- The Wall Street Rollup

- Posts

- November 23rd - The Week Ahead

November 23rd - The Week Ahead

Divy Recaps are roaring, plus the IPO latest

The Week Ahead Of Us 🔍

Welcome back!

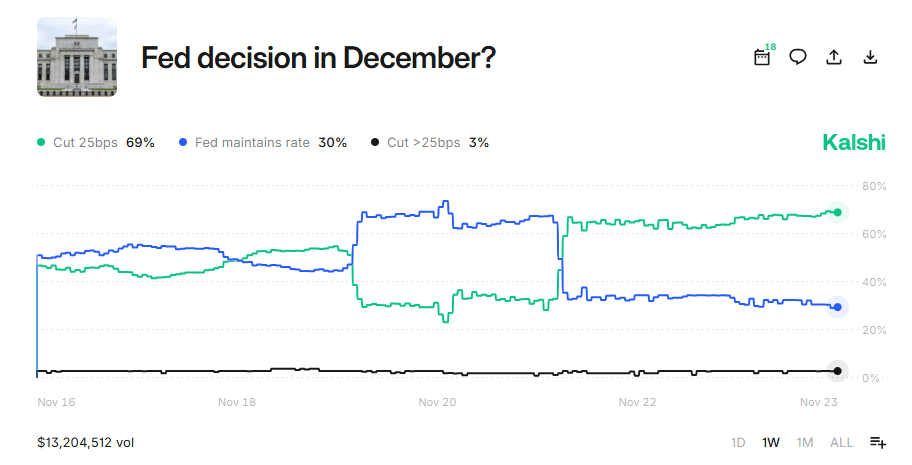

Futures are on the move higher (S&P +0.37% and Nasdaq +0.55%) as we look to recover from last week’s sell-off. Odds of a 25bps rate cut in December have moved back higher, now at 69% per Kalshi, following some constructive messaging from Fed officials.

Btw, we’re taking this Thursday off (for Thanksgiving) but we’re still going to send across an email at our normal Thursday AM time. The email will include all of our limited time Cyber Monday deals - including the last chance to upgrade to WSR Investing Club at a discount. We’ll be releasing a WSR Investing Club piece broadly to everyone tmrw morning too.

Here’s a look at earnings this week.

Monday: Zoom

Tuesday: Dell Technologies, Autodesk, Workday, HP, Urban Outfitters, Burlington, Dick's Sporting Goods, Best Buy, Kohl's, Abercrombie & Fitch, J.M. Smucker Company, Analog Devices

Wednesday: Deere & Company

Here’s a look at economic data this week (estimates are in quotations).

Tuesday: U.S. retail sales delayed report (0.3%), U.S. retail sales minus autos (0.3%), Producer price index (0.3%), Core PPI, PPI year over year, Core PPI year over year, S&P Case-Shiller home price index 20 cities, Business inventories delayed report (0.1%), Consumer confidence (93.4), Pending home sales (0.0%)

Wednesday: Initial jobless claims (225,000), Durable-goods orders delayed report (0.3%), Durable-goods minus transportation

Friday: Chicago Business Barometer PMI

Get your MD to give you MEMO access:

Hey guys, Harry here.

So I’m hooked.

I’ve been really impressed by Tenzing MEMO, an AI driven intelligence platform that uses advanced machine learning to research thousands of public companies.

MEMO is a game changer for investment professionals - transforming SEC filings, transcripts, presentations, articles, and data into rich and interactive insights.

Getting started with MEMO is easy. You can start for free with the code ROLLUP

Disclaimer: Tenzing MEMO is available for professional use only. A valid work email is required for this offer. Approved users receive a 3-week free trial to evaluate companies of their choosing with no commitment or credit card required.

Earnings Corner 📈 📉

Walmart $WMT ( ▲ 2.29% ) Beat on the top and bottom line, with revenue hitting $179.5B and EPS at $0.62. Strength was broad based as U.S. comps rose 4.5%, e-commerce climbed 27%, and higher-income households continued trading down even as low income shoppers softened during the SNAP pause. Walmart raised full year sales and earnings guidance, leaning on value, fast delivery, and expanding digital ad momentum heading into the holidays. The results highlight a clear theme this season: value players are winning both the cash strapped and the wealthy as mid-tier retailers face consumer caution.

Ross Stores $ROST ( ▲ 0.22% ) Beat expectations as 7% comps were driven by shoppers trading down, strong closeout deals, and broad category strength, a clear sign that off price retail is still winning with value hungry consumers.

Bath & Body Works $BBWI ( ▼ 7.63% ) Plunged to a new low after weak results and a guidance cut pushed the company to launch a turnaround plan centered on exiting noncore categories and refocusing on core fragrances and body care. The plan targets $250mm in cost savings over 2 years, but the weak numbers sent B&BW CDS spreads sharply wider.

BJ’s $BJ ( ▲ 2.72% ) Turned in steady results with moderate growth and no signs of acceleration, as traffic held up but didn’t break out. Shares slipped as the quarter reinforced the broader retail theme of value holding up while consumers stay cautious and spending remains tight.

For deeper, stock market research upgrade to the WSR Investing Club

Today’s Headlines 🍿

PE Firms Ramp Up Dividend Recaps as Exit Routes Stall: Sponsors are raising a record $28.7B in dividend-recap debt this year, tapping junk-loan markets to pay themselves as IPOs and M&A remain frozen. CLO demand and scarce new loan supply are empowering sponsors to push more dividend-related supply. With exits slowing to a crawl, firms are using debt-funded payouts to appease LPs while they wait for better exit conditions

Gemini 3 is out: Google released Gemini 3, their most intelligent model to date, and potentially the top model on the market. Gemini 3 Pro is topping leaderboards and their image generation model, Nano Banana Pro, is impressing users. Google dramatically improving their AI capabilities could serve as a future catalyst for OpenAI needing to raise more, or find a new revenue stream, to compete. It also might pressure and wipe out some of the unprofitable players reliant on VC financing

Some Private Equity Pros Ditch ‘Golden Handcuffs’ for Smaller Funds: Midlevel dealmakers at big buyout firms are increasingly leaving behind years of unvested carried interest to join smaller, more focused shops where they see a better shot at promotion and carry that will materialize. With some poor deals in the ‘21 vintage, and partnership tracks clogged at megafunds, the “theoretical” millions from carry look less attractive than a bigger slice of a smaller, better-performing fund. Boutique and sector-focused firms are capitalizing on the moment by luring talent from giants like Blackstone, KKR and TPG with richer carry, more influence on deals, and clearer paths to the top

There’s another way you can spin it: While the pressures facing PE is quite real, some in the industry think this is just a flush out of weaker, pandemic-era professionals. Larger shops have significantly higher cash pay, and carry at another shop is no sure thing, so many of the cases the WSJ reported on could very well just be immaterial flush outs.

Private Credit Defaults Seen Surging in 2026, UBS Warns: Private credit could face the sharpest rise in defaults next year, with rates climbing by up to 3 percentage points as inflation, higher borrowing costs and weaker consumers strain borrowers. UBS says the growth of PIK loans signals mounting liquidity pressure across the asset class and heavy exposure to AI-linked companies adds further risk

Blue Owl Weighs Reviving Shelved Fund Merger as Scrutiny Mounts:

Blue Owl is considering reviving its halted plan to merge OBDC with its private OBDC II fund, but only if OBDC’s share price rises closer to net asset value to avoid imposing ~20% losses on private-fund investors — the backlash that forced the firm to abandon the deal last weekThe collapse of the merger, initially pitched as a cost-saving, portfolio-overlap solution, has intensified concerns about private credit’s opacity and growing presence in retail accounts amid rising credit stress. Despite market jitters and recent stock pressure, Co-CEO Marc Lipschultz argues that fears are “ungrounded,” insisting both funds are performing well and that Blue Owl’s credit and AI-infrastructure businesses still face clear runway despite near-term volatility

Private Lenders Set to Take Over 48Forty Solutions: A lender group including Antares Capital is preparing to swap debt for equity and assume control of pallet company 48Forty Solutions after providing $1.75B in financing for Summit Partners’ buyout last year. FS KKR Capital Corp. has its loan to 48Forty marked at 46 cents. The proposed restructuring is expected to close by year-end

NY Fed's Williams Signals Openness to More Rate Cuts: President John Williams said policy is still “modestly restrictive” and that weakening labor markets now pose a greater risk than inflation, suggesting room for further rate cuts. His remarks sent Treasury yields sharply lower and pushed market odds of a December cut above 70%.

Other Fed officials, including Beth Hammack, pushed back, highlighting stalled progress on inflation and warning that additional easing may not be warranted. Boston Fed President Susan Collins is also part of that camp, saying that she sees no urgency for a December cut and remains undecided on what her vote will be. Collins thinks current policy is tilted just slightly towards combating inflation, and that “overall financial conditions are a bit of a tailwind, not a headwind”

EssilorLuxottica is in talks to buy 5%-10% of Armani: The eyewear company would act as a passive investor and would not have any board representation. The potential investment aligns with Giorgio Armani’s will, in which he named EssilorLuxottica as one of three preferred buyers

TAP Air Portugal draws interest from multiple bidders: The Portuguese government plans to sell a 49.9% stake in its national carrier, reserving 44.9% for private investors and 5% for airline employees. Air France-KLM, Germany’s Lufthansa Group, and British Airways owner IAG are among the bidders

Juventus raised €98mm in a share sale: The sale, equal to about 9% of the company’s capital, will help to reduce debt and support the company’s strategic plan. The Italian football club is focused on raising its international brand and maintaining “maximum sporting competitiveness”

Macquarie proposes $7.5B takeover of Qube: Owners of Qube, an Australian logistics and shipping-containers company, would receive A$5.20 in cash for each share, a 28% premium to Friday’s close

‘Wicked: For Good’ Shatters Record: Universal’s new movie dazzled with a massive $150M domestic debut, the biggest opening ever for a Broadway adaptation and the year’s second-largest launch. The sequel also pulled in $76M overseas, surpassing the first film’s international start

IPO Roundup:

Ackman Plans Dual Listings as Market Watches Closely: Bill Ackman is exploring early-2026 IPOs for Pershing Square and a new fund, Pershing Square USA, which would offer investors free shares and could value the firm above $10B

Canva Eyes IPO as User Growth Surges: COO Cliff Obrecht said the company is likely to pursue an IPO “in the next couple of years,” citing explosive early adoption of its newly free Affinity design suite, which saw two million downloads in two weeks. The $42B startup is leaning on AI tools and new executive hires as it prepares for life as a public company

Figma Shares Slip Below IPO Price as AI-Bubble Fears Hit Tech:

Figma briefly fell under its $33 IPO price for the first time, a sharp reversal from its 250% debut surge, as investors pull back from 2025’s frothiest tech listings amid rising concerns of an AI-driven bubbleCentral Bancompany Raises $373 Million in IPO: The Missouri-based regional lender priced its U.S. IPO at $21 per share, raising $373M and valuing the bank at just over $5 billion amid heightened scrutiny of smaller banks’ exposure to private-credit stress

M&A Transactions💭

SEMrush (NYS: SEMR), an online visibility management software platform, has reached a definitive agreement to be acquired for $1.9B by Adobe (NAS: ADBE). EV/EBITDA was 245.89x and EV/Revenue was 4.2x.

Exact Sciences (NAS: EXAS), provides cancer screening and diagnostic test products, has reached a definitive agreement to be acquired for $23.52B by Abbott (NYS: ABT). EV/Revenue was 7.63x. Centerview Partners and XMS Capital Partners advised on the sale.

Braehead Shopping Centre, a shopping center, was acquired by Frasers Group (LON: FRAS) for GBP 220.0M.

Acera Surgical, manufacturer of synthetic biomaterials, has reached a definitive agreement to be acquired for $725.0M by Solventum (NYS: SOLV). EV/Revenue was 8.06x. Truist Securities advised on the sale.

Desotec, developer of mobile filtration technology, has entered into a definitive agreement to be acquired for EUR 2.0B by EQT, Athos, and Merckle Family Office.

Commodity & Ingredient Hedging, provider of risk management services, has reached a definitive agreement to be acquired for $970.0M by Tokio Marine. EV/Revenue was 7.46x. William Blair & Company advised on the sale.

Clean Earth, operator of a waste management and processing company, has reached a definitive agreement to be acquired for $3.04B by Veolia Environment (PAR: VIE). Bank of America and Jefferies advised on the sale.

Daily Mail Owner reached GBBP 500.0M deal to buy Telegraph Media Group just days after RedBird Capital Partners withdrew its offer to buy the company.

Intelerad Medical Systems, developer of medical imaging platform, has reached a definitive agreement to be acquired for $2.3B by GE HealthCare Technologies (NAS: GEHC). UBS Group advised on the sale.

Private Placement Transactions💭

Eros Innovation, provider of IP, AI, blockchain, and immersive technology, received $150.0M of financing from Plentitude Capital.

Robotera, developer of humanoid robots, raised CNY 1.0B of Series A+ venture funding led by Geely Capital.

Physical Intelligence, operator of general-purpose company intended to bridge the gap between AI and the physical worlds, raised $600.0M of venture funding led by CapitalG at a pre-money valuation of $5.0B.

NestAI, developer of modular AI platforms, raised EUR 100.0M of venture funding from Nokia and Tesi.

MainFunc, developer of a search engine platform, raised $275.0M of Series B venture funding led by LG Technology Ventures and SBI Investment at a pre-money valuation of $975.0M.

Luma AI, operator of a video generator platform, raised $900.0M of Series C venture funding led by HUMAIN at a pre-money valuation of $3.1B.

Kalshi, developer of an online financial platform, raised $1.0B of venture funding led by CapitalG and Sequoia Capital at a pre-money valuation of $10.0B.

Aspen Neuroscience, developer of autologous cell therapies, raised $115.0M of Series C venture funding led by OrbiMeed, ARCH Venture Partners, Frazier Lifesciences Acquisition, and Revelation Partners.

Picnic, developer of an online grocery platform, raised EUR 430.0M of venture funding from undisclosed investors.

Peekaboo Labs, operator of an on-device AI service company, raised $500.0M of Seed Funding from East Gate Partners.

Odds of the Day 🍒

Kalshi traders are pricing in a 69% chance of a 25bps rate cut in December

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Now is your window - upgrade now for less than the price of Starbucks coffee.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.