- The Wall Street Rollup

- Posts

- What You Need To Know For January 15th

What You Need To Know For January 15th

Claude is Cooking. Earnings Season Kicks Off.

Together with CreditSights

Welcome back!

Quick programming note - our upcoming Sunday night piece will be moved to Monday night given Martin Luther King Jr. Day.

It was a tough day for tech, with Nvidia H200 chips potentially getting banned in China and more Software pain. Software is continuing to struggle and this has been a big theme we’ve zoned in on the past few weeks - some application based software vendors might be displaced as “vibe coding” transforms into something a Company can take in house. Claude Cowork in particular from this past week looks quite impressive, but it also isn’t quite “AGI”, or even near AGI. Still, as Gemini and Claude get continued praise, OpenAI might be falling behind the curve - causing potential future problems for those relying on OpenAI related commitments. Maybe that’s too harsh given the fact that OpenAI just poached back the Thinking Machines CTO and a couple other initial defectors.

Yesterday, we did a writeup on the role Credit is playing in AI buildout. This is worth the read if you have time for a longer-form read.

Let’s get into it.

Earnings Corner 📈 📉

Bank Roundup $JPM ( ▼ 1.9% ) $BAC ( ▼ 4.72% ) $WFC ( ▼ 5.62% ) $C ( ▼ 5.16% ) all reported this week. Big banks posted mostly solid 4Q results, but the group sold off as investor concerns around Federal Reserve independence and President Trump’s proposed 10% cap on credit-card APRs weighed on sentiment. Trading and net interest income generally held up, while investment banking remained the softer spot.

JPMorgan Chase beat expectations with revenue of $46.8B, up 7% year over year, and adjusted EPS of $5.23, though headline EPS reflected a preannounced $2.2B Apple Card reserve. Equities trading jumped 40%, offset by a 5% decline in investment banking fees, and management guided to roughly $95B of 2026 net interest income excluding markets.

Bank of America also topped expectations, posting revenue of $28.5B, up 7% year over year, and EPS of $0.98, driven by stronger net interest income and a 23% surge in equities trading, while guiding to 5-7% NII growth in 2026.

Wells Fargo missed EPS after $612M in severance charges, with revenue supported by higher lending but net interest income slightly below expectations; the bank guided to about $50B of 2026 interest income, modestly under consensus.

Citigroup beat on an adjusted basis as investment banking fees rose 35% on stronger M&A activity, though reported results were pressured by a roughly $1.2B pre-tax charge tied to its Russia exit. Executives across the group warned that a proposed credit card rate cap could restrict lending and pressure profitability.

Delta $DAL ( ▼ 6.82% ) Missed revenue but beat on EPS. The airline giant has been pressured by potential credit card cap news this week, but revenue came in at $14.6B, as management said the 43-day government shutdown forced flight reductions and took about two points off growth. EPS of $1.55 came in better than expected as Delta continued to benefit from a shift toward higher margin premium travel, offsetting weaker main cabin demand. Looking ahead, management leaned cautious, guiding FY26 earnings below expectations and framing the first quarter as steady rather than accelerating, which keeps the focus on the pace of growth.

WSR IC latest: On Monday, we published a WSR IC piece on Sanara Medtech $SMTI ( ▼ 2.99% ) - join WSR IC to access our research library.

2026 Credit Outlooks: Insights You Can Act On

Markets are moving fast. The year ahead will present new risks, new opportunities, and rapid changes across global credit. CreditSights’ 2026 Outlooks cut through the noise with the clarity you need to act with conviction. Gain access to:

Clear sector-level expectations from senior analysts

Actionable trade ideas to help refine your positioning

Independent research grounded in fundamentals and relative value

Download the outlooks that matter most to you and get the full reports at no cost.

Today’s Headlines 🍿

Anthropic’s agentic launch: Anthropic announced the launch of Claude Cowork, a general-purpose AI agent. Cowork is meant to assist non-technical users with common workplace tasks, such as editing a file or creating a spreadsheet. Cowork is now available to Claude Max users, a subscription that starts at $100 a month. The launch places Anthropic in direct competition with Microsoft’s Copilot, and reflects a broader trend in the industry toward agentic AI models that are capable of action and execution rather than just conversation.

Microsoft’s retort on electricity costs: Data centers have created many unwanted effects for communities in surrounding areas, including higher electricity costs. Microsoft says that it’s addressing these issues by building “community-first AI infrastructure.” The initiative has five main parts (electricity, water, jobs, taxes, and skills) and aims to minimize the local impact of data center development.

Inflation stays sticky: December CPI rose 2.7% YoY, slightly above the projected 2.6% and unchanged from November, signaling persistent price pressures. Core inflation came in cooler at 2.6% vs the 2.7% expected, though food prices accelerated. With inflation still above the Fed’s 2% target and unemployment falling, markets see a ~95% chance the Fed holds rates steady at its January meeting.

BlackRock trims headcount: BlackRock, the world’s largest asset manager, is cutting ~250 jobs (~1% of its global workforce) as CEO Larry Fink continues to reshape the firm and integrate its private credit push following the HPS acquisition. The move comes as Wall Street firms like Citi (1,000 layoffs) and UBS also cut costs.

In Other News 📖 🍿

Verizon outage disrupts service: A nationwide Verizon network issue left tens of thousands of customers without wireless voice and data access, with peak outage reports above 175,000 as engineers work to restore connectivity.

Crypto has rallied as the Senate is set to revisit a major crypto bill that aims to create structure and legislative guardrails for the market and digital asset firms, potentially boosting crypto prices and accelerating the adoption of blockchain technology in the U.S.

Saks Global entered Chapter 11 late Tuesday after its 2024 debt-heavy Neiman Marcus acquisition went south extremely quickly, securing $1.75B in new financing to fund operations through restructuring.

STG Logistics filed for Chapter 11 to eliminate ~91% of its debt and raise up to $150mm in DIP financing after a failed, debt-heavy XPO intermodal acquisition left the logistics firm overlevered amid a prolonged freight downturn.

Clayton Dubilier & Rice is seeking ~$26bn for its next flagship private equity fund. The fund could reach $28bn, putting it on track for one of the largest buyout fundraises ever despite a tough fundraising background for PE.

Netflix weighs all-cash WBD deal: Netflix is expected to convert its proposed ~$82.7bn acquisition of Warner Bros. Discovery’s HBO Max and film studio into an all-cash offer, which could accelerate shareholder approval and fend off a rival bid from Paramount Skydance.

Thoma Bravo’s AI pushback: TB’s Holden Spaht argued in the FT that specialized AI startups are poorly positioned, and comprehensive software platforms that integrate AI will be better off.

OpenAI signed a $10B deal with Cerebras to use their hardware for 750 megawatts’ worth of computing power, enabling faster response times when running AI models.

Goldman to acquire the Radford Studio Center, a historic LA film lot where Seinfeld was once shot, after the owner defaulted on its $1.1B mortgage.

Apollo is trying to open trading on a private debt deal for xAI, telling lenders that it’s willing to buy more of the $3.5B chip financing deal at par. The debt was used to fund xAI’s access to Nvidia’s GPUs.

Banks tighten pricing on Hologic’s $8.5B LBO loan, slashing the pricing to just 225 bps above the benchmark and cutting the size of term loan A in half, while getting set to syndicate a massive $7.25B TLB.

An Ares-led private credit group boosts their loan to a healthcare software platform being acquired by Veritas, leveraging a portability clause to upsize the loan from $1.3B to $1.6B.

myKaarma announces an investment from Warburg Pincus that will help the company expand its portfolio of AI-driven ops and payments solutions for auto dealerships.

Meta cuts over 1,000 jobs from the Reality Labs division as the company begins to reallocate resources away from the Metaverse and toward AI wearables and phone features.

Greenland’s prime minister says “we choose Denmark” when asked about Trump’s desire for the land.

M&A Transactions💭

Worldpay, operator of an electronic payment and banking platform, was acquired for $24.25B by Global Payments (NYS: GPN). Citigroup, Morgan Stanley, Evercore Group, BMO Capital Markets, PJT Partners, Goldman Sachs, and UBS Group advised on the sale.

PSB Academy, operator of a private independent tertiary education institution, was acquired for SGD 700.0M by Sun Venture.

The eDOCS Business of OpenText (TSE: OTEX), provider of legal technology services, was acquired for $163.0M by NetDocuments. Goldman Sachs advised on the sale.

K.F., provider of supply chain services based in Cambodia, has reached a definitive agreement to be acquired for $510.0M by Charles River Laboratories International (NYS: CRL).

J-W Power Company, manufacturer of natural gas compression equipment, was acquired by USA Compression Partners (NYS: USAC) for $860.0M. The consideration consists of $430.0M in cash utilizing available capacity under its revolving credit facility, with the balance of the consideration coming from approximately 18.2 million common units issued based on an effective price at signing of $23.50 per common unit, subject to certain purchase price adjustments. Jefferies advised on the sale.

Integrity Orthopaedics, developer of a rotator cuff repair device, has reached a definitive agreement to be acquired for $450.0M by Smith & Nephew (LON: SN).

Dogwood State Bank, a North Carolina state-chartered community bank, was acquired for $476.2M by TowneBank (NAS: TOWN). Piper Sandler advised on the sale.

The Broadband Connectivity and Cable Solutions Unit of CommScope Holding Company was acquired by Amphenol (NYS: APH) for $10.5B. EV/Revenue was 2.92x. BNP Paribas, Bank of America, Citigroup, Evercore Group, Mizuho Bank, and TD Securities advised on the sale.

BTIG, operator of global financial services, has reached a definitive agreement to be acquired for $1.0B by U.S. Bancorp (NYS: USB). EV/Revenue was 1.33x. Goldman Sachs and SHEUMACK GMA advised on the sale.

Lanteris Space Systems, provider of space technology and orbital infrastructure services, was acquired for $800.0M by Intuitive Machines (NAS: LUNR). EV/Revenue was 1.27x. Barclays advised on the sale.

DIG Airgas, manufacturer of industrial gases, was acquired for EUR 2.85B by Air Liquide (PAR: AI). EV/Revenue was 5.81x. J.P. Morgan and Goldman Sachs advised on the sale.

Applied Technology Services, provider of consulting engineering, testing, and inspection services, was acquired for $1.325B by SGS (SWX: SGSN). Houlihan Lokey and Rothschild & Co advised on the sale.

Quobly, developer of semiconductor-based technologies, has reached a definitive agreement to be acquired for $200.0M by Sealsq (NAS: LAES).

Coastal Cloud, provider of information technology consulting services, was acquired for $700.0M by Tata Consultancy Sciences (NSE: TCS). EV/Revenue was 4.96x. Guggenheim Partners advised on the sale.

Private Placement Transactions💭

X Square Robot, developer of foundation model, raised CNY 1.0B of Series A++ venture funding from ByteDance and Shenzhen Capital Group.

Wonder Group, developer of an online platform for food delivery, raised $1.39B of venture funding led by GV, New Enterprise Associates, and Accel.

Startorus Fusion, developer of new energy technology, raised CNY 1.0B of Series A+ venture funding led by Shanghai Science & Technology Venture Capital, Shanghai Jiading Science and Technology Investment Group, Shanghai Future Industry Fund, and CICC Capital.

Harmattan AI, developer of autonomous and scalable defense systems, raised $200.0M of Series B venture funding led by Dassault Aviation and Galion.exe.

Defense Unicorns, developer of an open-source and infrastructure-agnostic platform, raised $136.0M of Series B venture funding led by Bain Capital Tech Opportunities.

Wasabi, developer of cloud storage platform, raised $102.5M of venture funding in a deal led by L2 Point Management at a pre-money valuation of $1.7B.

Onebrief, developer of a visual strategy platform, raised $200.0M of Series D venture funding led by Battery Ventures and Sapphire Ventures at a pre-money valuation of $1.95B.

Horizonn3.ai, developer of a security automation platform, raised $100.0M of Series D venture funding led by New Enterprise Associates at a pre-money valuation of $560.0M.

GreenTech, provider of renewable energy and clean technology infrastructure services, raised $300.0M of venture funding led by Transition VC.

Etched, developer of an AI based computing hardware, raised $500.0M of venture funding led by Stripes at a pre-money valuation of $4.5B.

Deepgram, developer of an automated speech recognition platform, raised $130.0M of Series C venture funding led by AVP at a pre-money valuation of $1.17B.

Armadin, developer of a cybersecurity platform, raised $165.2M of venture funding from undisclosed investors.

Alpaca, developer of a modern brokerage platform, raised $150.0M of Series D venture funding led by Drive Capital at a pre-money valuation of $1.0B.

Odds of the Day 🍒

Polymarket traders are pricing in a 45% chance of a rate cut by April.

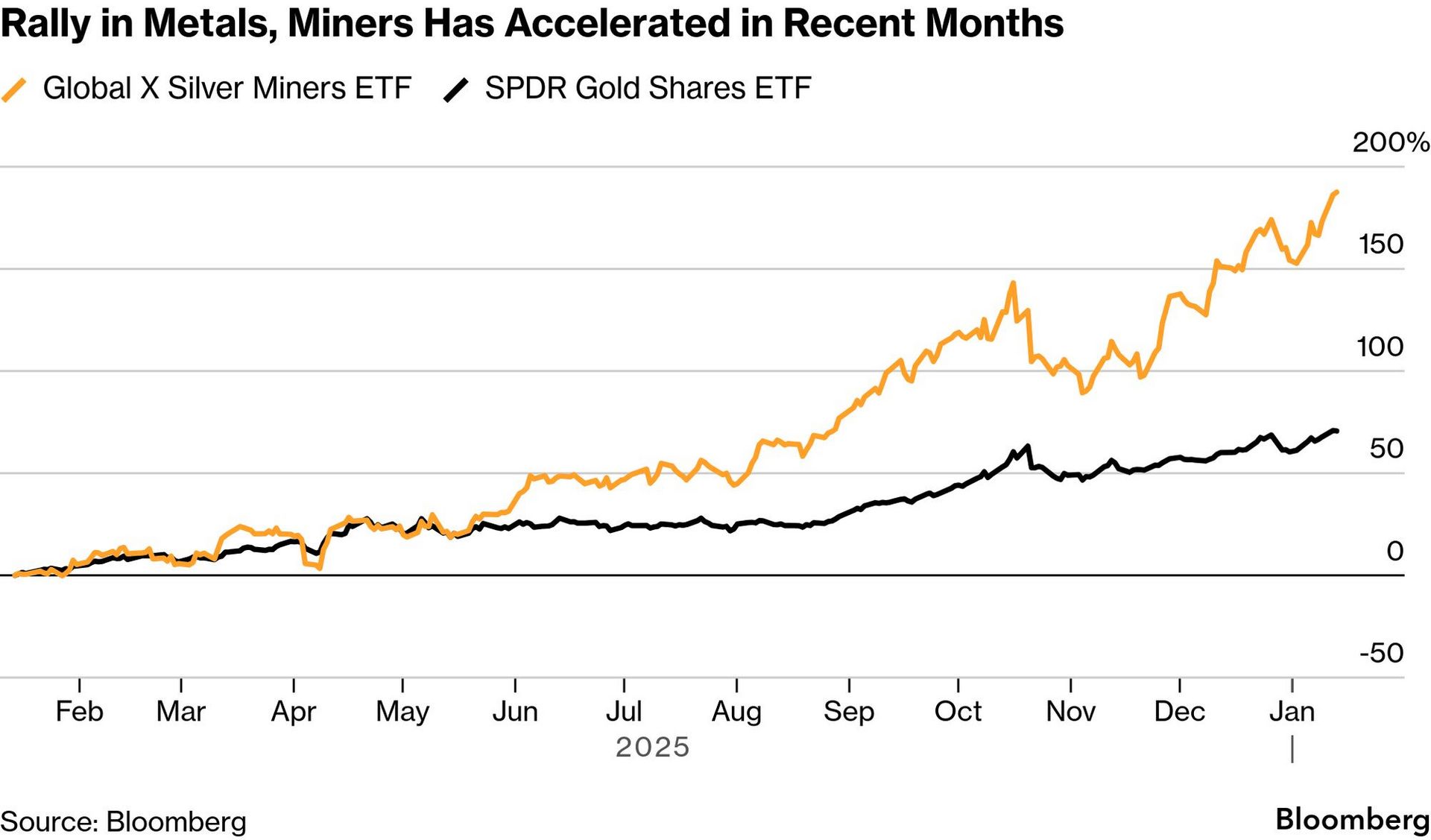

Noteworthy Chart 🧭

Metals have had a crazy 12 months:

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Polymarket