- The Wall Street Rollup

- Posts

- November 30th - The Week Ahead

November 30th - The Week Ahead

New Fed Chair is about to drop

The Week Ahead Of Us 🔍

Welcome back! Hope everyone had a great Thanksgiving. Not sure where the year went, but December is tomorrow and things are starting to get pushed into 2026. Futures are down slightly - obviously November was quite sluggish for stocks until rate cut odds spiked over the past week.

Meanwhile, Trump has stated that he knows who he’s picking as the next Fed Chair and will announce it soon 👀

Before we get into it, we wanted to note that this is the last call on our Cyber Monday deals (sent an email on the offers a few days back) and this is the last call to join the WSR Investing Club for $6.80/month.

Here’s a look at earnings this week.

Monday: MongoDB

Tuesday: CrowdStrike, Marvell Technology, American Eagle, GitLab, Signet Jewelers, United Natural Foods

Wednesday: Salesforce, Royal Bank of Canada, Snowflake, Dollar Tree, Five Below, Macy’s, PVH Corp, UiPath

Thursday: TD Bank, Kroger, Hewlett Packard Enterprise, Ulta, Dollar General, DocuSign, Hormel Foods

Friday: Victoria’s Secret & Co

Here’s a look at economic data this week (estimates are in quotations).

Monday: S&P final U.S. manufacturing PMI (48.6)

Tuesday: Auto sales (15.4mm)

Wednesday: ADP employment (20k), Import price index (0.1% m/m), S&P final U.S. services PMI (54.8), ISM services (52.1)

Thursday: Initial jobless claims (218k), U.S. trade deficit

Friday: Personal income (0.4% m/m), Personal spending (0.4% m/m), PCE index (0.3%), PCE y/y (2.8%), Core PCE index (0.2% m/m), Core PCE y/y (2.9%), Consumer sentiment prelim (52)

Earnings Corner 📈 📉

Dell $DELL ( ▲ 21.93% ) Revenue slightly missed while EPS beat at $2.59 on other stronger margins. AI carried the quarter, with $5.6B in AI server shipments and 37% y/y growth in servers and networking easily outweighing softness in PC sales. Dell guided a strong Q4 with $31.5B in revenue and $3.50 EPS, driven by $9.4B in expected AI sales and a higher full year AI server outlook.

Burlington $BURL ( ▼ 0.57% ) Warm weather dragged traffic and muted comps after back to school, highlighting how fragile discretionary demand is even in off price. Trends improved as temperatures cooled, but the quarter reinforced the broader theme of weather volatility and cautious consumers.

Dicks $DKS ( ▼ 3.74% ) Delivered strong core comps and moved quickly to shut weak Foot Locker stores, highlighting the split between resilient higher income sports spending and softer lower income demand, while still guiding confidently into the holidays

Best Buy $BBY ( ▼ 1.42% ) Lifted its forecast after a tech upgrade wave boosted comps, highlighting how innovation can unlock spending even as shoppers stay selective heading into the holidays.

Abercrombie & Fitch $ANF ( ▼ 1.2% ) Surged as Hollister’s strength and sharper youth momentum carried the quarter while the namesake brand softened, underscoring a holiday theme of teen driven demand outpacing slowing legacy banners. Not to tout our own horn, but we did a writeup on $ANF ( ▼ 1.2% ) before earnings and before this post-earnings rally...this feels like any reason as any to sign up to learn more about our future value picks

For deeper, stock market research upgrade to the WSR Investing Club

The Pickleball Boom Has a Franchisor — and Investors Are Taking Notice

Wall Street is waking up to pickleball. The fastest-growing sport in America has evolved from backyard pastime to billion-dollar industry — and PickleRage is positioning itself to be at the center of it.

Unlike individual club operators, PickleRage offers investors equity in the franchisor — giving accredited investors access to a diversified, asset-light business model with national scale. With hundreds of franchise locations planned over the next several years and a target 10.7x exit multiple, PickleRage is building the foundation for what could become the first dominant brand in indoor pickleball.

Behind the courts is a seasoned management team with a $2B track record in commercial real estate and private equity, applying institutional discipline to a rapidly expanding consumer trend.

If you’re looking for exposure to a high-growth category before it matures, this is your opportunity.

Note: Securities are only available to verified accredited investors who can bear the risk of loss of their investment. This advertisement is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation of an offer to buy any securities, which offer may be made only at the time a qualified offeree receives a current Private Placement Memorandum relating to a proposed investment opportunity.

Today’s Headlines 🍿

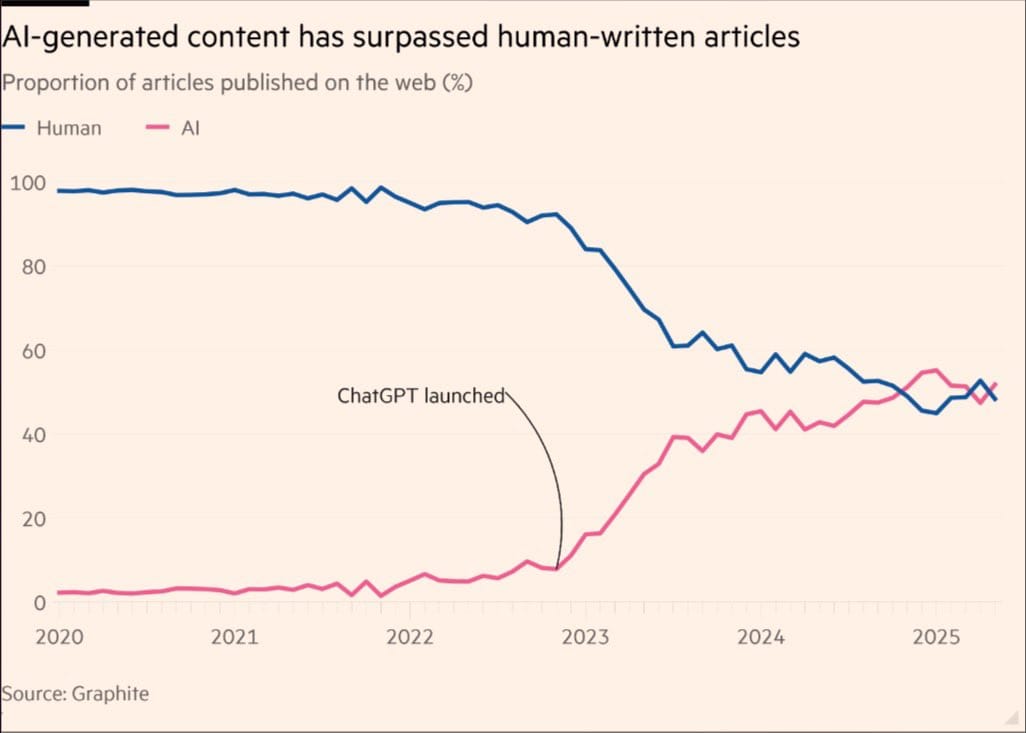

Black Friday and Cyber Monday takeaways: U.S. consumers spent a record $11.8B online this Black Friday, a 9.1% jump from last year according to a report from Adobe Analytics. A Salesforce report showed that while online sales grew to $18B, consumers actually purchased fewer items. Order volumes fell 1%, but a 7% increase in prices drove total sales higher. Shoppers heavily leaned on AI this year; $3B in U.S. online sales were driven by AI agents as AI-driven traffic to retail sites was up 805% this year. These trends are expected to continue on Cyber Monday with a projected $14.2B in online spending from U.S. consumers

Meanwhile, in-store sales growth was lacking as more consumers opted to shop from home. Some sources reported growth of up to 1.7%, while initial data from RetailNext showed that in-store traffic fell 3.6% this year.

Fed Beige Book Signals Cooling Job Market: The Fed reported softer hiring, reduced hours, and cautious consumer spending as economic momentum slows. Employment “declined slightly” through the middle of November and some businesses also flagged early AI uplift, acknowledging that new tech replaced some entry-level positions “or made existing workers productive enough to curb new hiring.” These trends strengthen expectations for a December rate cut despite lingering inflation pressures

HSBC Warns OpenAI Faces Massive Cash Shortfall: The bank estimates OpenAI won’t turn a profit by 2030 and will need another $207B to fund its compute-heavy expansion despite projected revenues topping $200B. Exploding infrastructure costs, thin margins, and uncertain monetization leave the company reliant on fresh capital as it races to meet unprecedented AI demand

Altice and the Co-Op square off: Telecom giant Altice USA has launched an antitrust complaint in New York against its organized creditor group. Altice alleges that its lenders, who make up the bulk of the $26B in debt outstanding, illegally colluded to freeze it out of the U.S. credit market and force it into bankruptcy

Co-ops are ways for creditors to organize and have negotiating power vs. stressed borrowers that normally want to pick them off in an LME. Naturally, a borrower was bound to complain. Kirkland and Ellis (who advises almost all of the borrowers who want to do LMEs) warned back in June that co-ops would eventually be challenged

Platinum’s Toilet Deal is a Donut: Fortress and Ares are among the lenders expecting a 0% recovery (aka a donut) on a loan to United Site Services, a Platinum Equity backed company. The portable toilet company was initially acquired in 2021 and saw demand rapidly decline, with a poor record integrating tuck-ins

Gemini is catching up to ChatGPT: Last week’s release of Gemini 3 has helped to boost both Alphabet’s stock and the chatbot’s usage, with monthly downloads now just below ChatGPT’s. Average minutes spent per visit has also increased, with Gemini users chatting for an industry leading ~7 minutes each time they visit the app or website

Elon is bullish Google and Nvidia: In a recent podcast, Elon said Google has “laid the groundwork for an immense amount of value creation from an AI standpoint,” and adds that Nvidia is now an obvious winner. Elon also says that AI, robotics, and spaceflight companies will be the main value drivers in the future

Databricks is set to raise $5B at a $134B valuation: The tech company’s latest funding round is designed to help employees sell shares, showing that the company is in no rush to IPO. Databricks also boosted their sales forecast to expectations of 55% growth this year, but noted it is operating at roughly breakeven

AI Data Centers Push U.S. Power Bills Higher: AI-driven data centers are straining the electric grid, driving residential electricity prices up 7.4% year-over-year to roughly 18 cents per kilowatt hour. Experts warn demand will keep climbing through the decade, especially in the West and Northeast, where prices are rising fastest

CME Data Center Overheats, Halting Global Futures Trading: A cooling failure at CME Group’s Aurora facility sent temperatures soaring to 120°F and shut down trading in key equity, bond, and commodity futures for 10 hours. The outage exposed the market’s vulnerability to a single point of failure as data-center strain grows in the AI era

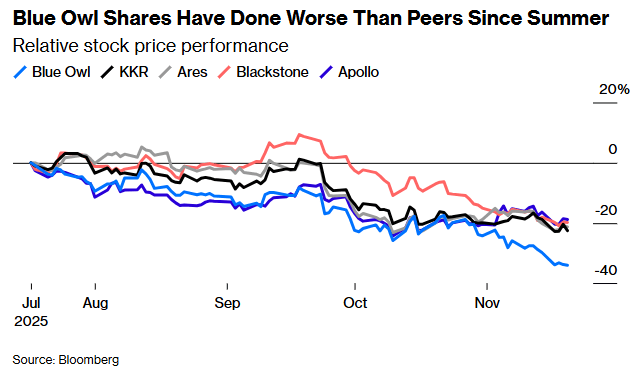

Blue Owl Becomes Focal Point for Market Jitters: A trifecta of investor fears over private-credit opacity, AI-driven data-center risks, and volatile retail capital has hammered Blue Owl’s stock. While CEO Marc Lipschultz argues these anxieties are “imaginary,” analysts say the firm’s heavy credit exposure and rapid expansion make it a natural target until sentiment shifts

HP to Cut Up to 6,000 Jobs as AI Reshapes Operations: The Company said it will eliminate up to 10% of its workforce by 2028 as it leans on AI to streamline product development, internal processes and customer support. HP warned that rising memory-chip costs could pressure margins next year even as demand for AI-enabled PCs grow. It’s hard to differentiate what is real replacement from AI vs. “AI speak” masking a declining business

Simon Jordan Reveals £50M Bid Attempt for Sheffield Wednesday: The former Crystal Palace owner says he assembled a well-funded consortium to buy the distressed club but walked away over EFL rules that would funnel millions to the outgoing owner

Sheffield United’s US Owners Seek Fresh Capital After Tough Start: COH Sports is exploring the sale of up to a 20% stake and renegotiating repayment terms after a difficult first year marked by on-field struggles and costly signings. The group also approached Sheffield Wednesday’s administrators about potential collaboration, though any move toward merging the fierce rivals would spark fan outrage

Snowstorm Disrupts Post-Holiday Travel: A Delta jet skidded off a runway in Des Moines as a powerful Midwest storm triggered whiteout conditions and a massive wave of travel chaos, with more than 1,400 flights canceled nationwide on Saturday, most due to severe weather across the upper Midwest. The same system caused a 45-car pileup in Indiana

Rick’s C-Suite Resigns: RCI Hospitality’s CEO and CFO both resigned on Friday. The troubled strip club operator recently sparked uproar for paying out a shareholder at a material premium and has been in hot water following tax auditor bribery allegations

Campbell’s Fires Executive After Secret Recording Surfaces: The company dismissed VP Martin Bally after audio emerged of him insulting Campbell’s products, customers, and coworkers in vulgar terms. The recording, released as part of a lawsuit by a former employee, has led Campbell’s to condemn the remarks as offensive and unrepresentative of its values

Disney’s “Zootopia 2” brought in $156mm domestically over the Thanksgiving holiday weekend: Both “Zootopia 2” and “Wicked: For Good” had excellent holiday weekends to fuel a record $41mm in global sales for IMAX. Total box office sales for the weekend were just under $300mm

Delivery Hero Faces Shareholder Pressure: Major investors are urging the company to consider a sale or break-up after years of losses and a 90% stock plunge from its peak. Their push for a strategic review has driven shares sharply higher as buyers circle key assets like its Korean unit

M&A Transactions💭

Vimeo was officially acquired for $1.28B by Bending Spoons. EV/Net Income was 824.07x and EV/Revenue was 3.07x. Allen & Company advised on the sale.

Truflo Marine, manufacturer of valves and related flow control products, has entered into a definitive agreement to be acquired for $225.0M by Fairbanks Morse Defense. Lazard advised on the sale.

Toyota of Montgomery, operator of a car dealership, was acquired for $151.0M by Dream Motor Group. Pinnacle Mergers and Acquisitions advised on the sale.

OCI Ammonia Holding, producer of ammonia fertilizers, has reached a definitive agreement to be acquired for EUR 290.0M by Agrofert.

Marigold Engage, developer of an integrated marketing automation software, was acquired for $325.0M by Campaign Monitor.

Koch Filter, manufacturer of air filtration systems, has reached a definitive agreement to be acquired for $450.0M by Atmus Filtration Technologies (NYS: ATMU). EV/Revenue was 2.88x. Lincoln International and Jefferies advised on the sale.

Green Dot (NYS: GDOT), a financial technology company, has reached a definitive agreement to be acquired for $1.1B by Smith Ventures. EV/EBITDA was 41.25x and EV/Revenue was 0.55x.

Canvas Energy, operator of an independent oil and natural gas company, was acquired for $550.0M by Diversified Energy Company (LON: DEC). Bank of America and Evercore Group advised on the sale.

Blue Foundry Bank (NAS: BLFY), a full-service bank, has reached a definitive agreement to be acquired for $243.0M by Fulton Financial (NAS: FULT). EV/Revenue was 5.32x. Piper Sandler advised on the sale.

With Intelligence, provider of data, intelligence, and connection services, was acquired for $1.8B by S&P Global (NYS: SPGI). EV/Revenue was 13.85x. Centerview Partners and Rothschild & Co advised on the sale.

W3C, provider of a payment technology service, was acquired for $175.0M by Exodus Movement (ASE: EXOD). D.A. Davidson Companies advised on the sale.

Premier, technology-driven healthcare improvement company, was acquired for $2.62B by Patient Square Capital. EV/EBITDA was 16.42x and EV/Revenue was 2.06x. Bank of America and Goldman Sachs advised on the sale.

In-Situ, manufacturer of water monitoring instrumentation and software, has reached a definitive agreement to be acquired for $435.0M by an undisclosed investor. EV/Revenue was 5.44x. EC Mergers and Acquisitions advised on the sale.

ht.digital, provider of professional services, has entered into a definitive agreement to be acquired for GBP 200.0M by Bridgepoint Group.

Guernsey Power Station, a natural gas combined-cycle power plant, was acquired for $2.33B by Talen Energy (NAS: TLN). Lazard and Morgan Stanley advised on the sale.

Caithness Moxie Freedom Generating Station, operator of a natural gas-fired greenfield power project, was acquired for $3.8B by Talen Energy (NAS: TLN). Lazard and Morgan Stanley advised on the sale.

Brooge Energy, an oil refinery and storage company, was acquired for AED 3.285B by Gulf Navigation Holding (DFM: GULFNAV).

Verint Systems, helps brands provide boundless customer experience automation, was acquired for $1.67B by Calabrio. EV/EBITDA was 13.39x and EV/Revenue was 1.88x. Evercore Group and Jefferies advised on the sale.

The Interpublic Group of Companies, among the world’s largest advertising holding company, was officially acquired for $15.613B by Omnicom Group (NYS: OMC). EV/EBITDA was 13.82x and EV/Revenue was 1.53x. Citigroup and Morgan Stanley advised on the sale.

Shine, developer of an international financial marketplace, has reached a definitive agreement to be acquired for DKK 10.0B by Cegid.

The Toll Road Assets of Sacyr were acquired by Actis for $1.565B.

New Way Trucks, manufacturer of refuse collection vehicles, was acquired for $450.0M by Federal Signal (NYS: FSS). Stifel Financial and Raymond James Financial advised on the sale.

Grupo Uvesco, operator of a chain of supermarkets, has entered into a definitive agreement to be acquired for EUR 700.0M by Stellum Capital, Inveready Asset Management, GAEA Inversion, Cerea Partners, Mr. Angel Jareno, Mr. Ramon Fernandez, and its management. AZ Capital and J.P. Morgan advised on the sale.

Enhanced Games, operator of a sports organization, has reached a definitive agreement to be acquired through a reverse merger by A Paradise Acquisition (NAS: APAD), the resulting combined entity will trade on the NASDAQ stock exchange under the ticker symbol UNHA. Berenberg Bank advised on the sale.

Ampere Computing, developer of microprocessors, was acquired for $6.5B by SoftBank Group (TKS: 9984). Evercore Group advised on the sale.

Aegis One, provider of liquefied natural gas shipping services, has reached a definitive agreement to be acquired for KRW 3.8T by Frontier Resources.

The Ethniki Hellenic General Insurance Company, provider of insurance services, was acquired for EUR 600.0M by Piraeus Bank.

Valtidone Logistic Development, provider of logistics real estate development services, was acquired for EUR 241.0M by CTP Invest (AMS: CTPNV).

Guild Holdings, a growth-oriented mortgage company, was acquired for $1.31B by Bayview Asset Management. EV/Net Income was 10.36x and EV/Revenue was 1.1x. Morgan Stanley advised on the sale.

Private Placement Transactions💭

X Energy, a leading developer of advanced SMR and fuel technology, raised $700.0M of Series D venture funding led by Jane Street.

Revolut, developer of a foreign exchange and money-transferring application, raised $3.0B of venture funding led by Coatue Management, Dragoneer Investment Group, Fidelity Management & Research, and Greenoaks Capital Partners at a pre-money valuation of $72.0B.

Harmonic, developer of a mathematical reasoning engine, raised $120.0M of Series C venture funding led by Ribbit Capital at a pre-money valuation of $1.33B.

Finn, operator of a software and IT service company, raised $100.0M of Seed Funding from Hitoshi Ito, Yuri Yamamoto, and Keisuke Kogure.

Zipline, provider of an automated drone delivery service, received $150.0M of Grant Funding from the U.S. Department of State.

Perpetual Next, developer of a climate technology, raised EUR 207B of Series B venture funding from Momentum Global Ventures.

Odds of the Day 🍒

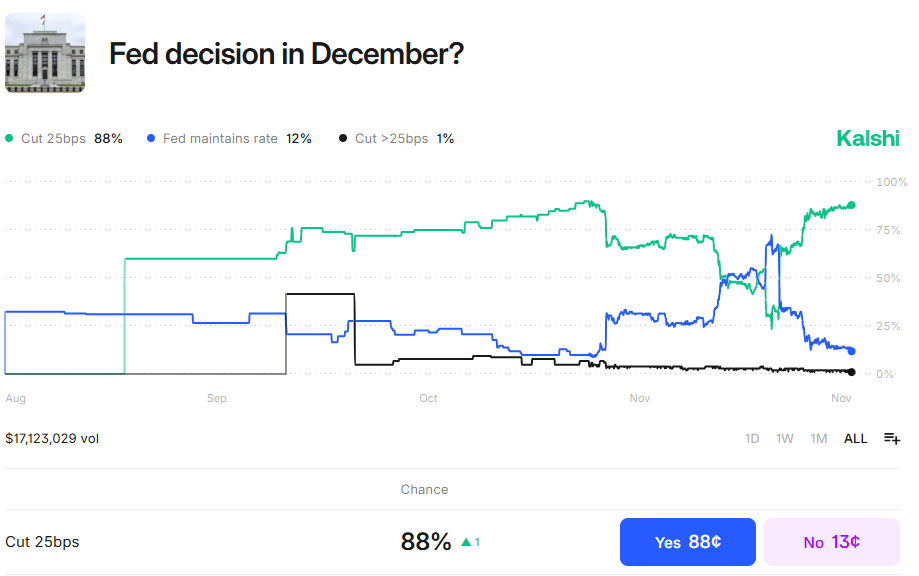

Kalshi traders are pricing in a 88% chance of a 25bps rate cut.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.