- The Wall Street Rollup

- Posts

- July 20th - The Week Ahead

July 20th - The Week Ahead

Brace yourselves - Earnings are Coming

Together With

Welcome back!

First off - on our Job Board, Buyside Hub we’ve added a section for internships and are also running an Investment Banking/Sell-Side Compensation Survey to complement our existing buyside compensation reports. Sign up for free to contribute and gain access.

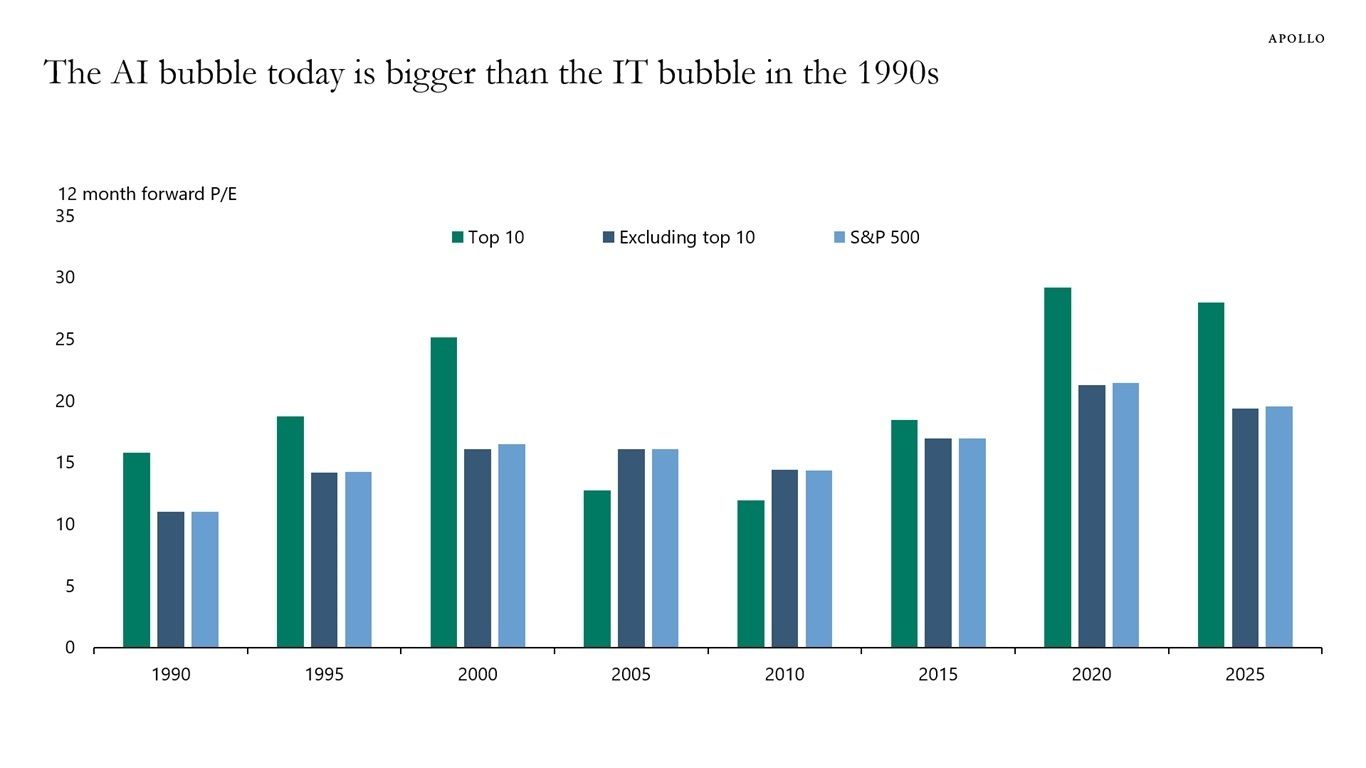

Futures are up slightly tonight. Tariffs are around the corner, and Lutnick spoke this morning, calling August 1st a hard deadline; but he feels good about an EU deal coming into place. Meanwhile the EU is evaluating retaliation plans - but with so many countries it’s been hard for them to reach consensus. There’s still plenty of time for TACO, but the market is broadly brushing off tariff impacts due to prior pivots and limited signs of it in the data thus far. The Fed meets next week, and outside of Waller (who is jockeying for Powell’s seat), voting members are expected to be very cautious. We generally think the market isn’t pricing in enough tariff risk and as things stand these price adjustments will be much more obvious to consumers in the fall. There are several pockets in the market that are clearly in “bubble mode” but it doesn’t feel quite like a late innings situation.

Economic data is solid, and the AI boom is outpacing spend relative to the late 90s/early 2000s initial internet boom. It was reported that Zuck is making $300mm offers to OpenAI researchers and getting turned down! The AI wars are showing no signs of slowing down, and you all see in our private placements section all the time how high these AI startup valuations are getting.

Tonight’s edition is in collaboration with Pegasus Insights - an AI-powered liquidity management platform built for PE and Deal Teams. Let’s get into it.

The Week Ahead Of Us 🔍

Here’s a look at earnings this week.

Monday: Verizon, Steel Dynamics, Domino’s Pizza, Crown Holdings

Tuesday: Coca-Cola, Philip Morris, RTX, Texas Instruments, Danaher, Lockheed Martin, Sherwin-Williams, Capital One, Northrop Grumman, General Motors, D.R. Horton, Equifax, PulteGroup, Quest Diagnostics, Halliburton, Genuine Parts, Tenet Healthcare

Wednesday: Alphabet, Tesla, IBM, T-Mobile, AT&T, Thermo Fisher, GE Vernova, Boston Scientific, NextEra Energy, Amphenol, CME Group, Fiserv, Moody’s, General Dynamics, O’Reilly Automotive, Freeport-McMoRan, Hilton, CSX Corporation, Chipotle

Thursday: Honeywell International, Union Pacific, Blackstone, Intel, L3Harris Technologies, Valero Energy, Nasdaq, Ameriprise Financial, Keurig Dr Pepper, Dow, Labcorp, Tractor Supply Company, Pool Corporation, American Airlines, Deckers Outdoor Corporation

Friday: HCA Healthcare, Charter Communications, Phillips 66, Centene Corporation, Booz Allen Hamilton, AutoNation

Here’s a look at economic data this week (estimates are in quotations).

Monday: U.S. Leading Economic Indicators (–0.2%)

Tuesday: Fed Chair Powell speaks at banking conference

Wednesday: Existing Home Sales (4.0M)

Thursday: Initial Jobless Claims (229K), S&P Flash Services PMI (53.2), S&P Flash Manufacturing PMI (52.4), New Home Sales (650K)

Friday: Durable Goods Orders (–11.0%), Core Durable Goods (0.5%)

Liquidity Management for the PE Backed CFO

In an LBO, Cash is king.

Pegasus Insights is a next-gen liquidity management platform purpose-built by Finance experts for Finance Leaders, Deal, PE-backed CFOs, Deal Teams, and Operating Partners.

Pegasus delivers:

Lighting fast cash and liquidity forecasting

Real-time visibility into cash

Seamless collaboration

Actionable levers to improve your Cash conversion cycle

Model faster, decide easier, and stay ahead.

Now live → Book a demo and see it in action.

Earnings Corner 📈 📉

Netflix $NFLX ( ▼ 0.71% ) Beat on revenue and EPS as sales grew 16% y/y, driven by stronger ad momentum and subscriber growth. The company is no longer breaking out sub counts but noted pricing and ad tier performance as key contributors. Margins improved, but Netflix flagged higher spending ahead of a packed second-half content lineup, including the Stranger Things finale, Wednesday S2, and more big releases. Guidance was raised by ~$1B at the midpoint for full-year revenue (to $44.8B–$45.2B) and slightly for free cash flow (to $8.0B–$8.5B), though 2H margins are expected to dip. Netflix also noted they used generative AI to create a scene in one of its original series, saying it made the production process faster and cheaper

GE Aerospace $GE ( ▼ 0.22% ) GE Aerospace past expectations as revenue hit $11.02B vs. $10.04B est. and EPS came in at $1.66 vs. $1.43. Demand for commercial engines and services drove a 27% surge in total orders, lifting results across both commercial and defense. Management raised full-year guidance across EPS, revenue, and free cash flow despite a $500M tariff hit. The shareholder return target through 2026 was also bumped 20%

PepsiCo $PEP ( ▲ 1.32% ) Beat on both revenue and EPS as early signs of a turnaround began to show. Management highlighted traction in zero-sugar drinks and healthier snacks, even as North America volumes remained weak. Executives expect a return to 4–6% organic growth in the coming quarters as cost cuts and brand resets take hold. Full-year guidance was reiterated

Taiwan Semiconductor $TSM ( ▲ 2.9% ) Beat big on revenue, coming in at $30.1B vs. $28.9B est, and on EPS at $2.47 vs. $2.28, as AI and high-performance chip demand powered a sales surge and 61% profit growth. Margins stayed strong across the board, with advanced chips making up a large portion of revenue. Guidance called for more growth in 3Q but at a slower pace, with margins expected to ease slightly

American Express $AXP ( ▲ 1.46% ) Revenue hit a record and beat, coming in at $15.8B, while EPS came in below headline expectations due to a tough y/y comp from last year’s onetime gain. Adjusted profit still rose 17% as spending by affluent cardmembers climbed 7%, showing continued strength despite macro uncertainty. Management pushed back on competitive pressure from JPM and Citi, saying product refreshes are planned on their own terms. Full-year guidance was reaffirmed. One interesting nugget was that while spending seems solid across the board, domestic economy-level air travel was one of the weaker segments this quarter

3M $MMM ( ▼ 1.16% ) Revenue and EPS both beat, with strength driven by margin expansion and steady organic growth across all business units. Full-year EPS guidance was raised to $7.75–$8.00, now including expected tariff headwinds.

Today’s Headlines 🍿

Retail numbers were strong - rising 0.6% in June, beating expectations of 0.1% and signaling consumer resilience in the face of tariffs after May sales decreased

Bessent speaks up against firing Powell: Reported by the WSJ, the Treasury Secretary discussed the matter with Trump and made his case to keep Powell as chair - calling out a strong economy and the likelihood of Fed cuts later this year

Trump considered cutting SpaceX contracts, initiating a review to identify wasteful spending after his fallout with Musk. However, most of the contracts were determined to be vital to NASA and the Department of Defense

OpenAI launched an agent - a tool that combines the capabilities of Deep Research and Operator to complete complex tasks on a user’s behalf. The agent can help to automate a variety of things, such as creating editable slideshows and spreadsheets, looking through users’ calendars to brief them on upcoming events, and planning and purchasing ingredients for a meal

Union Pacific is in talks to acquire Norfolk Southern, a deal would create a coast to coast network, becoming the first transcontinental railroad in the country and signaling “open season” on mega-mergers

Astronomer CEO Andy Byron resigned after his alleged affair with the company’s head of HR was exposed during a Coldplay concert

The latest on the Starbucks turnaround: Bloomberg did a deep dive on Brian Niccol’s strategy to turn around the struggling coffee giant. This includes 1) making Starbucks service more friendly and personalized (Condiment bars are making a comeback) 2) making locations more cozy with more seating and renovation, 3) speed - the avg Starbucks was cut from ~23 workers to 18 over the past 5 years and replacing labor with technology hasn’t really worked.

While there’s a lot of excitement given Niccol’s turnaround of Chipotle, you can see above that some of the ideas above are in conflict with improved Starbucks profitability

Colbert Cancelled: The late night show was reportedly losing $40mm/year, forcing CBS to cancel the show. Of the big three network late shows, “Late Show” has by far the smallest digital footprint on social media platforms

Big Food is in a period of self reflection: Consumer priorities are shifting, forcing major food corporations to reevaluate their plans for the future after growth has stalled in recent years. Kraft Heinz is mulling a breakup to focus on its condiments business, Kellogg and Kellanova were both acquired, and Pepsi has been forced to rework its portfolio of foods and beverages as the sentiment around processed foods changes

Another crypto exchange may go public: Bullish, backed by Peter Thiel, also owns media outlet CoinDesk. The digital asset firm ranks in the top five exchanges by spot volume for Bitcoin and Ether, and has filed for IPO to trade on the NYSE under BLSH

Meanwhile, the GENIUS Act was officially signed on Friday, establishing regulations for stablecoins and paving the way for major banks and corporations to begin issuing their own

Block will join the S&P 500: Jack Dorsey’s startup, a payments firm that owns Cash App and Square, will replace Hess (acquired by Chevron) in the S&P 500 this Wednesday. Shares jumped more than 8% after hours on the news

Juul is back: FDA regulators ruled that the company can keep its e-cigarettes and refill cartridges on the market, citing studies that show their benefit as an alternative to traditional cigarettes

Altice lands a $1B ABS backed by hybrid-fiber coaxial assets - led by GS and Angelo Gordon at a 8.875% rate

Meanwhile in fiber land, Zayo is nearing a deal with lenders to amend & extend $5B of debt due in 2027, helping the Company with its plans to buy Crown Castle fiber assets

Boots Prices - $4.5B of leveraged loans and HY bonds supporting Sycamore’s buyout of The Boots Group tightened by 25bps to S+350 for the US TL tranche

Grubhub goes Private Credit: Grubhub’s owner, Wonder, is approaching lenders, including private credit lenders about raising $400-$500mm in debt to refi existing debt, potentially adding a PIK feature that would be inclusive of a 13% rate

BASF Coatings Arm Bids: Carlyle, KPS, Lone Star, and Platinum are among the Sponsors evaluating bidding up to $7B for the chems giant’s coatings unit

DC Layoffs: Through May, DC’s federal workforce has decreased by 22.1k, with workers across multiple agencies being let go. The effects have started to roll in - most recently with the EPA, which laid off over 3k employees with the elimination of its scientific research division

M&A Transactions💭

Brookfield Infrastructure Partners (TSE: BIP.UN) will acquire Hotwire Communications, provider of fiber optic telecommunications services, from Blackstone for $7.0B. Barclays advised on the sale.

Huntington Bancshares (NAS: HBAN) agreed to acquire Veritex Holdings (NAS: VBTX), a bank based in Dallas, Texas, in an all-stock deal valued at ~$1.9B.

SuranceBay, developer of insurance software solutions, has reached a definitive agreement to be acquired for $162.5M by Verisk Analytics (NASS: VRSK).

SP Telecommunications, provider of network infrastructure services, has entered into a definitive agreement to be acquired for SGD 290.0M by AQX Digital Infrastructure.

Reorganized ISA, operator of integrated satellite and terrestrial network, was acquired for $3.1B by SES (LUX: SESGL). Berkshire Global Advisors, Morgan Stanley, PJT Partners, Goldman Sachs, ING Group, and Societe Generale advised on the sale.

Talen Energy is acquiring two power plants, Caithness Moxie Freedom Project and Guernsey Power Station, for $3.8B.

Guernsey Power Station, a natural gas combined-cycle power plant, has reached a definitive agreement to be acquired for $2.33B by Talen Energy (NAS: TLN). Lazard and Morgan Stanley advised on the sale.

Great Lakes Data Racks & Cabinets, manufacturer of data racks and cabinets, has reached a definitive agreement to be acquired for $200.0M by Vertiv (NYS: VRT). Harris Williams advised on the sale.

Ansys (NAS: ANSS), an engineering software company, was acquired for $35.407B by Synopsys (NAS: SNPS). EV/EBITDA was 40.47x and EV/Revenue was 13.71x. Qatalyst Partners advised on the sale.

The Essential Home Business of Reckitt Benckiser Group has reached a definitive agreement to be acquired for $4.8B by Advent International. EV/Revenue was 10.6x. Morgan Stanley, Goldman Sachs, and Robey Warshaw advised on the sale.

Hess, an independent oil and gas producer, was acquired for $5.975M by Chevron (NYS: CVX). EV/EBITDA was 9.91x and EV/Revenue was 5.28x. J.P. Morgan and Goldman Sachs advised on the sale.

Blueprint Medicines (NAS: BPMC), a biopharmaceutical company, was acquired for $9.5B by Sanofi (PAR: SAN). EV/Revenue was 16.9x. Jefferies advised on the sale.

BlueHaven Wealth Management, provider of personalized financial planning, was acquired for $400.0M by Osaic.

American Bank, operator of an independent financial institution, has reached a definitive agreement to be acquired for $321.5M by Prosperity Bancshares (NYS: PB). Stephens advised on the sale.

Private Placement Transactions💭

TTH Networks, operator of a consultancy company, raised $110.0M of venture funding from undisclosed investors.

Thinking Machines Lab, operator of an AI research and product company, raised $3.0B of Seed funding led by Andreessen Horowitz at a pre-money valuation of $9.0B.

Substack, operator of a subscription-based publishing platform, raised $100.0M of Series C venture funding led by The Cherin Group and BOND Capital at a pre-money valuation of $1.0B.

Renibus Therapeutics, operator of a biotechnology company, raised $110.9M of Series B venture funding from cathexis Ventures, Bios Partners, and other undisclosed investors.

New Outlook Network, developer of residential construction projects, raised $110.0M of venture funding from undisclosed investors.

Lovable, developer of an AI powered software development platform, raised $200.0M of Series A venture funding led by Accel Management Company at a pre-money valuation of $1.6B.

Ht Acquisition, a company in stealth mode, raised $110.0M of venture funding from undisclosed investors.

Hadrian, developer of an autonomous manufacturing platform, raised $260.0M of Series C venture funding led by Founders Fund, Lux Capital, and Morgan Stanley.

Base Boy Entertainment, developer of an entertainment platform, raised $110.0M of venture funding from undisclosed investors.

Perplexity AI, developer of AI powered information discovery tools, raised $100.0M of venture funding from undisclosed investors at a pre-money valuation of $17.9B.

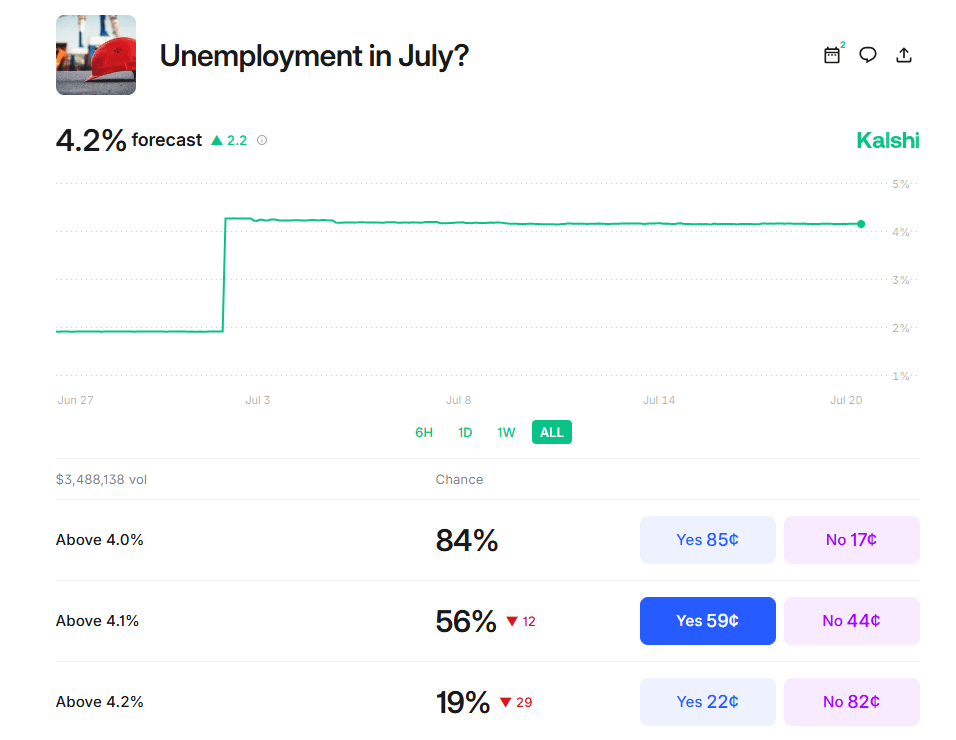

Odds of the Day 🍒

Kalshi traders are pricing in a 56% chance of Unemployment above 4.1% this month

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

Meme Cleanser 😆

Your house and half of your 401k

— Meghan Maureen (@Keggs719)

8:45 PM • Jul 17, 2025

Easily one of the most annoying posts I've ever seen

— _s.a.m.e.m.e.m.e_ (@st_louis_stan)

12:12 PM • Jul 19, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Access our Market Data: Our market data is sponsored by Koyfin, the best free financial analysis and visualization platform out there. Need premium analytics? Koyfin is offering Wall Street Rollup readers 15% off on any new sign-ups.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Finance Merch Referrals ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.