- The Wall Street Rollup

- Posts

- July 27th - The Week Ahead

July 27th - The Week Ahead

EU Deal Time plus a Speculation Alarm Bell Went Off

Welcome back! Futures are up because trade deals are on!

Look the “TACO” we’ve largely talked about has played out, but on the other side of the coin, Trump is "*largely* getting everything he wants. Yes, we all know from economics class that these tariffs are going to get passed onto the consumer, but the EU deal announced earlier today in particular comes with a lot of additional snacks in the goodie bag - with 0% tariffs on US goods, 50% tariffs remaining on steel and aluminum goods, and several hundred billions of EU commitments for US Investment and US energy purchases. However, the EU auto industry got a quick win - with auto tariffs decreasing from 27.5% to 15%. Funny enough - the blended EU tariff rate post this deal is going from 13.5% to ~18%…Meanwhile, the China trade talks got extended out another 90 days, with talks resuming on Monday. The August 1st deadline for smaller trading partners seems largely intact.

Today’s newsletter is in collaboration with Third Bridge’s expert network. Let’s get into it.

The Week Ahead Of Us 🔍

Welcome back!

Here’s a look at earnings this week.

Monday: Welltower, Waste Management, Cadence Design Systems, Nucor, Whirlpool, Brown & Brown, Universal Health Services

Tuesday: Visa, Procter & Gamble, UnitedHealth Group, Merck, Booking Holdings, Boeing, Spotify, American Tower, Starbucks

Wednesday: Microsoft, Meta Platforms, QUALCOMM, Ford, Altria Group, GE HealthCare, Allstate, Prudential Financial, Humana, eBay, Hershey, American Electric Power, Lam Research, V.F. Corporation, UBS, Tyson Foods

Thursday: Apple, Amazon, Mastercard, AbbVie, S&P Global, Stryker, KKR, Comcast, Sanofi, Anheuser-Busch InBev, Cigna, Bristol-Myers Squibb, CVS Health, Air Products and Chemicals, Kellanova, Edison International, Huntington Ingalls, AES Corporation

Friday: Berkshire Hathaway, Exxon Mobil, Chevron, Colgate-Palmolive, Ares Management, Kimberly-Clark, LyondellBasell Industries, Cboe Global Markets

Here’s a look at economic data this week (estimates are in quotations).

Monday: None scheduled

Tuesday: Advanced U.S. Trade Balance (–96.6B), Retail Inventories (0.3%), Wholesale Inventories (–0.3%), S&P Case-Shiller Home Price Index (3.40%), Consumer Confidence (93.0), Job Openings (7.8 million)

Wednesday: ADP Employment (–33,000), GDP (–0.5%), Pending Home Sales (1.8%), FOMC Interest-Rate Decision (HOLD), Fed Chair Powell Press Conference

Thursday: Initial Jobless Claims (217,000), Employment Cost Index (0.9%), Personal Income (–0.4%), Personal Spending (–0.1%), PCE Index (0.1%), PCE y/y (2.3%), Core PCE (0.2%), Core PCE y/y (2.7%), Chicago PMI (40.4)

Friday: U.S. Employment Report (147,000), Unemployment Rate (4.1%), Hourly Wages (0.2%), Hourly Wages y/y (3.7%), S&P Final Manufacturing PMI (49.5), ISM Manufacturing (49.0%), Construction Spending (–0.3%), Consumer Sentiment Final (61.8), Auto Sales (15.3 million)

Fueling decisions with expert insights

For nearly 20 years, Third Bridge has been partnering with the world's top consultancies and investors to unearth the unique expert insights they need to accelerate and improve their decision-making.

With a network of over 1.5 million experts and the world's largest Library covering over 65,000 private and public companies, Third Bridge puts the richest insights at your fingertips

Real insights from real people.

Dedicated account managers acting as your extended team.

Instant access to our Library of expert knowledge, unlocking insights across every sector, geography and topic.

Unrivalled depth and breadth of knowledge, enabling you to gain all the insights you need from one trusted partner.

We use our collective geographic, industry, and company experience to custom source the best experts for your specific requirements while giving you access to: the world’s largest Library of company intelligence, 1:1 expert calls, Surveys to confirm expert insights at scale and Advisors for longer-term engagements.

It's why the world’s largest hedge funds, mutual funds, private equity funds, and management consultancies rely on Third Bridge for a deeper, more complete view of risk and opportunity.

You can seamlessly integrate our insights directly into your workflow through our partnerships with Bloomberg, FactSet, S&P Capital IQ, Refinitiv, Portrait Analytics, and Hebbia.

One partner, all the insights.

Expert calls | Library | Surveys | Advisors | Data feeds

Earnings Corner 📈 📉

Charter $CHTR ( ▲ 7.62% ) had very unimpressive numbers, sending the stock tumbling. The cable provider lost 111,000 customers, worse than expectations of -73k, as the Company has been losing share to AT&T, Verizon, and T-Mobile.

Union Pacific $UNP ( ▲ 0.65% ) Beat on revenue and EPS, with strong operational efficiency and volume gains offsetting intermodal softness. Bulk and industrial shipments improved; freight velocity and workforce productivity also rose. The company also confirmed advanced merger talks with Norfolk Southern, though no timeline or terms were disclosed.

Blackstone $BX ( ▼ 0.36% ) Beat on revenue and EPS, driven by strength in credit and private equity and a surge in performance fees. Inflows hit $52B, lifting AUM to $1.2T. Perpetual capital AUM rose 16%. Management flagged tariff related construction cost risks but continues to deploy in real estate.

Keurig Dr Pepper $KDP ( ▲ 2.31% ) Beat on revenue, with sales up 6.1%. EPS came in in line at $0.49. U.S. beverage strength and pricing drove growth, and wellness and energy drink categories rose 30%. The U.S. coffee segment improved sequentially but remains pressured, and management warned tariffs could impact costs. Full-year guidance was reaffirmed.

Dow Inc. $DOW ( ▲ 1.44% ) Missed on both revenue and EPS. Volume and pricing fell across all segments, led by weakness in Packaging & Specialty Plastics and Industrial Intermediates. Management cited margin compression, trade related uncertainty, and restructuring costs, while outlining a $6B+ cost and earnings initiative through 2026. Their dividend policy was also cut in half.

Tractor supply $TSCO ( ▼ 0.16% ) Beat on revenue but missed on EPS, with net sales up 4.5% and diluted earnings at $0.81. Growth came from new store openings and strong demand in consumables and seasonal categories. SG&A rose faster than sales due to planned investments and slight fixed cost deleverage. FY outlook was reaffirmed, with tariff risk seen as manageable given U.S.-sourced inventory and flexible supply chains.

Pool Corp $POOL ( ▼ 0.51% ) Revenue missed, coming in light, but EPS beat. Gross margins held steady at 30%, and operating income rose slightly despite soft sales in Texas and California and pressure on new pool construction. Commercial sales saw modest gains, while digital platform POOL360 continued to scale. Management trimmed FY EPS guidance on weaker-than-expected renovation activity and no rate relief.

American Airlines $AAL ( ▼ 1.55% ) Beat on revenue and EPS. Domestic softness, flat corporate travel, and storm disruptions weighed on performance, though international demand held up better. Guidance disappointed, with both 3Q and full-year outlooks reinstated at levels well below earlier projections, reflecting ongoing macro pressure and limited visibility.

Deckers $DECK ( ▲ 19.46% ) Beat on both revenue and EPS. Growth was fueled by strong performance at HOKA ($653M) and a rebound in UGG, with brand momentum carrying into the current quarter. Guidance for 2Q revenue and earnings came in solid, reflecting confidence despite broader consumer caution.

HCA Healthcare $HCA ( ▲ 1.19% ) Beat on both revenue and EPS. Strength came from higher admissions and improved margins, with operating leverage supporting earnings upside. Management raised full-year guidance for both sales and profit, citing continued volume growth and patient outcomes.

Today’s Headlines 🍿

Speculative Stock Market Trades are nearing records: Goldman’s Speculative Trading Indicator has hit one of its highest levels on record, slightly below but around dot-com bubble era and post-pandemic era levels. Goldman also noted clients are starting to get more comfortable shorting non-profitable tech

Stimulus Checks could be on the way: Trump is evaluating using tariff revenue to send rebate checks to lower-income Americans. This needs to go through Congress first, of course, and they’re off for the summer

ChatGPT-5 is coming: In August, OpenAI will launch their latest model. The model is expected to unify o3 reasoning capabilities and provide more logic-based performance while trying to lower the amount of hallucinations

The NFL is evaluating taking a 10% stake in ESPN. This move may help align the NFL & ESPN together, removing the type of risk that TNT struggled with when the NBA moved away from them. The move could grant ESPN full control over NFL Network and NFL RedZone

Astronomer’s clapback: The B2B startup that saw their CEO resign in disgrace after Coldplay’s Chris Martin allegedly exposed their CEO cheating, hired Chris Martin’s ex-wife, the famed actress Gwyneth Paltrow, in a sly little response to the whole incident

Could Jimmy Kimmel be next? With Stephen Colbert’s recent cancellation, industry experts are wondering whether late-night talk shows have a place in a post-linear TV world. According to reports, Jimmy Kimmel’s show loses a similar amount of money as Colbert’s old show (annual losses of $40mm). Kimmel’s contract with Disney expires in 2026, while in comparison, Jimmy Fallon and Seth Meyers both had their contracts renewed with NBC through 2028

Fantastic Four had a nice weekend - following the heels of Superman’s return, the Fantastic Four reboot brought in $118mm domestically and $218mm globally in its opening weekend

Forward Air is on the block. Apollo, Clearlake, Platinum, and EQT are among the sponsors who submitted bids to buy Forward Air, a U.S. freight forwarding service

In 2024, there were 161 PE deals in the Dental Industry - this could be a problem for Consumers: As small practices get bought out, consumers start to see overcharging, understaffing, and potentially excessive dental treatments. Read the full piece here

LVMH is in talks to sell Marc Jacobs, valuing the brand at around $1B

A Hung Deal gets done: Patient Square Capital’s buyout of Patterson, a dental and animal health markets supplier, was finally offloaded after being hung for a few months. The $1.4B+ S+450 TL was offloaded by UBS at an OID of 90 cents, while Citi’s $500mm in senior secured notes went at an OID of 94.5

Vine will return - but in AI form: The former short-form app, that X owns, is set to return 9 years later, with AI-powered six-second clips

Spilling the Tea: Well as said on Thursday, the Tea app, the dating app women use to talk anonymously about men, was obviously going to lead to a bad outcome - and it did quite quickly - on Friday, hackers gained access to 72,000 images, including selfies and Photo IDs used for account verification

Institutional-Grade Opportunities for HNW Investors

Long Angle connects HNW entrepreneurs and executives with institutional-grade alternative investments. No membership fees. Access includes:

Private equity, credit, search funds, hedge funds, secondaries

$100M+ invested annually, leverage collective expertise and scale

Invest alongside pensions, endowments, and family offices

M&A Transactions💭

Narda-MITEQ, designer and manufacturer of custom radiofrequency, microwave subsystems, and components, was acquired for $300.0M by Amphenol (NYS: APH). KippsDeSanto & Company advised on the sale.

Iodine Software, developer of a clinical documentation integrity software, has reached a definitive agreement to be acquired for $1.25B by Waystar Health (NAS: WAY). J.P. Morgan advised on the sale.

Fundamental Income Properties, operator of a net investment platform, was acquired for $2.2B by Starwood Property Trust. Evercore Group, Wells Fargo, and Stephens advised on the sale.

FD Technologies (PINX: FDRVF), a group of data-driven businesses, was acquired for GBP 5700.0M by TA Associates Management. EV/Revenue was 7.52x and EV/Net Income was 3.7x. J.P. Morgan and Rothschild & Co advised on the sale.

Click, operator of a digital payment and mobile banking platform, a 49% stake in the company was acquired by Halyk Savings Bank (XKAZ: HSBK) for $176.4M.

City Office REIT (NYS: CIO), a real estate investment trust, has reached a definitive agreement to be acquired for $928.387M by MCME Carell Holdings. EV/EBITDA was 12.49x and EV/Revenue was 5.5x. Raymond James Financial advised on the sale.

Beijing Securities, provider of securities brokerage, was acquired for CNY 1.536B by Beijing State-Owned Assets Management.

Alpha Group International (LON: ALPH), a high-tech, high-touch provider of enhanced financial solutions, has reached a definitive agreement to be acquired for GBP 1.805B by Corpay (NYS: CPAY). Centerview Partners advised on the sale.

Triumph Group, designs and manufacturer a broad portfolio of aerostructures, was acquired for $4.06B by Berkshire Partners and Warburg Pincus. EV/EBITDA was 25.56x and EV/Revenue was 3.21x. Goldman Sachs advised on the sale.

Synovus Financial (NYS: SNV), provides commercial and consumer banking, has entered into a definitive agreement to be acquired for $8.6B by Pinnacle Financial Partners. The transaction values the company at $16.7B. EV/Net Income was 22.61x and EV/Revenue was 7.26x. Morgan Stanley and Keefe, Bruyette & Woods advised on the sale.

ESSA Bank & Trust, a holding company, was acquired for $214.0M by CNB Financial (NAS: CCNE). EV/Net Income was 148x and EV/Revenue was 3.27x. PNC Capital Markets advised on the sale.

Verve Therapeutics, clinical-stage company, was acquired for $1.333B by Eli Lilly (NYS: LLY). The company will receive a contingent payout of $300.0M based on a genetic-medicines firm achieving certain clinical milestones. EV/Revenue was 22.36x. Centerview Partners and Guggenheim Partners advised on the sale.

Eleventh Hour Games, developer of gaming software, has reached a definitive agreement to be acquired for JPY 132.0M by Krafton (KRX: 259960).

Private Placement Transactions💭

Vanta, developer of a compliance management platform, raised $150.0M of Series D venture funding led by Wellington Management at a pre-money valuation of $4.0B.

Mondus Capital, developer of shared equity home loan platform, raised $105.0M of mezzanine financing.

Aidoc, developer of a decision support platform, raised $150.0M of venture funding in a combination of equity and debt led by Square Peg Capital and General Catalyst.

Armada, developer of an edge computing platform, raised $131.0M of venture funding from M12, Glade Brook Capital Partners, and Overmatch.

Odds of the Day 🍒

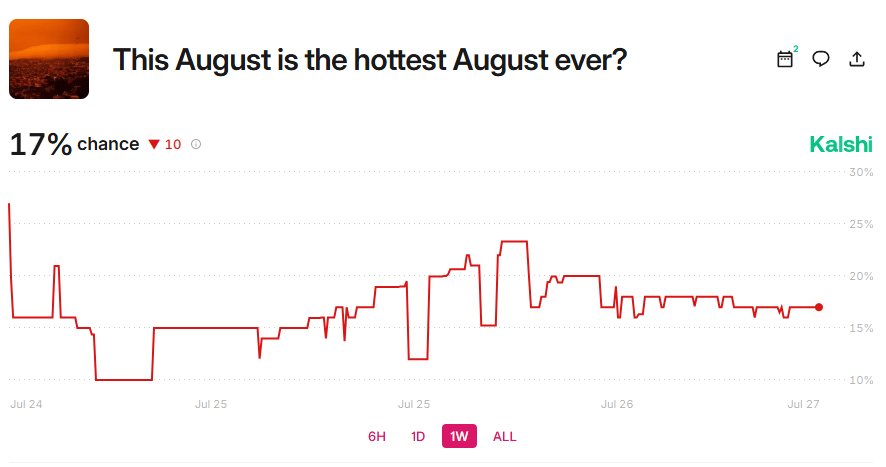

It’s been a hot summer - but Kalshi traders are pricing in just a 17% chance of August being the hottest August ever.

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

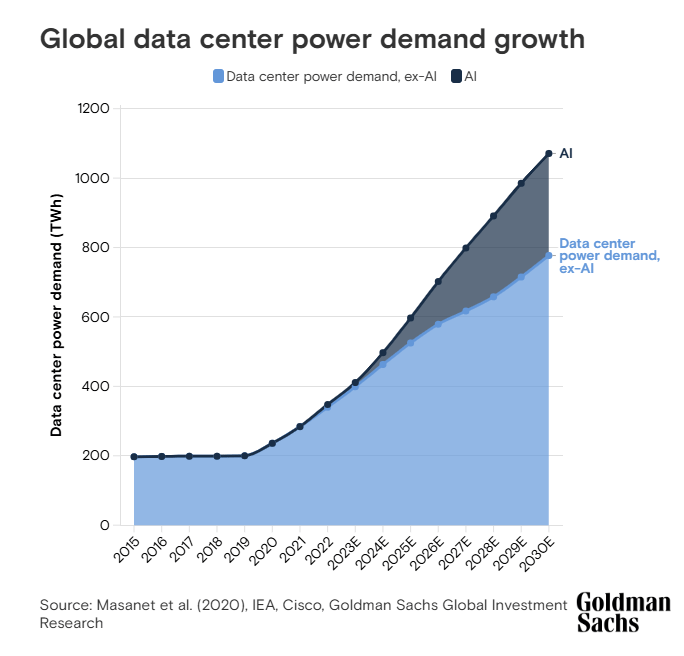

Goldman’s forecast for AI related data center demand

Meme Cleanser 😆

“ChatGPT, please tell me the next big meme stock. Make no mistakes.”

— High Yield Harry (@HighyieldHarry)

12:30 PM • Jul 25, 2025

Knowing your coworker is interviewing for another job but you can’t prove it yet

— Upper East Sell Sider (@UpperEastUpside)

3:43 PM • Jul 25, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Autopilot Portfolio Update: High Yield Harry recently launched 4 portfolios on Autopilot including The Golden Age of Private Credit portfolio and the Tariff Trade portfolio. You can autopilot my trades and strategies by signing up here.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Finance Merch Referrals ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.

Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.