- The Wall Street Rollup

- Posts

- What You Need To Know For December 4th

What You Need To Know For December 4th

Robots Rally, Private Credit goes on the defensive

Welcome back,

We got head faked on the new Fed Chair announcement, as per President Trump, it now sounds like an early 2026 announcement. It looks like Kevin Hassett is going to the new Fed Chair, and Treasury Secretary Scott Bessent is reportedly being considered to replace him as NEC head.

We recently passed the 3-year anniversary of ChatGPT’s release. It’s crazy how far we’ve come in the past 3 years, but yesterday’s robotics names rally had me wondering whether that will be soon become a thematic story. The Trump administration is reportedly now turning its attention towards domestic robotic development. Commerce Secretary Howard Lutnick is reportedly “all in” on accelerating the industry’s development and considering issuing an executive order on robotics next year. While semi-vague in nature, this announcement and yesterday’s price action caught my eye.

Let’s get into it.

Earnings Corner 📈 📉

Crowdstrike $CRWD ( ▲ 1.71% ) Posted a slight top and bottom line beat as ARR accelerated and net new ARR surged, showing customers are still consolidating spend onto its platform despite last year’s outage. The quarter reinforced cybersecurity as a defensive AI beneficiary, and guidance landed essentially in line as management pointed to steady demand and rising AI driven threat activity.

American Eagle $AEO ( ▼ 1.16% ) Beat expectations, helped by Aerie’s 11% comp surge that carried the quarter. The brand’s high-profile campaigns with Sydney Sweeney and Travis Kelce boosted attention more than sales, and momentum was strongest where product and value resonate which is Aerie’s advantage. That strength continued into a record Thanksgiving weekend, and the company now expects 4Q comps to rise 8-9%.

Salesforce $CRM ( ▲ 1.61% ) Delivered a clean print with a big EPS beat, steady bookings, and raised guidance. The real relief was Agentforce topping $500M and showing that Salesforce might have an actual AI revenue engine.

Snowflake $SNOW ( ▼ 2.67% ) Posted a strong quarter, but shares slipped as investors looked past the beat and focused on rising costs and uneven profitability. Growth stayed strong with product revenue up 29% and RPO up 37%, underscoring that AI driven data infrastructure demand is still resilient even as margins take time to catch up.

Dollar Tree $DLTR ( ▼ 1.23% ) Value retail kept winning across incomes as shoppers stayed price sensitive but still reached for small higher priced items. Dollar Tree lifted guidance as trade up items helped drive traffic and margins.

For deeper, stock market research upgrade to the WSR Investing Club.

For anyone who missed our 80% off Cyber Monday deal, we are still running a 50% off offer introductory offer through year-end and have also introduced an annual plan.

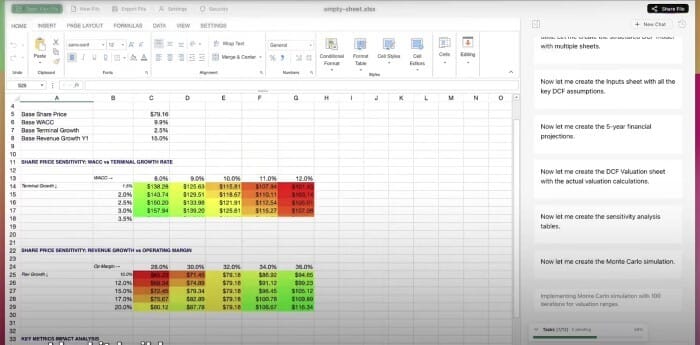

Shortcut is Disrupting Excel, a Deeper Look 🔍

Shortcut just got a major upgrade. Accuracy is up ~18.4% on internal benchmarks and the difference should feel immediately noticeable.

Introducing Shortcut v0.5, the Superhuman Excel Agent. It finishes an institutional-grade, 13-tab FP&A model correctly in minutes - 10x faster than humans

Give Shortcut a spin! It's now free to try and live on its website, as an Excel add-in, and a Google Sheets extension.

Shortcut keeps advancing further. Tasks that were very difficult became doable, doable tasks became relatively easy, and easy tasks became essentially solved.

Today’s Headlines 🍿

Morgan Stanley is holding talks to offload some of its Data Center exposure, per Bloomberg. The bank has held talks about an SRT of AI infrastructure loans. In October, MS arranged ~$30B of SPV financing for Meta's Hyperion datacenter. MS has been pretty active in the space, leading HY bond offerings for TeraWulf, Cipher Mining, and Applied Digital Corp

Anthropic Explores Massive IPO Amid $300B+ Valuation Race With OpenAI:

The AI leader is reportedly preparing for one of the largest IPOs ever while simultaneously pursuing a private funding round backed by big commitments from Microsoft and NvidiaPayrolls fall: November private payrolls unexpectedly fell by 32k, well below estimates for an increase of 40k. Smaller businesses in particular saw steep job cuts, with a decline of 120k workers, the biggest drop since March 2023. Education and health services had the biggest gain with 33k hires, and leisure and hospitality also added 13k jobs. Professional and business services (-26k), information services (-20k), and manufacturing (-18k) were the sectors with the biggest losses

This comes as mom-and-pop bankruptcies have hit a record, with over 2.2k bankruptcies filed so far this year under Subchapter V rules. High borrowing costs, tariffs, and cautious consumers have begun to weigh on earnings for small firms

Meanwhile, U.S. mortgage rates fell to 6.32%, near a one-year low. New mortgage applications rose 3% on the week to the highest level since early 2023, while applications to refinance fell 4% but remain up 109% y/y

Private-Credit Fears Rest on Misunderstanding, Apollo Founder Says: Marc Rowan wrote a Bloomberg Op-Ed yesterday and argues that critics are wrongly conflating the $38T investment-grade private-credit market with the much smaller $2T leveraged-lending segment, creating misguided panic about systemic risk. He says private credit is largely rated, transparent, tradable, and actually strengthens financial stability by shifting long-duration lending away from banks and into better-capitalized investors

Meanwhile, Apollo’s Jim Zelter had a really interesting thought this week - he said “we’re going to get more secular distress than cyclical distress” : By this, Zelter means that AI will change broad businesses models and create secular dislocation, not just some kind of downside case of down 5, 10, 15% vs. the base case - but a case where underwriters missing the downside by multiples

Blue Owl doubles down: Blue Owl employees put their money where their mouth is bought $115mm of Public BDC equity amid the BDC merger uproar. The company and its employees have now spent over $200mm on share purchases in the past month, including $70mm of shares in the parent company

Businesses Rush to Secure Tariff Refunds Ahead of Supreme Court Ruling: Major companies including Costco, Revlon and Bumble Bee are filing lawsuits or customs claims in hopes of reclaiming part of the roughly $200 billion in duties collected under President Trump’s sweeping tariffs. With the Supreme Court appearing skeptical of Trump’s legal authority for the levies, firms are scrambling to preserve refund rights amid uncertainty over whether (and how) repayments would actually be issued

The Battle for Warner Bros: Netflix may now be the favorite to acquire Warner Bros Discovery’s studio and streaming assets, but David Ellison at Paramount apparently has a plan B, and has now added a $5B breakup fee (up from $2.1B originally). Paramount has made an all-cash offer for the entire company, including cable channels like CNN. Although Netflix is reportedly seen by the WBD board as a “better steward” of WBD’s assets, Ellison hopes that an offer to buy the whole company and his relationship with the Trump administration may give Paramount’s bid an edge

Medline is weighing marketing its $5B IPO starting next week: The medical supplies company is ready to go public again after being bought out for $34B in 2021. Backed by Blackstone, Carlyle, and Hellman & Friedman, Medline expects to line up $2B in commitments from cornerstone investors before officially taking orders

Michael and Susan Dell Pledge $6.25 Billion to Expand “Trump Accounts”: The Dells will deposit $250 into investment accounts for 25M children, vastly expanding the reach of the new federally funded “Trump accounts” program. Their gift aims to spark a broader philanthropic movement as the government prepares to launch the savings accounts next year

NYC Picks Cohen, Bally’s and Genting for New Casino Licenses: New York selected three massive casino projects — including Steve Cohen’s $8B plan next to Citi Field — to anchor a long-delayed push for downstate gambling. The developments are expected to generate billions in tax revenue and tens of thousands of jobs, reshaping Queens and the Bronx while Manhattan bids failed amid fierce community opposition

Americans Sour on ‘Slop Bowls’ as Fast-Casual Chains Lose Momentum:

Once-dominant brands like Chipotle, Sweetgreen, and Cava are seeing sales slump as diners shift away from customizable lunch bowls toward cheaper, more filling handhelds such as sandwiches and tacosNvidia Buys $2B Stake in Synopsys: The purchase is part of a major multiyear deal to accelerate compute-intensive engineering, agentic AI, and cloud-based design workflows. CEO Jensen Huang says the collaboration will slash chip-design workloads from weeks to hours and further shift the industry toward GPU-accelerated computing

Consulting Giants Freeze Starting Pay as AI Undercuts Junior Roles: Firms like McKinsey, BCG and Bain have held graduate salaries flat for a third year, as AI reduces the need for large cohorts of junior analysts and pressures the industry’s traditional pyramid model. Major consultancies are shifting hiring toward mid-career specialists while cutting back on graduate recruitment, anticipating big productivity gains from generative AI

Billionaire Bets on Flying Taxis to Fix South Florida Gridlock: Stephen Ross is partnering with Archer Aviation to build a network of vertiports for electric air taxis connecting Miami, Fort Lauderdale, Palm Beach and his West Palm properties, with one-way trips costing up to $200 and taking around 30 minutes

Ken Griffin is offloading the last of his Chicago properties: Griffin’s Park Tower penthouse, currently listed at $12.5mm, is now under contract with a buyer. The sale will complete Griffin’s move out of Chicago after relocating Citadel’s headquarters to Miami in 2022

OpenAI’s Sam Altman declared a “code red” following the rise of Gemini, declaring the need to focus on improving ChatGPT and put off other initiatives like Ads and Shopping

Apple’s design chief has been poached by Meta: Alan Dye, who has led Apple’s user interface team for the last decade and was behind the Liquid Glass design, is now on his way to Meta. Dye will focus on integrating AI features into Meta’s consumer devices, such as smart glasses and VR headsets

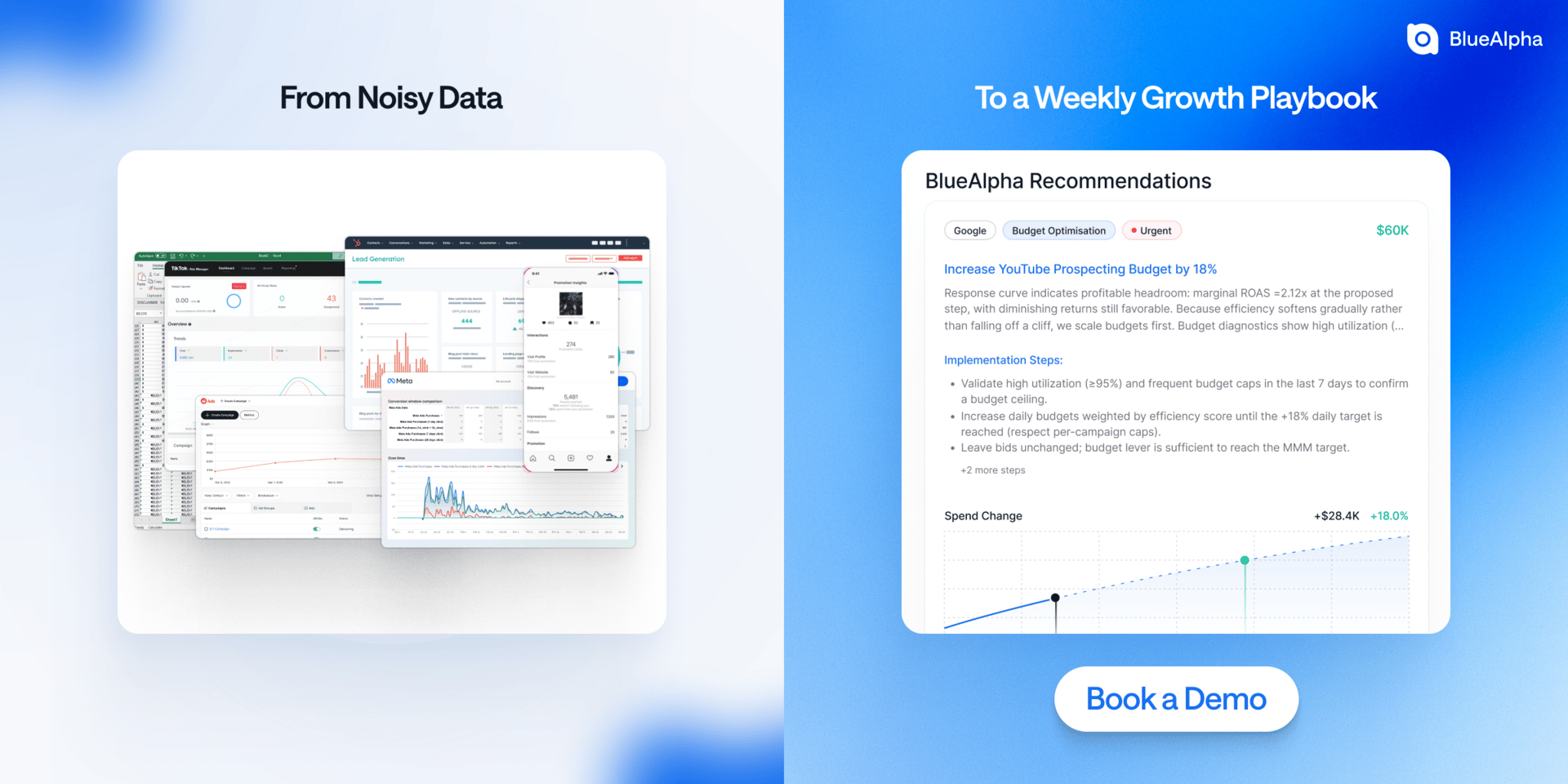

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.

M&A Transactions💭

Bun, developer of an all-in-one JavaScript runtime platform, was acquired for an undisclosed amount by Anthropic.

The Finance, Risk, and Regulatory Reporting Business Unit of Wolters Kluwer was acquired by Regnology for EUR 450.0M. Raymond James Financial advised on the sale.

Stakeholder Midstream, operator of a midstream oil and gas company, has reached a definitive agreement to be acquired for $1.25B by Targa Resources (NYS: TRGP). EV/Revenue was 123.76x. Jefferies advised on the sale.

Shogini Technoarts, manufacturer of printed circuit boards, was acquired for INR 5.06B by Amber Enterprises (NSE: AMBER).

Ronzoni, producer of dry pasta based intended for bakes and tosses, was acquired for $375.0M by Richardson International.

Purchasing Power, operator of a financial wellness and purchasing platform, has reached a definitive agreement to be acquired for $420.0M by PROG Holdings (NYS: PRG). Barclays advised on the sale.

Pioneer, manufacturer of electronic and digital entertainment products, was acquired for $1.1B by Innolux (TAI: 3481). Bank of America and Deutsche Bank Securities advised on the sale.

Paragon Energy Solutions, provider of nuclear energy technology products, was acquired for $585.0M by Mirion Technologies (NYS: MIR). Moelis & Company and Robert W. Baird & Co. advised on the sale.

Low Carbon, operator of an investment and asset management company, was acquired for GBP $1.1B by CVC DIF. Evercore Group advised on the sale.

Laurentian Bank of Canada (TSE: LB), provider of banking services, has entered into a definitive agreement to be acquired for CAD 1.9B by Fairstone Bank of Canada. EV/Net Income 14.03x and EV/Revenue 1.94x. J.P. Morgan and Blair Franklin Capital Partners advised on the sale.

KIND, developer and manufacturer of hearing acoustics and optics, was acquired for EUR 700.0M by Demant (CSE: DEMANT).

JET Tankstellen Deutschland, operator of fuel stations and convenience stores, was acquired for $2.8B by Energy Equation Partners.

Innovator Capital Management has entered into a definitive agreement to be acquired by The Goldman Sachs Group through a $2.0B LBO. Oppenheimer & Company advised on the sale.

Hanesbrands, manufactures basic and athletic apparel, was acquired for $6.6B by Gildan Activewear (TSE: GIL). EV/EBITDA was 14.47x and EV/Revenue was 1.87x. Evercore Group, Morgan Stanley, and Goldman Sachs advised on the sale.

Fosber, designer and manufacturer of complete corrugator lines, entered into a definitive agreement to be acquired for $900.0M by Brookfield Asset Management.

First IC Corp (PINX: FIEB), a bank holding company, was acquired for $206.0M by MetroCity Bankshares (NAS: MCBS). Stephens advised on the sale.

EnterCard Group, provider of credit cards and consumer loans, was acquired for SEK 2.75B by Swedbank (STO: SWED A). EV/Revenue was 1.99x.

EMCOR UK, provider of facilities management services and a division of Emcor Group, was acquired by OCS Group for $225.0M. Evercore Group advised on the sale.

Concrete Pipe & Precast, manufacturer of concrete products, was acquired for $675.0M by Commercial Metas (NYS: CMC). Evercore Group advised on the sale.

The Phia Group, provider of outsource cost containment and payment integrity services, was acquired for $425.0M by InTandem Capital Partners. Covington Associates and TripleTree advised on the sale.

IMO Car Wash Group, provider of car washing and cleaning systems, has entered into a definitive agreement to be acquired for EUR 406.0M by Franchise Equity Partners. Rothschild & Co advised on the sale.

The Digital Transformation Solutions Business Unit of Harman International Industries was acquired for $375.0M by Wipro (BBOM: 507685). Deutsche Bank advised on the sale.

Eventbrite (NYS: EB), developer of an event technology platform, has entered into a definitive agreement to be acquired for $500.0M by Bending Spoons. EV/Revenue was 1.7x. Allen & Company advised on the sale.

Corellium, developer of security research software, was acquired for $170.0M by Cellebrite DI (NAS: CLBT). J.P. Morgan advised on the sale.

Celestial AI, developer of a data center and AI computing platform, has reached a definitive agreement to be acquired for $3.25B by Marvell Technology (NAS: MRVL). Morgan Stanley advised on the sale.

Catchpoint, developer of a technology platform, was acquired for $250.0M by LogicMonitor. Cantor Fitzgerald advised on the sale.

CAC Group, provider of insurance broker and advisor expertise, has reached a definitive agreement to be acquired for $1.026B by The Baldwin Group (NAS: BWIN).

A gold mine located in Abidjan, Ivory Coast, of Barrick Mining was acquired by Banque Atlantique for $305.0M. TD Securities advised on the sale.

Alliance, operator of a farmer-owned red meat company, was acquired for NZD 270.0M by Dawn Meats. EV/Revenue was 0.19x.

Veza, developer of a data security platform, was acquired for $1.0B by ServiceNow Ventures. Qatalyst Partners advised on the sale.

Smith Detection, manufacturer of threat detection and screening products, has entered into a definitive agreement to be acquired for GBP 2.0B by Smiths Group. Barclays advised on the sale.

Bhushan Power & Steel, manufacturer of steel products, has reached a definitive agreement to be acquired for INR 157.5B by JFE Steel.

Private Placement Transactions💭

Share.It, operator of a school-facility sharing and reservation platform, raised $8.0B of Series C venture funding from IBK Venture Investment, Woori Venture Partners, and Korea Development Bank.

Protego Biopharma, developer of a small molecule therapeutics platform, raised $130.0M of Series B venture funding led by Novartis Venture Fund and Forbion.

Juxie Intelligent, developer and manufacturer of core intelligent drive components, raised over CNY 2.0B of Series C venture funding led by Beijing Energy Investment Holding.

Heven AeroTech, developer of an aerospace technology, raised $100.0M of Series B venture funding led by IonQ at a pre-money valuation of $900.0M.

Creditas, developer of a digitally secured lending platform, raised $108.0M of Series G venture funding led by Andbank at a pre-money valuation of $3.19B.

Black Forest Labs, developer of generative AI image models, raised $300.0M of Series B venture funding led by Andreessen Horowitz and Salesforce Ventures at a pre-money valuation of $2.95B.

Mujin, developer of industrial robots, raised JPY 36.4B of Series D venture funding led by NTT Data Group and Qatar Investment Authority.

Kalshi, developer of an online financial platform, raised $1.0B of Series E venture funding led by Paradigm at a pre-money valuation of $10.0B.

Eon, developer of a cloud backup posture management platform, raised $300.0M of Series D venture funding led by Gil Capital at a pre-money valuation of $3.7B.

Curative, provider of health insurance services, raised $150.0M of Series B venture funding from Chris Anderson, Michael Novogratz, and Justin Mateen at a pre-money valuation of $1.13B.

Antithesis, developer of quality assurance software, raised $105.0M of Series A venture funding led by Jane Street.

Angle Health, operator of a health insurance platform, raised $134.0M of Series AA venture funding.

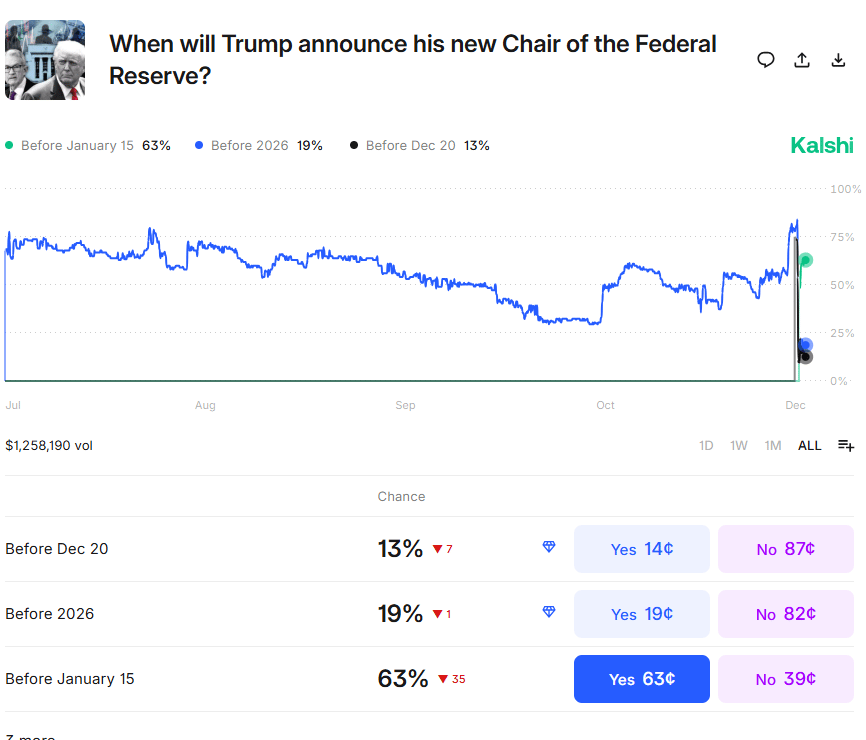

Odds of the Day 🍒

Kalshi traders are pricing in a 63% chance of Trump announcing a new Fed Chair by Jan 15th.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 50% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.