- The Wall Street Rollup

- Posts

- What you Need to Know for Feb 5th

What you Need to Know for Feb 5th

Our new thesis - a few big winners, a lot of big losers

Welcome back! Btw, we’re going to push Sunday night’s piece back a bit until after the Super Bowl. We bet you probably want to watch the big game instead of reading our Newsletter mid-game.

Software has been getting smoked all week. In particular, legal software companies (Legalzoom), plus some research driven companies (Moody’s, S&P, Thomson Reuters) got in trouble after Anthropic launched a new AI plug-in that can read files, organize folders, and draft docs.

But the big concern is regarding Private Equity and Private Credit manager software loan exposure. Blue Owl has been the poster child, but Apollo, Blackstone, KKR, Ares, and TPG all took a hit on Tuesday. They recovered yesterday, as I made the point that selling off the largest asset managers to express a negative software view doesn’t make sense for too long.

This leads me to updating our newsletter’s market thesis around AI & software: While we’ve been calling out Claude risk for a while now, it seems clear we’re entering a bifurcated world where are a few big winners (Claude and Google seem to be among them) while dozens upon dozens of firms (many of which have traded off heavily this month) might face severe disruption if they can’t adopt competitive agentic use cases across their offering. The largest AI beneficiaries are likely to emerge unscathed from any market volatility, and become increasingly antifragile. While we’ve expressed worries of “two waves” of AI, where a lot of the overvalued AI companies need to be flushed out in a “first wave”, it’s clear that there’s going to be a simultaneous flush out of SaaS companies, in addition to the inferior vaporware/wrapper/too niche type of AI providers. That’s a bold take, I know, but a significant part of AI is going to be a zero-sum game.

Separately, crypto can’t catch a bid and is continuing to trade off as investors are lacking enthusiasm for the asset class. Meanwhile Silver sold off hard last night, let’s see if the YTD rally cools off today.

Let’s get into it

Earnings Corner 📈 📉

$UBER ( ▲ 1.61% ) Revenue and demand beat expectations but earnings missed. The company guided softer near term profits as higher taxes and cheaper rides weighted on margins. AV focused exec Balaji Krishnamurthy was named CFO and he reiterated planes to scale robotaxis, keeping focus on whether Uber can become an AV demand aggregator.

$GOOG ( ▼ 0.63% ) Beat earnings with record result, topping $400B in annual revenue, driven by strength in Cloud and advertising as AI momentum continued. Gemini reached roughly 750M monthly users as AI features expanded, and they were able to lower Gemini serving units costs by 78% last year. Meanwhile, Waymo has now logged more than 20M fully autonomous trips, highlighting how their AI investment is translating into a scaled player.

$PLTR ( ▼ 7.54% ) Highlighted surging AI demand as customers expanded contracts and size of initial deals, driving 70% revenue growth. Shares dropped as valuation concerns resurfaced amid the broader market selloff.

$CMG ( ▼ 3.61% ) Fell after reporting another quarter of declining traffic (-3.2% y/y decline in transactions, SSS -2.5%) and guiding to flat 2026 same store sales, reinforcing concerns that price fatigue and rising costs are dragging demand.

Eli Lilly's and Novo Nordisk were a tale of two cities: $LLY ( ▼ 8.82% ) delivered a major earnings beat and raised outlook as surging demand for Mounjaro and Zepbound drove volume growth that offset pricing pressure, while $NVO ( ▼ 8.07% ) warned that sales could fall as intensifying competition, pricing pressure, and slower momentum in its GLP-1 portfolio weighed on its outlook.

$DIS ( ▼ 1.37% ) Named parks chief Josh D’Amaro the CEO, as streaming profits improved, though softer tourism and rising sports and expansion costs weighed on near term growth.

Semis: $AMD ( ▼ 4.01% ) had a terrible Wednesday after providing a weak forecast relative to buyside expectations. Qualcomm $QCOM ( ▼ 7.97% ) gave a revenue forecast that disappointed the street, calling out iPhone component shortages. Arm $ARM ( ▲ 5.59% ) also had a lower-than-expected sales guide.

For deeper, stock market research upgrade to the WSR Investing Club

The 40% off offer will end soon.

What Smart Money Knows

Polymarket is the world's largest prediction market, with a 90%+ accurate track record on interest rates, corporate earnings, and geopolitical risks.

When you read The Oracle by Polymarket, you'll learn to think like the top .01% of forecasters on Polymarket, traders who stop at nothing to develop unique insights on the news.

The Oracle takes you inside their unusual playbooks. Here’s what’s inside:

🔮 He Made $300k Betting on a "Narcissistic Sociopath"

RememberAmalek bought Mamdani at 8% odds by finding mathematical errors in polls the market trusted. He turned $800 into $1.4M on Polymarket.

> Read how

🔮 $286 to $1M from 'Reversing Stupidity'

🔮 Just Call Them

Hedge fund manager Chris DeMuth Jr. reveals his playbook for special situations research. From paying homeless guys to surveil government offices, to the dark arts of FOIA requests, and getting executives to spill their guts on calls.

Subscribe Free to The Oracle by Polymarket. Learn to think like a world class forecaster.

Today’s Headlines 🍿

Private Credit BDCs: AI-driven fears about the software industry have affected private credit as well, leading to many BDCs selling off this week in what’s being dubbed the “SaaSpocalypse.” Software is the largest sector exposure for BDCs at around 20%, making the industry especially sensitive. The decline in debt prices pushed $18B of U.S. tech loans into distressed trading levels, while companies like Perforce, FinThrive, Dayforce, and Calabrio have been particularly pressured.

Apollo is one manager that was ahead of the curve, cutting its direct lending funds’ software exposure by almost half in 2025. The firm’s John Zito called out the downside last fall, saying that “the real risk is — is software dead?”

Private Equity’s “zombie companies”: Private equity is increasingly stuck with so-called “zombie companies,” portfolio companies weighed down by high debt, weak growth, and lower valuations. With exits frozen and holding periods at record highs, roughly $1T in assets are trapped.

Anthropic takes aim at AI ads: Anthropic made its Super Bowl debut by directly mocking ads in AI chats, positioning Claude as an ad-free alternative to OpenAI and ChatGPT. The splashy campaign highlights a shift in AI competition, where user trust, not just model performance, is becoming a key differentiator.

Hung Deal: A Deutsche-led group of banks is stuck with $1.2B of software loans as the threat of AI disruption stokes fear in investors. The banks were unable to sell the loans backing Conga’s acquisition of PROS Holdings’ B2B unit, and will now pivot to a $625mm term loan to fund the deal. The group was also due to refinance a $540mm loan maturing in 2028, but it will now remain outstanding.

In Other News 📖 🍿

Washington and Tehran will hold de-escalation talks in Oman on Friday, sending oil prices <$65.

D.E. Shaw is pushing for leadership and board changes at CoStar, blaming the company’s underperformance on its money-losing Homes.com expansion.

Disney announces parks chief Josh D’Amaro to succeed Bob Iger as CEO, while Disney TV and streaming head Dana Walden will become president and chief creative officer.

Pepsi cuts snack prices by up to 15% after consumer pushback over affordability, aiming to boost purchase frequency.

Target’s new CEO Michael Fiddelke admits they lost trust with shoppers and employees amid political controversy, soft sales, and market-share losses, and outlined plans for a renewed focus on core categories.

Adobe spent $1.4B on Ads in 2025, up 30% y/y as it ramps promotion of its AI tools to defend market share.

Cipher Mining gets $13B of orders for its $2B junk-bond sale. The five-year BB bond will yield 6.125%, and will help fund the Black Pearl data center that will be leased to AWS.

26 North’s Josh Harris warns about retail involvement in PE, saying that retail investors don’t understand that the structures offer less liquidity during a time of need.

EQT is weighing a sale of its stake in Thinkproject, a SaaS provider that could be valued at as much as $1.8B.

Rocket Companies shares jumped 6% on Tuesday after the CEO announced that mortgage loan production volume surged to its highest level in four years.

The Washington Post is laying off 1/3 of its workforce, with especially heavy losses in sports, local, and foreign coverage.

IPO News:

Clear Street is seeking $1.05B in an IPO, offering 23.8 million shares for $40 to $44 each. The top of the range would give the broker a market value of $12B. BlackRock has signed up as a cornerstone investor for $200mm of the IPO shares.

Veradermics, a hair loss biopharma firm, raised $256mm in an IPO priced above the top of its marketed range. The company has a market value of $596mm at the IPO price, ending the day up 122%.

M&A Transactions💭

Texas Instruments strikes a $7.5B deal to acquire Silicon Labs (NAS: SLAB). Texas Instruments will acquire Silicon Labs for $231 per share in cash, implying a premium of about 69% to the stock’s last unaffected closing price on Tuesday. Qatalyst Partners is advising on the sale.

Vertica Analytics Database Platform, provider of an analytics database platform, has entered into a definitive agreement to be acquired for $250.0M by Rocket Software.

Tyr Tactical, manufacturer of tactical gear, was acquired for $170.0M by Cadre Holdings (NYS: CDRE). The purchase consisted of $120.0M of cash and $24.0M of Cadre Holdings common stock, as well as $1.0M of Cadre Holdings Common stock in the form of RSU awards to be granted to certain employees of Tyr Tactical. The company will receive a contingent payout of $25.0M based on the achievement of specified net revenue targets. William Blair & Company advised on the sale.

Tennova Healthcare-Clarksville, operator of a hospital, was acquired for $600.0M by Vanderbilt University Medical Center. Leerink Partners advised on the sale.

Teciem, provider of treasury and capital market services, was acquired for $2.0B by Apax Partners. The transaction was supported by $1.44B in debt financing. Evercore Group and Perella Weinberg Partners advised on the sale.

A Eight Premium Hotel Portfolio was acquired by Sunday PropTech for INR 6.0B.

SomaLogic Operating Company, developer of proteomic technology designed to commercialize life science research tools, was acquired for $425.0M by Illumina (NAS: ILMN). The company will receive a contingent payout of $75.0M in near-term performance-based milestones and performance-based royalties. Centerview Partners and UBS Group advised on the sale.

REV Group, a U.S.-based designer, manufacturer, and distributor of specialty vehicles, was acquired for $425.0M by Terex (NYS: TEX). EV/EBIDTA was 4.65x and EV/Revenue was 0.3x. J.P. Morgan advised on the sale.

Prolec GE, manufacturer of transformers, was acquired for $5.275B by GE Vernova (NYS: GEV). EV/Revenue was 1.76x. J.P. Morgan advised on the sale.

Peakstone Realty Trust (NYS: PKST), an internally managed, publicly registered real estate investment trust, has entered into a definitive agreement to be acquired for $1.85B by Brookfield Asset Management. EV/EBITDA was 15.46x and EV/Revenue was 8.34x. Bank of America advised on the sale.

Parker Hannifin, operator of a global facet filtration business, has reached a definitive agreement to be acquired for $820.0M by Donaldson Company (NYS: DCI).

OmniMax International, manufacturer of residential building products, was acquired for $1.335B by Gibraltar Industries (NAS: ROCK). EV/EBITDA was 12.14x and EV/Revenue was 2.36x. Rothschild & Co advised on the sale.

Northfield Bancorp (NAS: NFBK), the holding company for Northfield Bank, has reached a definitive agreement to be acquired for $597.0M by Columbia Bank (NAS: CLBK). EV/Revenue was 3.87x. Raymond James advised on the sale.

The Water Management Business of Norma Group (ETR: NOEJ) was acquired by advanced Drainage Systems (NYS: WMS) for $1.0B. Centerview Partners and Jefferies advised on the sale.

The Consumer Fiber Operations of Lumen Technologies (NYS: LUMN) was acquired by AT&T (NYS: T) for $5.75B. J.P. Morgan, Morgan Stanley, and Goldman Sachs advised on the sale.

The US Protection Business of Legal & Genal Group was acquired for $2.3B by Meiji Yasuda Life Insurance Company.

Inigo, provider of specialty insurance and reinsurance services, was acquired for $1.67B by Radian Group (RDN). Evercore Group advised on the sale.

HSBC Life, provider of life insurance services in the UK, was acquired for GBP 260.0M by Chesnara (LON: CSN).

Foran Mining (TSE: FOM), engaged in the acquisition, exploration, and development of mineral properties, has reached a definitive agreement to be acquired for CAD 4.231B by Eldorado Gold (TSE: ELD). Morgan Stanley and Stifel advised on the sale.

For The Record, developer of digital recording software, has reached a definitive agreement to be acquired for $212.5M by Tyler Technologies (NYS: TYL).

The Feminine Care Business of Edgewell Personal Care (NYS: EPC) was acquired by Essity (STO: ESSITY B) for $340.0M. Perella Weinberg Partners advised on the sale.

Eddyfi Technologies, developer of advanced non-destructive testing inspection technologies, was acquired for $1.45B by ESAB (NYS: ESAB). EC Mergers and Acquisitions advised on the sale.

Dimensa, developer of digital financial solutions, has reached a definitive agreement to be acquired for BRL 1.4B by Evertec (NYS: EVTC).

Composition Brands, provider of premium residential and commercial kitchen, was acquired for $675.0M by 26North Partners. The transaction values the company at $1.32B. Goldman Sachs advised on the sale.

Comerica, with assets of around $80.0B, Comerica is primarily relationship-based commercial bank, was acquired for $10.9B by Fifth Third Bancorp (NAS: FITB). EV/Net Income was 15.77x and EV/Revenue was 3.24x. J.P. Morgan, Keefe, Bruyette & Woods, Stifel Financial, and Goldman Sachs advised on the sale.

Center for Research in Security Prices, provider of financial and market research data, was acquired for $365.0M by Morningstar (NAS: MORN). EV/Revenue was 6.64x. Kroll and William Blair & Company advised on the sale.

Celestial AI, developer of a data center and AI computing platform, was acquired for $6.0B by Marvell Technology (NAS: MRVL). Morgan Stanley advised on the sale.

The Micromax Business of Celanese (NYS: CE) was acquired by Element Solutions (NYS: ESI) for $500.0M. EV/Revenue was 1.67x. Morgan Stanley advised on the sale.

Byrne Equipment Rental, provider of industrial and construction equipment rental services, was acquired for $400.0M by GFH Financial Group.

Burger King China, a subsidiary of Restaurant Brands International, was acquired for $350.0M by CPE Funds Management. Morgan Stanley advised on the sale.

The Avelox Antibiotics Business of Bayer was acquired by HSG by EUR 260.0M.

Webster Financial (NYS: WBS), a full-service provider of financial services, has reached a definitive agreement to be acquired for $12.3B by Banco Santander (MAD: SAN). EV/Net Income was 12.62x and EV/Revenue was 4.26x. J.P. Morgan advised on the sale.

Pacific Asset Management, provider of asset management services, has reached a definitive agreement to be acquired for $418.8M by Pinnacle Investment Management (ASX: PNI).

The European Onshore Business of Orsted has entered into a definitive agreement to be acquired for DKK 10.7B by Copenhagen Infrastructure Partners.

NuVista Energy (TSE: NVA), engaged in the exploration, delineation, development, and production of oil and natural gas, was acquired for CAD 2.7B by Ovintiv (NYS: OVV). EV/EBITDA was 3.73x and EV/Revenue was 2.33x. CIBC Capital Markets, Peters & Co., RBC Capital Markets, and Richardson Barr advised on the sale.

MATRIXX Software, developer of a digital commerce platform, was acquired for $197.0M by Amdocs (NAS: DOX).

Inspirato, a private, luxury hospitality club, was acquired for $239.615M by Exclusive Resorts. EV/EBITDA was 4.38x and EV/Revenue was 0.97x. ROTH Capital Partners advised on the sale.

Hang Seng Bank, a Hong Kong-based financial institution, was acquired for HSBC Global Asset Management for $13.6B. Morgan Stanley advised on the sale.

Dowlais Group, a specialist engineering group, was acquired for $1.44B by American Axle & Manufacturing (NYS: AXL). Barclays and Rothschild & Co advised on the sale.

Bachan’s, producer of traditional barbecue sauce, has reached a definitive agreement to be acquired for $400.0M by The Marzetti (NAS: MZTI). Centerview Partners advised on the sale.

Ayesa Engineering, provider of multidisciplinary engineering and project management services, has entered into a definitive agreement to be acquired for $700.0M by Colliers International. EV/Revenue was 1.89x. Baird Partners and Arcano Partners advised on the sale.

Infineon Technologies (ETRLI FX) reached a definitive agreement to acquire The Non-optical Analog/Mixed-Signal Sensor Business of ams-OSRAM (SWX: AMS) for EUR 570.0M. EV/EBITDA was 9.89x and EV/Revenue was 2.7x. Morgan Stanley advised on the sale.

ST Telemedia Global Data Centres, operator of a global network of data centers, has reached a definitive agreement to be acquired for $5.1B by Singtel and Kohlberg Kravis Roberts. The transaction values the company at an estimated $6.22B. J.P. Morgan advised on the sale.

Private Placement Transactions💭

Anthropic is planning an employee tender offer at $350B.

Resolve AI, developer of a software engineering support platform, raised $125.0M of Series A venture funding led by Lightspeed Venture Partners at a pre-money valuation of $875.0M.

Waymo, developer of a self-driving technology, raised $16.0B of venture funding in a deal led by Dragoneer Investment Group, DST Global, and Sequoia Global at a pre-money valuation of $110.0B.

Varo, developer of a financial platform, raised $123.9M of Series G venture funding led by Warburg Pincus and Coliseum Capital Management.

Humanoid Robot Innovation Center, developer of industrial robots, raised over CNY 700.0M of venture funding from Baidu, Shun Xi Fund, and Tsinghua Holdings Capital.

Guoke Ion, manufacturer of ion therapy medical equipment, raised CNY 800.0M of venture funding led by Legend Capital and Social Security Fund Zhongguancun Independent Innovation Special Fund.

Tomorrow.io, developer of a local weather forecasting platform, raised $175.0M of venture funding led by Stonecourt Capital and HarbourVest Partners.

Skyryse, developer of a flight automation operating system, raised an estimated $300.0M of Series C venture funding led by Autopilot Fund at a pre-money valuation of $850.0M.

Overland AI, developer of AI based autonomous navigation and transportation technology, raised $100.0M of venture funding through a combination of debt and equity. Equity portion of $80.0M was led by 8VC. $20.0M of debt portion was provided by TriplePoint Capital.

Midi Health, developer of a virtual care clinical platform, raised $100.0M of Series D venture funding led by Goodwater Capital at a pre-money valuation at $900.0M.

Trugo Tech, developer of wire-controlled chassis components, raised CNY 700.0M of Series C venture funding from Zheshang Innovest Capital Management, Coco Capital, and Blue Lake Capital.

Third Arc Bio, operator of a biotech company, raised $217.0M of Series A venture funding led by Cormorant Asset Management, Hillhouse Investment Group, and Andreessen Horowitz at a pre-money valuation of $150.0M.

SynthBee, developer of a novel computing intelligence platform, raised $100.0M of seed funding led by Crosspoint Capital Partners at a pre-money valuation of $140.0M.

Positron, developer of custom hardware designed to accelerate machine learning applications, raised $230.0M of Series B venture funding led by Jump Trading, Unless, and Objective Capital Management at a pre-money valuation of $770.0M.

Newcleo, developer of clean and safe nuclear technology, raised EUR 240.71M of Series A venture funding from Banca Patrimoni Sella & C., Viaro Energy, and Ingerop.

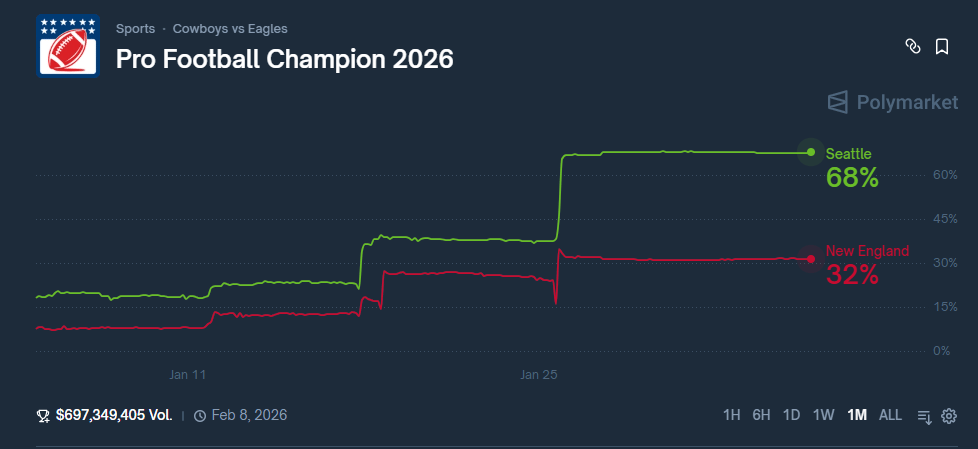

Odds of the Day 🍒

Polymarket traders are pricing in a 25% chance of

Noteworthy Chart 🧭

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Polymarket