- The Wall Street Rollup

- Posts

- January 19th - The Week Ahead

January 19th - The Week Ahead

Tariffs are back, just in time for Davos

The Week Ahead Of Us 🔍

Welcome back!

Also, happy Davos week to those who celebrate (we don’t).

Hope everyone who had today off got some time to unwind. And some time to stop worrying about software stocks puking. We’ll get more into it below, but one of our key 2026 predictions was that war between AI and Software would get fiercer, and that’s broadly what’s played out as folks are increasingly becoming more impressed with Claude’s advancement.

Long-time software leaders are now becoming battleground stocks with contrasting bullish & bearish anecdotes about who will leverage AI vs. who will get eaten by AI. Here is an example where Salesforce $CRM ( ▲ 4.3% ) is touted as a winner by VC Harry Stebbings, while Base44’s founder shared an anecdote of a customer terminating a $350k Salesforce contract in favor of a custom solution they built in-house.

Canadian stocks flattish today, but it looks like the U.S. will open down(the S&P is -0.9% and Nasdaq is -1.2%) following all the tariff noise Trump has been making around Greenland.

Let’s get into it. Here’s a look at earnings this week.

Tuesday: Netflix, 3M, U.S. Bancorp, D.R. Horton, United Airlines, Fastenal

Wednesday: Johnson & Johnson, Charles Schwab, Prologis, Truist Financial, Travelers Companies, Halliburton

Thursday: Procter & Gamble, GE Aerospace, Abbott, Intel, Capital One, Freeport-McMoran, CSX, McCormick & Company, Old Republic International, Alcoa Corp.

Friday: SLB Limited, Comerica, Booz Allen Hamilton Holding Corp.

Here’s a look at economic data this week (estimates are in quotations).

Tuesday: None scheduled

Wednesday: Construction spending (0.1%), Pending home sales (1.0%)

Thursday: Initial jobless claims (208,000), GDP first revision (4.3%), Personal income (0.4%), Personal spending (0.5%), PCE index (0.2%), PCE y/y, Core PCE index (0.2%), Core PCE y/y

Friday: Consumer sentiment (54.0), S&P flash U.S. services PMI, S&P flash U.S. manufacturing PMI

There’s only one place to go for Wall Street Comp Data

Buyside Hub has the best wall street compensation analytics out there. Access data for:

Investment Bankers

Sales & Trading

Private Equity

Private Credit & High-Yield

Hedge Funds and the rest of the Buyside

This is the platform you need for comp negotiations and to make sure your bonus is better than your peers.

Contribute to get free access:

Earnings Corner 📈 📉

$MS ( ▼ 3.0% ) Beat on revenue and EPS, driven by strength in wealth management as higher client assets and solid net new asset inflows lifted fees. Investment banking also rebounded, with advisory activity improving as M&A picked up across regions. Shares rose as results reinforced Morgan Stanley’s shift toward more durable fee based revenue.

$GS ( ▼ 3.67% ) Missed revenue but beat on EPS, with equities trading and asset and wealth management outperforming as elevated client activity and market volatility lifted results. Investment banking also improved as M&A activity picked up, while the revenue miss reflected the exit of the Apple Card loan portfolio.

$BLK ( ▼ 1.36% ) Beat earnings and revenue expectations as a year end market rally lifted fee income and pushed assets under management to a record $14T. Results were driven by strong ETF inflows, higher performance fees, and continued momentum in higher margin private markets. Shares rose as investors focused on accelerating inflows, a dividend hike, and BlackRock’s more durable, fee based earnings mix.

For deeper, stock market research upgrade to the WSR Investing Club

Today’s Headlines 🍿

EU weighs €93B retaliation over Greenland dispute: The EU is considering €93B in tariffs and potential market restrictions on US companies after President Trump threatened 10% tariffs on European allies opposing his push to take control of Greenland, effective February 1st. Trump says these tariffs will rise to 25% on June 1st unless a deal for Greenland is reached. European leaders are adding leverage ahead of Davos talks, while signaling a preference for de-escalation.

Software selloff deepens: Software stocks continue to slide as investors worry AI tools could replace core application functions rather than complement them. Over the past year, Salesforce is down 26%, ServiceNow 37%, Adobe 29%, and Workday 25%. Anthropic’s AI agent Cowork is amplifying concerns that productivity gains may cannibalize traditional SaaS models.

Sports betting faces new pressures: Shares of DraftKings $DKNG ( ▲ 0.12% ) and Flutter Entertainment $FLUT ( ▲ 1.68% ) fell sharply after data showed online sportsbook revenue falling ~40% YoY during NFL wildcard weekend, while prediction markets like Kalshi saw record NFL trading volumes (~$720mm), fueling fears of growing competition from federally regulated betting alternatives.

Investors pull $7B from top private credit funds: Fears over credit quality following the First Brands and Tricolor bankruptcies caused investors to pull over $7B from some of the biggest funds on Wall Street at the end of last year. Redemptions were running at about 5% of the net value of the investment portfolios, and executives expect the $7B figure to grow as funds report more numbers in the coming weeks.

In Other News 📖

Goldman Sachs is exploring prediction markets, a move that could lend credibility to the lightly regulated but fast-growing sector. CEO David Solomon said the firm sees strategic potential but expects progress to be gradual.

Thinking Machines Lab lost several prominent founding members to OpenAI, including cofounders Brett Zoph and Luke Metz, making the Mira Murati founded lab’s future somewhat unclear.

Trump is pushing for an emergency auction of PJM Power. Tech companies would bid on 15-year contracts that support the construction of ~$15B worth of new power plants, aiming to increase generation capacity without spiking consumers’ electricity bills. This sent names like $VST ( ▲ 2.47% ) $CEG ( ▲ 2.86% ) and $TLN ( ▼ 0.51% ) down.

Vail reported a 20% drop in skier visits so far this year as snowfall across its western U.S. resorts was approximately 50% below the historical 30-year average.

Mr. Beast secured a $200mm investment from Tom Lee’s Bitmine, the world’s largest corporate holder of Ethereum, with plans to collaborate on decentralized finance initiatives.

Amazon’s first attempt to block Saks’ bankruptcy funding has failed, with a judge approving a $400mm financing package. Amazon claims that Saks breached their deal to sell its products on Amazon’s platform, leaving their $475mm equity investment in the business “worthless.”

Private-asset secondary deal volume jumped 41% to a record $226B in 2025, driven by $120B of LP portfolio sales (+35%) and $106B of GP-led deals (+50%), with continuation funds accounting for the bulk of activity as investors seek liquidity.

IPO Rundown: SpyGlass and Solv Energy file for IPOs. SpyGlass needs funding for late-stage trials of its intraocular lens and drug delivery solutions for chronic eye conditions, while Solv hopes to capitalize on the growing demand for energy storage in data centers.

PE group CVC entered a $3.5B partnership with insurance giant AIG. AIG will commit up to $2B to funds managed by CVC, plus up to $1.5B for a new wealthy individuals fund.

Hellman & Friedman is weighing a sale of medical device company Cordis at a valuation of over $9B. H&F acquired the company for about $1B in 2021.

Clayton Dubilier & Rice and TPG Inc. are in talks with private credit lenders to raise $2.5bn+ of debt for Covetrus, refinancing $2bn of existing debt and funding a potential add-on acquisition at 5pp over benchmark rates. (Selena)

Cable One Inc. is in early talks with Truist Financial to raise ~$1bn to refinance $575m of near-term bond maturities and fund its buyout of Mega Broadband.

Gold ($4677.50) and Silver ($94.40) hit new highs, with investors moving away from the USD as threats on Greenland and a new slate of tariffs create an uncertain global economic outlook.

A Reminder about our Referral Program

Send to friends and Gain WSR Investing Club Access ☕️

M&A Transactions💭

Aspy Global Services, provider of occupational risk prevention and regulatory compliance services and a subsidiary of Atrys Health (MAD: ATRY), was acquired for EUR 145.0M by Laboratorio Echevarne.

TRYT Group, provider of permanent job placement services, has reached a definitive agreement to be acquired for JPY 29.4B by Copro Holdings (TKS: 7059).

Senqcia, manufacturer of structural building materials, has reached a definitive agreement to be acquired for JPY 69.0B by Noritsu Koki (TKS: 7744).

Penumbra (NYS: PEN), designs, manufacturers, and markets an array of thrombectomy and embolization devices, has reached a definitive agreement to be acquired for $15.0B by Boston Scientific (NYS: BSX). EV/EBITDA was 79.14x and EV/Revenue was 11.25x. Perella Weinberg Partners advised on the sale.

Korea Environment Technology, provider of waste management and disposal services, was acquired for $500.0M by Gaw Capital Partners. EV/Revenue was 7.38x. UBS Group advised on the sale.

Klockner & Co (ETR: KCO), a German-based steel and metal distributor, has reached a definitive agreement to be acquired for $2.1B by Worthington Steel (NYS: WS). EV/EBITDA was 22.23x and EV/Revenue was 0.46x. Goldman Sachs advised on the sale.

Bakkavor Group, manufactures and markets a wide variety of freshly prepared foods, for GBP 1.2B by Greencore Group (LON: GNC). Citigroup advised on the sale.

Altamire Technologies, operator of a multi-intelligence consultancy, insights, and open-source company, was acquired for $375.0M by Parsons (NYS: PSN). Baird Partners advised on the sale.

PSI Software, a software producer, was acquired for EUR 702.0M by Warburg Pincus. EV/Revenue was 3.12x. Goldman Sachs advised on the sale.

PrizePicks, developer of a daily fantasy betting platform, was acquired for $1.53B by Allwyn. The transaction comprises of a contingent payout of an estimated $2.0B subject to the company achieving certain performance metrics over 3 years. Moelis & Company advised on the sale.

The Tartaruga Verde Project & Module III in Rio de Janeiro of Petroleo Brasileiro was acquired for $450.0M by Brava Energia. The transaction values the assets at an estimated $900.0M.

Logan Stampings, manufacturer of standing seam metal roof clips, was acquired for $205.0M by Worthington Enterprises (NYS: WOR). BellMark Partners advised on the sale.

Denny’s, America’s franchised full-service restaurant chains, was acquired for $620.0M by Yadav Enterprises. EV/EBITDA was 12.52x and EV/Revenue was 1.36x. Truist Securities advised on the sale.

Centiel, manufacturer of uninterruptible power supply systems, has reached a definitive agreement to be acquired for CHF 125.0M by HT5. EV/Revenue was 2.84x.

Gulf Island Fabrication, a U.S. based company that is a fabricator of complex steel structures, was acquired for $203.598M by IES Holdings (NAS: IESC). EV/EBIDTA was 17.78x and EV/Revenue was 1.27x.

Private Placement Transactions💭

WeLab Holdings, operator of an online financial platform, raised CNY 1.7B of Series D venture funding from TOM Group (HKG: 02383), Prudential Hong Kong, and Fubon Bank.

Tulip Interfaces, developer of a data analytics and insight platform, raised $120.0M of Series D venture funding led by Mitsubishi Electric at a pre-money valuation of $1.3B.

Roadgrid, operator of an electric vehicle charging infrastructure, raised $120.0M of Series A venture funding led by Venture Catalysts.

Rain, developer of a cryptocurrency trading platform, raised $250.0M of venture funding from undisclosed investors at a pre-money valuation of $1.93B.

Parloa, developer of a conversational AI platform, raised $350.0M of Series D venture funding led by General Catalyst at a pre-money valuation of $2.65B.

Mytra, developer of an AI-based warehouse management technology, raised $140.0M of Series C venture funding led by Avenir Growth Capital at a pre-money valuation of $425.0M.

Merge Labs, the company is currently operating in Stealth mode, raised $252.0M of seed funding from OpenAI, Bain Capital, and Gabe Newell at a pre-money valuation of $600.0M.

Higgsfield, developer of an AI-driven video creation platform, raised $130.0M of Series A venture funding led by GFT Ventures at a pre-money valuation of $1.17B.

Beast Industries, operator of a creator-led content-to-commerce platform, raised $200.0M of venture funding from BitMine Immersion Technologies.

Interstellar Technologies, provider of space transportation and satellite development services, raised JPY 44.6B of Series F venture funding through a combination of debt financing and equity at a pre-money valuation of JPY 64.97B. JPY 21.8B of equity was led by woven by TOYOTA.

ClickHouse, developer of an online analytics processing database management system, raised $400.0M of Series D venture funding led by Dragoneer Investment Group at a pre-money valuation of $14.6B.

Terralayr, developer of a software startup intended to collect energy from grid-scale storage, raised EUR 192.0M of venture funding led by Eurazeo and Rive Private Investment.

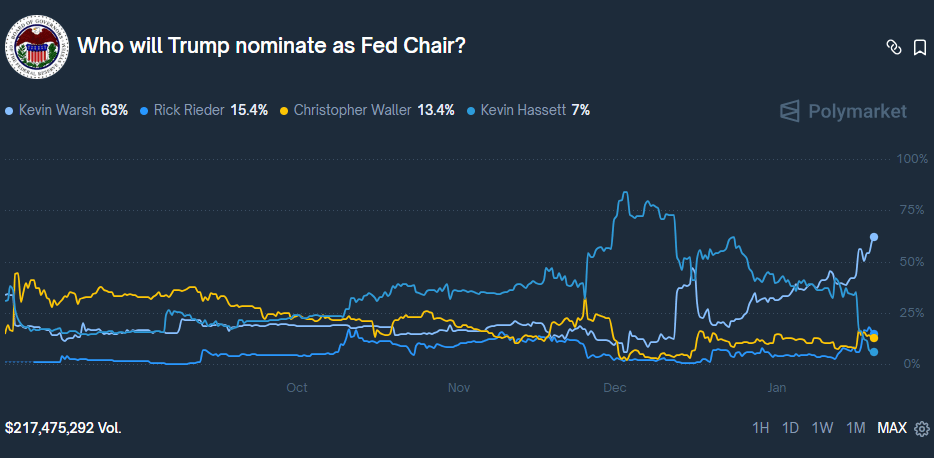

Odds of the Day 🍒

Polymarket traders are pricing in a 63% chance of Kevin Warsh becoming the Fed Chair. Who’s going to win in this four horse race?

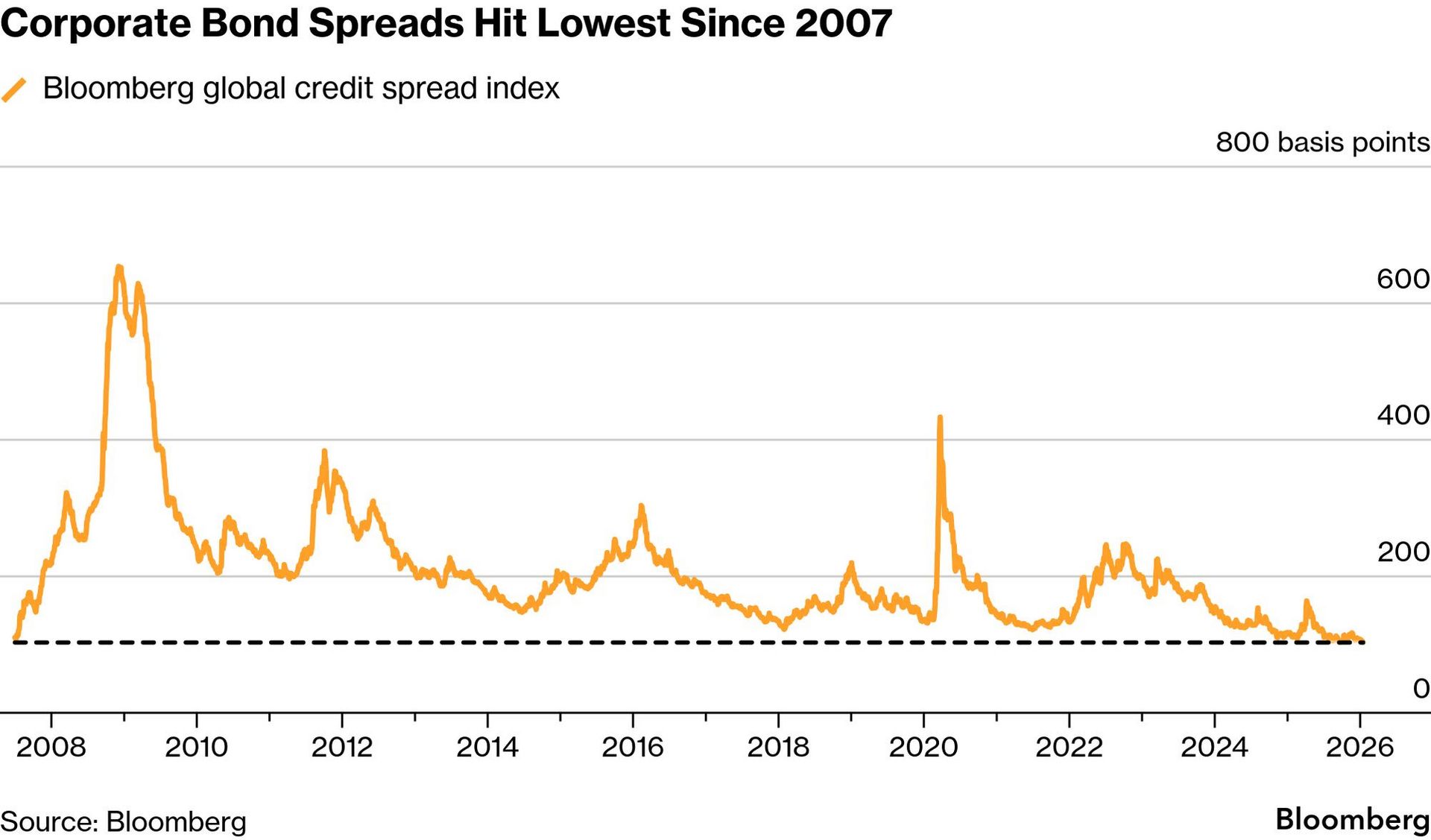

Noteworthy Chart 🧭

Corporate spreads are grinding tighter:

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Polymarket