- The Wall Street Rollup

- Posts

- The Week Ahead - September 28th

The Week Ahead - September 28th

The Biggest LBO Ever? Plus, Adams drops out

Together with Pegasus

The Week Ahead Of Us 🔍

Welcome back! We’ve got a light week ahead as 3Q wraps up.

Remember, we’re running searches for a few private credit jobs - with origination roles in Cali and DC, an entry-level analyst role in Dallas, and a Credit Analyst role in NYC. Apply directly through those links.

Btw, we’ve heard murmurs of Investment Banking recruiting kicking off soon - so look into access to the Banking Playbook here. Built by Investment Bankers for future Investment Bankers.

Let’s get into it. Here’s a look at earnings this week.

Monday: Carnival Corporation, Jefferies Financial, Progress Software

Tuesday: Nike, Paychex, United Natural Foods, Lamb Weston

Wednesday: Conagra Brands, RPM International, Acuity

Here’s a look at economic data this week (estimates are in quotations).

Monday: Pending home sales (0.0%)

Tuesday: S&P Case-Shiller home price index (20 cities),Chicago Business Barometer PMI (43.0), Job openings (7.1M), Consumer confidence (95.8)

Wednesday: ADP employment (40,000), Construction spending (-0.2%), S&P final U.S. manufacturing PMI, ISM manufacturing (48.9%), Auto sales

Thursday: Initial jobless claims (228,000), Factory orders (1.5%)

Friday: U.S. employment report (45,000), U.S. unemployment rate (4.3%), U.S. hourly wages (0.3%), Hourly wages year over year (3.6%), S&P final U.S. services PMI, ISM services (51.7%)

Fed Governor Speeches

Monday: Fed Reserve Governor Christopher Waller, Cleveland Fed President Beth Hammack, Atlanta Fed President Raphael Bostic

Tuesday: Fed Reserve Vice Chair Philip Jefferson, Chicago Fed President Austan Goolsbee

Wednesday: None

Thursday: Dallas Fed President Lorie Logan

Friday: Fed Reserve Vice Chair Philip Jefferson

Liquidity Management for the PE Backed CFO

In an LBO, Cash is king.

Pegasus Insights is a next-gen liquidity management platform purpose-built by Finance experts for Finance Leaders, Deal, PE-backed CFOs, Deal Teams, and Operating Partners.

Pegasus delivers:

Lighting fast cash and liquidity forecasting

Real-time visibility into cash

Seamless collaboration

Actionable levers to improve your Cash conversion cycle

Model faster, decide easier, and stay ahead.

Now live → Book a demo and see it in action.

Earnings Corner 📈 📉

Costco $COST ( ▼ 0.66% ) The wholesale grocery store posted a slight top and bottom-line beat. Revenue rose 8% to $86.2, and EPS was $5.87. Comparable sales rose 6.4% when adjusted for gas prices and currency, driven by double-digit gains in membership fees (up 14%), e-commerce (up 13.5%), and fresh food. Management also noted tariff headwinds and trimmed discretionary inventory as consumers cut back. Costco does not issue formal guidance, but investors remain cautious as U.S. comp sales growth continues to decelerate and the stock’s premium valuation leaves little room for multiple expansion.

For deeper, stock market research upgrade to the WSR Investing Club

Today’s Headlines 🍿

The biggest LBO ever? EA is set to go private in a $50B deal, a number that would surpass the agreement to take TXU Energy private for $32B in 2007. Silver Lake, Saudi Arabia’s Public Investment Fund, and Jared Kushner’s Affinity Partners are the leading investors. The video game company was valued at $43B before the news, which sent the stock up nearly 15%

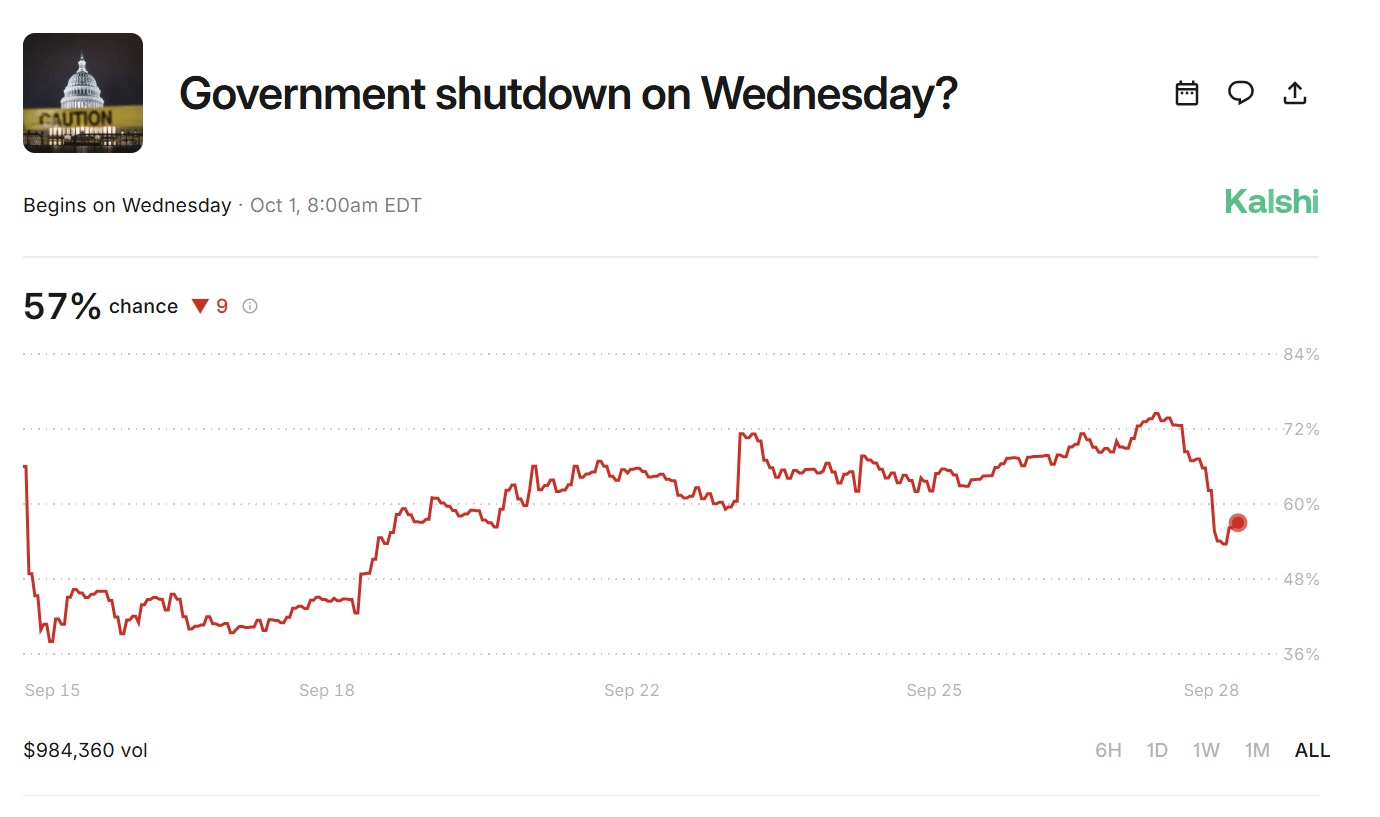

Government shutdown news: Trump is set to meet with top congressional leaders from both parties on Monday as the 10/1 deadline nears. Democrats are focused on healthcare and want to extend Affordable Care Act credits, and republicans acknowledge that their concerns will have to be addressed - but not until later this year, stating “you can’t do this by Tuesday”

Adams drops out: Eric Adams, NYC’s mayor, has decided to drop out after polling quite poorly to Zohran. The expectation is that support will consolidate around former NY governor Andrew Cuomo, although Zohran is heavily favored to win

The U.S. will impose a 100% tariff on pharmaceuticals: The tariff will apply to branded, patented drugs and will take effect on October 1st, unless firms build plants locally. This is much lower than the 250% rate Trump had floated for pharmaceuticals, but the tariff is still significant, and industry experts warn of supply chain disruptions. Novartis and Roche are two companies with extra risk here - they have a higher share of active ingredient sites that are international

Trump is also adding a 25% tariff to heavy-duty trucks, a 50% levy on kitchen cabinets and bathroom vanities, and a 30% levy on upholstered furniture, effective October 1st. Mexico and Canada are most vulnerable to the new truck tariffs, while China and Vietnam are the top sources of imported furniture

TikTok’s U.S. future takes shape: Oracle, Silver Lake, and Abu Dhabi’s MGX will take a combined 45% stake in TikTok USA, while ByteDance retains 19.9% and other investors hold the rest. Trump is set to back the deal with an executive order, keeping the app alive in the U.S. under new American-led governance

Walmart’s AI warning: CEO Doug McMillon says artificial intelligence will “change literally every job,” eliminating some roles while creating others

The retailer expects its 2.1 million-strong workforce to stay flat for three years as jobs shift, with new roles like “agent builders” emerging and others phased outMicrosoft Cheaper to Borrow Than Uncle Sam: A quirk in bond markets has left Microsoft debt trading at lower yields than equivalent Treasurys—something that almost never happens. Two of its AAA-rated bonds recently dipped into “negative spread” territory versus government debt

Consumer Spending remains strong, increasing at an inflation-adjusted 0.4% pace in August. This is the third straight month of gains, suggesting that consumers continue to power the economy despite sticky inflation

Inflation was little changed in August - the PCE index posted a 0.3% gain for the month, rising 2.7% on an annual basis. Core PCE rose 0.2% for the month and 2.9% y/y. All numbers were in line with consensus

Wall Street’s elite lose to a 24-year old: Sasha Cohen had to look up the rules before playing, but the Lincoln Center marketing associate outlasted hundreds of Wall Street’s best to win a poker tournament at an annual charity event

Tai Lopez’s scam falls apart: The SEC accused Tai Lopez and Alex Mehr, founders of Retail Ecommerce Ventures, of running a Ponzi scheme. The two would buy well-known retail brands, such as RadioShack, out of bankruptcy, but had “made material misrepresentations” to investors - defrauding them out of roughly $112M

The Head of Macro concedes: Former Greenlight analyst James Fishback admitted to sharing confidential portfolio details and agreed to cover the firm’s legal costs. The dispute adds to his growing notoriety after launching Azoria Capital and clashing with the Fed over Trump-era policies

Kimmel Back On Local TV: After a weeklong blackout, Nexstar and Sinclair put “Jimmy Kimmel Live!” back on 60+ ABC affiliates following his brief network suspension tied to comments after Charlie Kirk’s killing. The groups cited viewer/advertiser feedback and “free speech” commitments, said no one in government influenced them, and flagged new accountability asks to Disney

Xi presses Trump on Taiwan: Beijing sees Trump’s hunger for a trade deal as leverage to push Washington into formally opposing Taiwanese independence, a shift from past U.S. ambiguity. Such a move could fracture U.S.–Taiwan ties and hand Xi his biggest diplomatic prize

Starbucks Restructuring: The coffee giant will spend $1B to close about 500 North American stores and cut 900 non-retail jobs, its second round of layoffs this year. CEO Brian Niccol says the reset aims to revive sales by focusing on remodeled cafés, more barista hours, and customer service

Private Credit Goes Big: Blackstone is leading a $7B investment in Sempra’s Texas LNG export project, using private credit funds to bypass banks and repackage the deal into notes. Apollo, KKR, and Goldman joined in, underscoring how Wall Street giants are turning debt into equity to finance mega infrastructure

Bond traders eye jobs data as shutdown looms: Investors say the September jobs report will be pivotal for confirming a cooling labor market and supporting more Fed rate cuts, but a possible Oct. 1 government shutdown could delay its release. Markets currently price in an 80% chance of another cut at the Fed’s Oct. 28–29 meeting

M&A Transactions💭

Theratechnologies, a specialty pharmaceutical company, was acquired for $254.0M by Future Park. EV/EBITDA was 155.26x and EV/Revenue was 3.01x. Barclays and Raymond James advised on the sale.

Duagon, manufacturer of train communication and control products, has reached a definitive agreement to be acquired for EUR 500.0M by Knorr-Bremse (ETR: KBX).

DigitalOwl, developer of a natural language processing platform, has entered into a definitive agreement to be acquired for $200.0M by Datavant.

APEM, provider of consultancy services, has reached a definitive agreement to be acquired for $335.0M by Applus+. Lazard advised on the sale.

LGIC, provider of network infrastructure services, has reached a definitive agreement to be acquired for $500.0M by No.1 (TKS: 3562).

Groupe La Centrale, operator of an online marketplace for used vehicles, has reached a definitive agreement to be acquired for EUR 1.0B by Naspers (JSE: NPN).

Dentalcorp Holdings (TSE: DNTL), engaged in acquiring dental practices, has reached a definitive agreement to be acquired for CAD 2.2B by GTCR. The transaction values the company at CAD 3.3B. EV/EBITDA was 14.35x and EV/Revenue was 2.06x. Canaccord Genuity and INFOR Financial advised on the sale.

Sixth Street Partners and Metropoulos & Company acquired 8% of the New England Patriots for $720.0M. The transaction values the team at an estimated $9.0B. Sixth Street Partners will hold 3% of the team and Metropoulos & Company will hold a 5% stake.

Private Placement Transactions💭

Cohere, developer of a natural language processing software, raised $600.0M of venture funding led by Radical Ventures and Inovia Capital at a pre-money valuation of $6.4B.

Inspiren, operator of an AI-powered ecosystem, raised $100.0M of Series B venture funding led by Insight Partners and SaaS Ventures.

Bahodopi Nickel Smelting Indonesia, operator of a stainless steel processing facility, raised KRW 197.82B of venture funding from Ecopro.

MSB FUND, operator of a cryptocurrency trading platform, raised $150.0M of Series B venture funding led by Sequoia Capital at a pre-money valuation of $1.05B.

Kraken, developer of a trading platform designed to offer cryptocurrency exchange and services, raised $500.0M of venture funding led by Tribe Capital at a pre-money valuation of $14.5B.

Odds of the Day 🍒

Kalshi traders are pricing in a 57% chance of a government shutdown on Wednesday.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

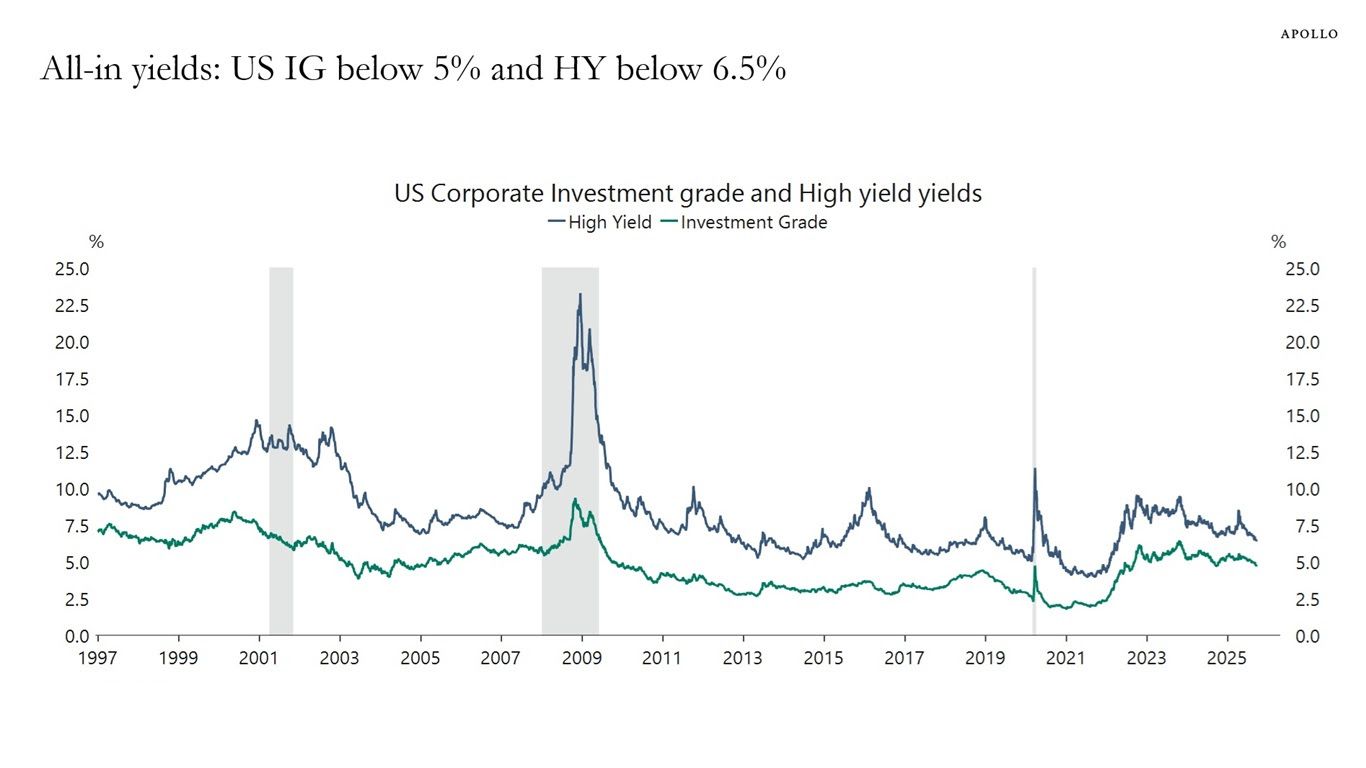

Spreads continue to grind tighter (Apollo)

Meme Cleanser 😆

“Wait so ChatGPT is just a bunch of data from Reddit and Wikipedia?”

— High Yield Harry (@HighyieldHarry)

9:14 AM • Sep 27, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Autopilot Portfolio Update: High Yield Harry recently launched 4 portfolios on Autopilot including The Golden Age of Private Credit portfolio and the Tariff Trade portfolio. You can autopilot my trades and strategies by signing up here.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.

Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.