- The Wall Street Rollup

- Posts

- The Week Ahead - October 5th

The Week Ahead - October 5th

The AI Train Isn't Stopping

The Week Ahead Of Us 🔍

Welcome back!

3Q25 is over, and 2026 is almost here! If you had to summarize 2025 in a nutshell, I think we’re going to look back at how the AI buildout went parabolic (for better or worse). A lot of the articles we’ll share below are focused on the bullish & bearish arguments you can make around AI. We’re a broken record - our economic outlook mocks Trump’s “Wow, everything’s computer” quote. Basically, consumer data shows enough ammo to merit some incremental rate cuts, but our economy and markets are actually quite gangbusters because of robust AI spend. This ginormous AI buildout is the only thing keeping everything hot, and will certainly keep the rest of ‘25 going hot, but 2026 feels like a battleground topic between extreme bullishness (continued AI investment, plus a lower rate environment) and pessimistic bearishness (inflation worries plus worries AI ROI/payback period will start looking quite poor and that hyperscalers could reduce spending) - Harry

Let’s get into it. Here’s a look at earnings this week.

Monday: Constellation Brands

Tuesday: McCormick & Company, Penguin Solutions

Wednesday: AZZ Inc

Thursday: Pepsico, Delta Air Lines, Levi Strauss, Tilray Brands

Friday: No Notable Names

Here’s a look at economic data this week (estimates are in quotations).

Monday: None

Tuesday: U.S. trade deficit (-$60.7B), Consumer credit ($14.0B)

Wednesday: Minutes of Fed's September FOMC meeting

Thursday: Initial jobless claims, Wholesale inventories

Friday: Monthly U.S. federal budget, Consumer sentiment prelim (53.5)

Fed Speeches

Monday: Kansas City Fed President Jeff Schmid

Tuesday: Atlanta Fed President Raphael Bostic, Federal Reserve governor Stephen Miran, Minneapolis Fed President Neel Kashkar, Federal Reserve governor Stephen Miran, Federal Reserve Vice Chair for Supervision Michelle Bowman’s welcoming remarks

Wednesday: St. Louis Fed President Alberto Musalem’s opening remarks, Minneapolis Fed President Neel Kashkari, Federal Reserve governor Michael Barr, and Chicago Fed President Goolsbee

Thursday: Federal Reserve Chair Jerome Powell opening remarks, Vice Chair for Supervision Michelle Bowman welcoming remarks & speech, Minneapolis Fed President Neel Kashkari and Fed governor Michael Barr discussion, San Francisco Fed President Daly

Friday: Chicago Fed President Austan Goolsbee’s opening remarks

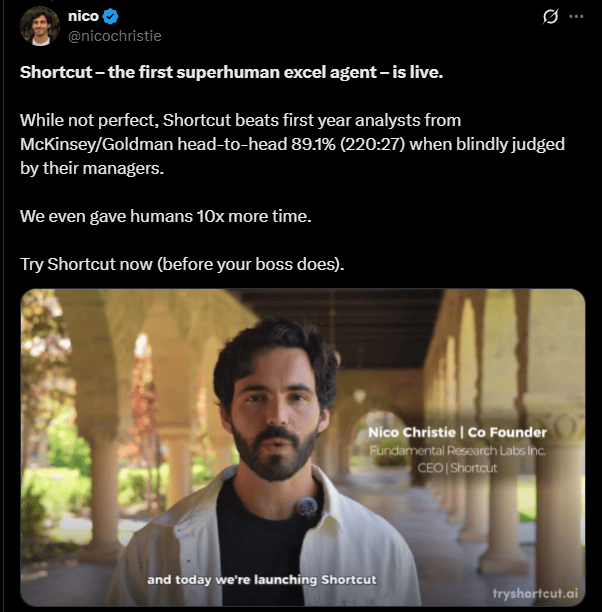

Together With Shortcut

Born out of an MIT lab, Shortcut embeds Excel’s same exact look, feel, and interface into an agentic AI software.

Users can run prompts to automatically build models, as well as upload existing excel files into Shortcut.

The Internet has been flocking to the world’s first superhuman excel agent.

See what all the buzz is about:

Upgrade to WSR Investing Club 📈

There’s no earnings to talk about today, so we’re going to talk about our Paid Plan - WSR Investing Club.

2-4 times a month, the Wall Street Rollup team delivers high-conviction stock research and analysis: helping you all cut through the noise, spot potential opportunities faster, and stay ahead of the curve. Last Tuesday, we completed another piece on $NATL ( ▲ 1.23% ) which you read about here.

Now is the best time to join. For deeper, stock market research upgrade to the WSR Investing Club

Today’s Headlines 🍿

JP Morgan is worried about Nuclear: JPM’s IB team is worried about investors overhyping nuclear, especially given that it generally takes a decade to build new plants. Bloomberg estimates that there will be a $350B nuclear spending boom, with reactor output increasing by 63% by 2050

AI Spending could go into 2027: JP Morgan expects the 5 largest hyperscalers, Google, Amazon, Meta, and Oracle, to collectively spend over $1.2 TRILLION by 2027

Via JP Morgan

BlackRock’s $40B Data Center bet: BlackRock is in advanced talks to acquire Aligned Data Centers in a $40B deal. The lesser-known infrastructure company raised $12B earlier this year to expand its footprint and support the surging demand for data centers, positioning itself to be a major beneficiary of the boom in AI spending

No Jobs Numbers: There were no jobs numbers on Friday due to the government shutdown and volatility at the BLS

Government shutdown latest: The Senate once again did not pass dueling funding bills, keeping the government shut until at least Monday. The Republicans proposed resuming funding at current levels through late November, while the Democrats’ version included additional healthcare spending

Kevin Hassett said that layoffs for federal employees will begin if Trump decides that congressional negotiations to reopen “are going absolutely nowhere”

The latest Fed Talk: The weakening job market has been the main focus recently, but several Fed officials remain more concerned with higher inflation. Dallas Fed President Lorie Logan said the U.S. is farther away from its inflation target than it is from the maximum employment goal, and reiterated that officials should move cautiously with rate cuts. Chicago Fed President Austan Goolsbee echoed a similar sentiment, citing estimates from his staff that suggest the unemployment rate remained unchanged last month

Vice Chair Philip Jefferson also spoke on how the Fed is balancing both risks, stating that he will continue to evaluate the appropriate stance as new economic data comes out and White House policies are finalized. Even Governor Stephen Miran said his view on inflation could be amended, but only if housing costs unexpectedly jumped. Jefferson said he doesn’t expect the government shutdown - and lack of economic data reporting - to significantly hinder the Fed

Private Equity eyeing Costa Coffee: Bain Capital has submitted a bid for the world’s second largest coffee chain, with an offer in the £1.5-£2.0 range. Coca-Cola has decided to sell the company after Costa has struggled with rising costs and competition from upmarket rivals such as Gail’s (which Bain owns). KKR has also shown interest in the sale

Big Ten in Talks on $2B Private Capital Deal: League exploring new commercial arm to provide upfront payments to schools while retaining control over operations.

Private Equity’s Quiet Hand in Drug Research: Many clinical trials are now reviewed by boards linked to the same investors backing drugmakers, raising red flags over conflicts of interest and patient safety

Private credit finds new life in the AI boom: After struggling to deploy record cash piles, major private lenders are seizing on the AI data center rush — funding massive builds from Louisiana to London. According to a new BBG Opinion, Firms like Pimco, Blue Owl, Ares, and Blackstone see AI infrastructure as their next big lending frontier as traditional banks retake ground

First Brands gets interim DIP approval amid collateral chaos: The company secured $1.1B in emergency financing despite unresolved disputes among lenders over collateral and possible factoring irregularities. Evolution hinted it may seek an examiner or trustee after alleging “unauthorized transfers” as investigations continue into double-pledged receivables

Jim Chanos warns private credit is fueling another crisis: The famed short seller compared Wall Street’s $2T private credit boom to pre-2008 subprime excesses, calling First Brands’ collapse a “red flag” for opaque, overleveraged lending. He said the “magical machine” of high-yield private debt hides risk behind layers of intermediaries — a system he argues is “a feature, not a bug”

Sharpie proves U.S. reshoring can cut costs: Newell invested nearly $2B to automate and retrain in Maryville, TN, tripling-to-quadrupling output and onshoring most Sharpie production without price hikes or headcount cuts (only the felt tip is imported). The centralized, automated plant now makes 500M+ markers a year

Japan kills its ‘zombies’: With rates rising and governance reforms, Tokyo is letting unprofitable firms fail—bankruptcies hit a decade high as the TSE and new laws push “creative destruction.” Pain is real for owners, but a tight labor market is absorbing workers and redirecting capital toward more productive companies

Fun Fact: Taylor Swift’s The Life of a Showgirl is her shortest album yet, with just 12 tracks, a nod to it being her 12th studio release

M&A Transactions💭

Paramount Skydance to buy The Free Press for an estimated $150.0M and names its founder Bari Weiss as the editor-in-chief of CBS News.

Soterra, provider of land management services, has reached a definitive agreement to be acquired for $462.0M by Molpus Woodlands Group. Perella Weinberg Partners advised on the sale.

Royal Boskalis Westminster’s Tugboat and Salvage Operations in Australia and Papua New Guinea has reached a definitive agreement to be acquired for $600.0M by Boluda Towage Europe.

Berkshire Hathaway (NYS: BRK.A) has reached a definitive agreement to acquire The OxyChem Division in Dallas, Texas of Occidental Petroleum (NYS: OXY) for $9.7B. EV/Revenue was 1.94x. Barclays advised on the sale.

LG Toray Hungary Battery Separator, manufacturer of battery separator film, has reached a definitive agreement to be acquired for KRW 280.0B by LG Chem (KRX: 051910).

Froneri International, producer of ice cream, PAI Partners’ stake in the company was rolled into a continuation fund from PAI Strategic Partnerships for an estimated EUR 7.5B. The transaction values the company at EUR 15.0B. Deutsche Bank, Rothschild & Co, and Evercore Group advised on the transaction.

Deliveroo, an online food delivery platform, was acquired for GBP 2.9B by DoorDash (NAS: DASH). EV/EBITDA was 93.17x and EV/Revenue was 1.41x. Allen & Company, Barclays, and Goldman Sachs advised on the sale.

Ceres Partners, provider of investment management services, was acquired for $500.0M by WisdomTree (NYS: WT). The company will receive a contingent $225.0M to be paid in 2030, subject to compound annual revenue growth of 12-22% measured over five years. EV/EBITDA was 22.12x and EV/Revenue was 13.26x. Berkshire Global Advisors advised on the sale.

A Portfolio of 10 Data Centers Across the USA and Canada were acquired by Centersquare.

Big 5 Sporting Goods, a specialty retailer company, was acquired for $340.8M by Worldwide Golf Shops. EV/Revenue was 0.45x. Moelis & Company advised on the sale.

Be-Mobile, developer of a traffic management platform, was acquired for $183.1M by EasyPark Group. The transaction values the company at $197.519M.

Avtron Power Solutions, manufacturer of load banks, has reached a definitive agreement to be acquired for $1.125B by Legrand (PAR: LR). EV/Revenue was 3.21x.

Nucleus Commercial Finance, operator of a fintech company, was acquired for $475.0M by Pulse.

Bamboo, provider of insurance services, has entered into a definitive agreement to be acquired for $1.01B by CVC Capital Partners. The transaction values the company at $1.75B. Evercore Group and Piper Sandler advised on the sale.

Private Placement Transactions💭

Teylor, developer of an online lending platform, raised EUR 150.0M of venture funding from Fasanara Capital.

Edgewood Properties, a company in stealth mode, raised $673.18M of venture funding from undisclosed investors.

Apex, developer of standardized satellite buses, raised $200.0M through a combination of debt and Series D venture funding at a post-money valuation of $838.77M. The equity portion of $161.2266M was led by Interlagos Capital. The transaction was supported by $38.7734M of debt financing.

Supabase, developer of an open-source backend platform, raised $202.29M of Series D venture funding led by Accel at a pre-money valuation of $1.8B.

Odds of the Day 🍒

Kalshi traders are pricing in a 91% chance of Taylor Swift to hold top ten spots on Billboard Hot 100 for the week of October 18th.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Meme Cleanser 😆

Get rich then get off the grid.

— Daniel Berk 🐝 (@danielcberk)

2:26 PM • Oct 3, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.