than expected.

Discord has confidentially filed for a US IPO, as the chat platform with over 200m monthly users weighs a potential public listing in March.

Vista Equity is a big believer in agentic AI, betting that the next phase of AI growth will come from private software companies.

Brad Jacob’s QXO secures $1.2B in new financing from a group led by Apollo as it readies to make acquisitions in the building product suppliers industry.

Digital media startup Semafor has raised $30mm at a $330mm valuation as it plans to hire more journalists and expand globally.

M&A Transactions💭

KKR acquired sports private equity firm Arctos for $1B.

Sprayway, a manufacturer of cleaning products, was acquired for $300.0M by Highline Warren. Goldman Sachs advised on the sale.

Minto Apartment REIT (TSE: MI.UN), an open-ended REIT, has reached a definitive agreement to be acquired for $2.3B by Crestpoint Real Estate Investments. EV/EBITDA was 24.3x and EV/Revenue was 15.1x. BMO Capital Markets, Desjardins Capital Markets, and TD Securities advised on the sale.

The Space Propulsion and Power Business of L3 Harris Technologies has reached a definitive agreement to be acquired for $500.0M by AE Industrial Partners. The transactions values the company at $845.0M. Jefferies advised on the sale.

Industry Ventures, operator of an investment firm, was acquired for $665.0M by The Goldman Sachs Group (NYS: GS). The transaction comprises of a contingent payout of $300.0M upon the completion of future performance through 2030. Oppenheimer & Company advised on the sale.

FirstBank, provider of banking and financial services, was acquired for $4.1B by PNC Financial Services Group (NYS: PNC). Morgan Stanley and Goldman Sachs advised on the sale.

Daedalean, developer of ML based avionics technology, was acquired for $225.0M by Destinus.

Cogentrix Energy, developer of independent power generation assets, has reached a definitive agreement to be acquired for $4.7B by Vistra (NYS: VST). Evercore Group advised on the sale.

The Precision Sensors and Instrumentation Product Business of Baker Hughes was acquired by Crane (NYS: CR) for $1.5B. EV/EBITDA was 19.17x and EV/Revenue was 2.95x. Evercore Group advised on the sale.

XConn Technologies, developer of semiconductor interconnect, has reached a definitive agreement to be acquired for $540.0M by Marvell Technology (NAS: MRVL). Evercore group advised on the sale.

VehicleCare, provider of car repair services, has reached a definitive agreement to be acquired for $277.0M by Roadzen (NAS: RDZN).

Ramudden, provider of temporary traffic control equipment, has entered into a definitive agreement to be acquired for EUR 2.5B by I Squared Capital. Goldman Sachs and Deutsche Bank advised on the sale.

Onestream (NAS: OS), an AI enabled and extensible software platform, has entered into a definitive agreement to be acquired for $6.418B by Hg. EV/Revenue was 11.25x. Centerview Partners and J.P. Morgan advised on the sale.

Mentee Robotics, developer of AI powered humanoid robots, has reached a definitive agreement to be acquired for $612.0M by Mobileye Global (NAS: MBLY). Goldman Sachs advised on the sale.

Leonard Valve Company, manufacturer of water-temperature control valves, was acquired for $470.0M by A. O. Smith (NYS: AOS). Robert W. Baird & Co. and Jefferies advised on the sale.

GELLEC, manufacturer and provider of lithium-ion battery separator material, was acquired for CNY 5.08B by FSPG Hi-Tech Company (SHE: 000973).

Dark Blue Therapeutics, developer of targeted therapeutics, was acquired for $840.0M by Amgen (NAS: AMGN). Bank of America advised on the sale.

Catalina Marketing Japan, provider of marketing services, was acquired for JPY 39.7B by Biprogy (TKS: 8056).

Vista Bank, provider of commercial bank services, was acquired for $369.0M by National Bank Holdings (NYS: NBHC). EV/Net Income was 10.92x. Jefferies advised on the sale.

Seven West Media, operates Seven Network, was acquired for AUD 385.0M by Southern Cross Media Group (ASX: SXL). Kroll advised on the sale.

Koch Filter, manufacturer of air filtration systems, was acquired for $450.0M by Atmus Filtration Technologies (NYS: ATMU). EV/EBITDA was 13.89x and EV/Revenue was 2.88x. Lincoln International advised on the sale.

Duagon, manufacturer of train communication and control products, was acquired for EUR 500.0M by Knorr-Bremse (ETR: KBX).

Cidara Therapeutics, developing immunotherapeutics, was acquired for $6.5B by Merck & Co. (NYS: MRK). EV/Cash Flow was 37.66x. Evercore Group and Goldman Sachs advised on the sale.

Private Placement Transactions💭

RayNeo, developer of augmented reality glasses, raised CNY 1.0B of venture funding led by CITIC Jinshi Investment Company.

Lyte, developer of an AI powered interoperability and workflow orchestration platform, raised $107.0M of venture funding led by Avidgor Willenz.

Forterra, developer of a robotic vehicle autonomy technology, raised $238.0M of Series C venture funding led by Moore Strategic Ventures at a pre-money valuation of $906.73M.

Cambium Biomaterials, developer of advanced materials technology, raised $101.4M of Series B venture funding led by 8VC at a pre-money valuation of $308.97M.

xAI, developer of an AI platform, raised $20.0B of Series E venture funding led by Valor Equity Partners at a pre-money valuation of $210.0B.

Photonic, developer of fault-tolerant quantum technologies, raised CAD 180.0M of venture funding led by Planet First Partners.

LMArena, developer of an AI interaction and feedback platform, raised $150.0M of venture funding led by Felicis and UC Investments at a pre-money valuation of $1.35B.

Kraken Technologies, developer of a cloud-based energy system management platform, raised $1.0B of venture funding led by D1 Capital Partners at a pre-money valuation of $7.65B.

Swap, operator of a product return platform, raised $100.0M of Series C venture funding led by ICONIQ Growth and DST Global.

Rakuten Medical, developer of precision-targeted cancer therapies, raised $100.0M of Series F venture funding led by TaiAx Capital LP.

Nitro Commerce, developer of an AI platform, raised $449.0M of Series A venture funding led by Cornerstone Ventures.

Semafor, developer of global news platform, raised $30.0M of venture funding from undisclosed investors at a $330.0M valuation.

Odds of the Day 🍒

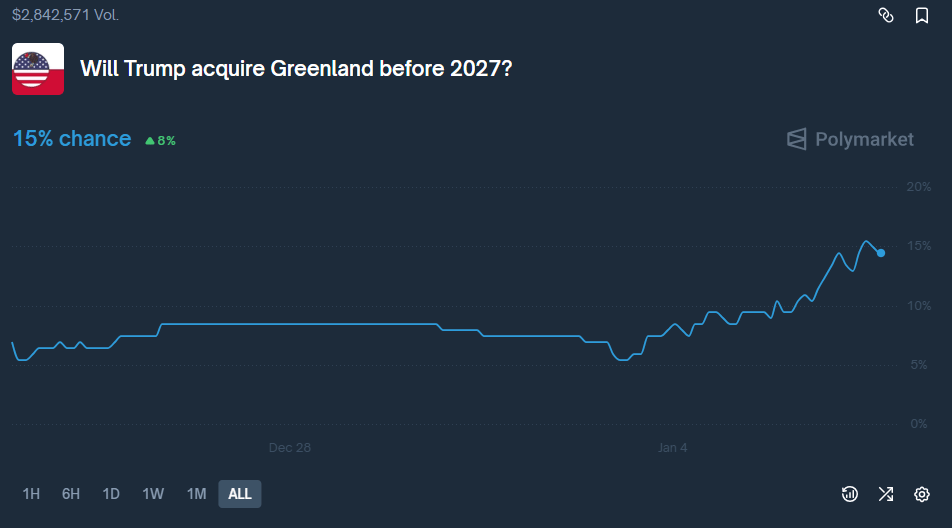

Polymarket traders are pricing in a 15% chance of Trump “acquiring” Greenland before 2027.

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. Endex.ai is today’s Partner. *Today’s Odds of the Day is in paid partnership with Polymarket