- The Wall Street Rollup

- Posts

- January 11th - The Week Ahead

January 11th - The Week Ahead

Powell is under Investigation, Allegiant acquires Sun Country

The Week Ahead Of Us 🔍

Welcome back!

We’re off to a solid start in the markets in 2026, with last week’s unemployment numbers slightly better than expected. There’s been some Trump related noise around credit card rate caps, defense companies buybacks & dividends, and restricting institutional housing purchases, but it’s unclear how much of that is actually something that can be instituted without congressional approval. Expect to see more efforts by the Trump Administration to go after cost of living pressures as they look towards a 2026 midterms that looks like a light-blue wave currently. Futures are off slightly. Let’s get into it.

The banks are kicking off earnings, here’s a look at what’s coming up this week.

Monday: Sify Technologies

Tuesday: JP Morgan Chase, Bank Of New York Mellon, Delta, Concentrix

Wednesday: Bank of America, Wells Fargo, Citigroup, H.B. Fuller

Thursday: Morgan Stanley, Goldman Sachs, BlackRock, J.B. Hunt

Friday: PNC Financial, State Street, M&T Bank

Here’s a look at economic data this week (estimates are in quotations). Inflation data is going to be the focus this week.

Tuesday: NFIB optimism index, U.S. Consumer price index (0.3%), CPI year over year (2.7%), Core CPI (0.3%), Core CPI year over year (2.7%), U.S. new home sales (709,000), U.S. budget deficit, RCM/TIPP Economic Optimism Index

Wednesday: U.S. retail sales (0.4%), Retail sales minus autos (0.3%), U.S. Producer price index (0.3%), Core PPI, PPI year over year, Core PPI year over year, U.S. Business inventories, Existing home sales (4.25M), Federal Reserve’s Beige Book

Thursday: Initial jobless claims (220,000), U.S. import prices (-0.2%), Empire state manufacturing survey (1.0), Philadelphia Fed’s manufacturing survey (-4.0)

Friday: Industrial production (0.2%), Capacity utilization (76.0%)

Together With Proladex

Access the Private Equity and Service Provider Network

Proladex centralizes high quality service providers for private equity teams, helping investors streamline sourcing, diligence, and operational support.

Our platform delivers a curated list of credible vendors across:

- Capital Markets & Advisory

- Executive Search & Recruiting

- Quality of Earnings & Diligence

- Consulting & Brokerage

Vendors gain access to targeted PE buyers through our directory, vendor news feed, distribution network, RFP page, and events.

Users can sign up at no cost at portal at Proladex.com.

Service providers can explore our introductory trial by scheduling a call.

Today’s Headlines 🍿

US prosecutors have opened a criminal probe into Fed Chair Powell: In what seems to be a very politically driven investigation, the Federal Reserve was served by the DoJ on Friday with subpoenas regarding Chair Powell’s statements on the costs of renovating Federal Reserve office buildings. This is a gross overstep in the Federal Reserve’s independence and comes following a year of the Trump administration voicing heated disagreement in how the Fed was approaching their interest rate policies.

December jobs report comes in soft: US nonfarm payrolls rose 50k in December, missing expectations of 73k, but the unemployment rate unexpectedly fell to 4.4% (est. of 4.5%). Prior months were revised lower, with October now showing a 173k job loss and November cut to 56k, underscoring a weak hiring backdrop. Wage growth remained consistent, with average hourly earnings up 0.3% m/m and 3.8% y/y, in line and above expectations, respectively. This report paints a mixed picture as investors are split between ~50-75bps of cuts in 2026.

DeepSeek news could be coming: Chinese AI startup DeepSeek plans to release its next-gen V4 model in the coming weeks, with internal benchmarks showing stronger coding performance than rival OpenAI and Anthropic models. The upgrade improves long-prompt handling and training stability, underscoring DeepSeek’s rapid progress despite US chip export restrictions and lower GPU usage.

California’s wealth tax: California’s proposed Billionaire Tax Act would impose a one-time 5% tax on net worth for residents worth $1bn+ as of Jan. 1, 2026, leaving little time to change tax residency. Lawyers say the retroactive start date is designed to block billionaire exits but could trigger legal challenges as some wealthy residents rush to establish ties elsewhere. Google founders Larry Page and Sergey Brin were among those who fled California at year-end over wealth tax worries that might’ve left EACH of them with a $60B tax bill.

First Brands files lawsuit as cash runs low: The bankrupt auto-parts maker has sued Edward Jones, a former executive and the brother of company founder Patrick Jones, and its largest creditor, Onset Financial. First Brands alleges that Jones and Onset conspired to “defraud creditors out of billions of dollars of property” by creating supposed sale and leaseback contracts that saddled the company with billions in debt on “outrageous terms”, such as alleged 300% IRRs. First Brands is now looking to recover the cash and property that were obtained through these fraudulent transactions. The lawsuit comes as the company is running critically low on cash, with only enough remaining to sustain operations through January.

Top PE groups dominate fundraising: The top 10 PE funds have taken the largest share of U.S. fundraising in more than a decade last year, accounting for 46% of all PE capital raised through September 30th. This is up from a 35% share in 2024, underscoring how a broader slowdown in the industry has led to investors focusing their capital on large managers.

Join the rest of The Wall Street Rollup community by signing up for our premium newsletter. Our 80% off campaign is now over, but you can still access our entire newsletter for 40% off for a limited time. For deeper, stock market research upgrade to the WSR Investing Club

In Other News 📖 🍿

Trump targets credit-card profits: President Trump called for a one-year 10% cap on credit-card interest rates. Banks warn this would sharply restrict credit card access, while many are unsure whether this can ever be done via executive order.

Markets slipped Friday after the Supreme Court declined to rule on challenges to President Trump’s tariffs, pushing the decision to Wednesday and prolonging uncertainty for tariff-exposed stocks.

President Trump ordered Fannie Mae and Freddie Mac to buy $200bn in mortgage-backed securities to lower mortgage rates, though economists say the move may have a limited impact and raises liquidity questions.

Saks is planning to file for Chapter 11 bankruptcy as soon as Sunday, and is also in advanced discussions on a ~$1.25B debtor-in-possession financing package with creditors.

Apple succession watch: John Ternus, Apple’s head of hardware engineering, has emerged internally as a leading candidate to succeed Tim Cook as CEO, as the company quietly accelerates long-term leadership planning.

Meta announced agreements with nuclear power providers Vistra, TerraPower, and Oklo, securing resources for its Prometheus supercluster computing system.

Forgent Power Solutions has filed for IPO. The company designs and manufactures electrical equipment used in data centers.

Hillenbrands $1.8B leveraged loan buyout financing deal kicked off on Friday, with BofA and UBS leading the loan sale for the industrial equipment manager.

RJR Capital raises $1.1B for debut private credit fund focusing on investments in Asia Pacific, aiming to provide a net IRR of 16%.

KKR Chief Operating Officer Ryan Stork is stepping down effective immediately and will leave the firm at the end of Q1, after joining in 2022 and helping build out its technology and global operations platform.

Bob’s Discount Furniture has filed for IPO, hoping to continue adding new locations and grow from 200 stores today to 500+ by 2035.

Walmart and Google have partnered to let shoppers discover and buy Walmart products through Google’s Gemini AI assistant, following Walmart’s similar deal with OpenAI’s ChatGPT.

Paramount is seeking to reinvent MTV, and has spoken with several major companies and leaders in the music industry about acquiring a stake in the cable network.

M&A Transactions💭

Allegiant will acquire Sun Country Airlines Holdings in a $1.5B deal. Allegiant and Sun Country shareholders with own 67% and 33% of the combined company respectively. Barclays advised Allegiant and Goldman advised Sun Country.

Wenrix, developer of an AI-powered predictive analytics platform, was acquired for $300.0M by Etraveli Group.

SGNL, developer of an authorization platform, has reached a definitive agreement to be acquired for $740.0M by CrowdStrike Holdings (NAS: CRWD).

The European Petrochemicals Business of Saudi Basic Industries has entered into a definitive agreement to be acquired for $500.0M by AEQUITA. EV/Revenue was 0.14x. Lazard and Goldman Sachs advised on the sale.

Keystone Cement Company, manufacturer of masonry cement, has reached a definitive agreement to be acquired for $310.0M by Titan America (NYS: TTAM).

Hang Seng Bank (HKG: 00011), a Hong Kong-based financial institution, has entered into a definitive agreement to be acquired for $13.6B by HSBC Global Asset Management.

Good Culture, producer of airy products, has entered into a definitive agreement to be acquired for $500.0M by L Catterton and Manna Tree. Houlihan Lokey advised on the sale.

Global Healthcare Exchange, developer of cloud-based technology and services, has entered into a definitive agreement to be acquired for $5.0B by Veritas Capital Fund Management. Evercore group advised on the sale.

Bajaj General Insurance, provider of general insurance, was acquired for INR 121.9B by Bajaj Finserv (BOM: 532978).

G&B Infratech, operator of solar and wind renewable energy, was acquired for $250.0M by Seraya Partners.

City Office REIT, a real estate investment trust, was acquired for $1.1B by MCME Carell Holdings. EV/Revenue was 6.72x. Raymond James Financial advised on the sale.

Private Placement Transactions💭

Radiant, manufacturer of a portable nuclear microreactor technology, raised $350.0M of Series D venture funding led by Boost VC and Draper Associates at a pre-money valuation of $1.53B.

Parabilis Medicines, developer of cell-penetrating mini proteins, raised $305.0M of Series F venture funding led by RA Capital Management, Janus Henderson Investors, and Fidelity Management & Research Company.

EpiBiologics, developer of protein degradation therapeutics, raised $107.0M of Series B venture funding led by GV and Johnson & Johnson JJDC.

Diagonal Therapeutics, operator of a biotech company, raised $125.0M of Series B venture funding led by Sanofi Ventures and Janus Henderson Investors.

Corgi, operator of an AI powered insurance platform, raised $108.0M of venture funding led by Glade Brook Capital Partners, Seven Stars Ventures, and Leblon Capital.

Alveus Therapeutics, developer of biological and small-molecule treatments, raised $197.7M of Series A venture funding led by Andera Partners, Omega Funds, and New Rhein Healthcare at a pre-money valuation of $85.1M.

Rain, developer of noncustodial wallet, raised $250.0M of Series C venture funding led by ICONIQ Capital at a pre-money valuation of $1.7B.

Orca Bio, developer of cell therapy products, raised $250.0M of Series F venture funding through a combination of equity and loan. The Series F equity portion of $150.0M was led by Lightspeed Venture Partners. A loan financing of $100.0M was provided by Silicon Valley Bank.

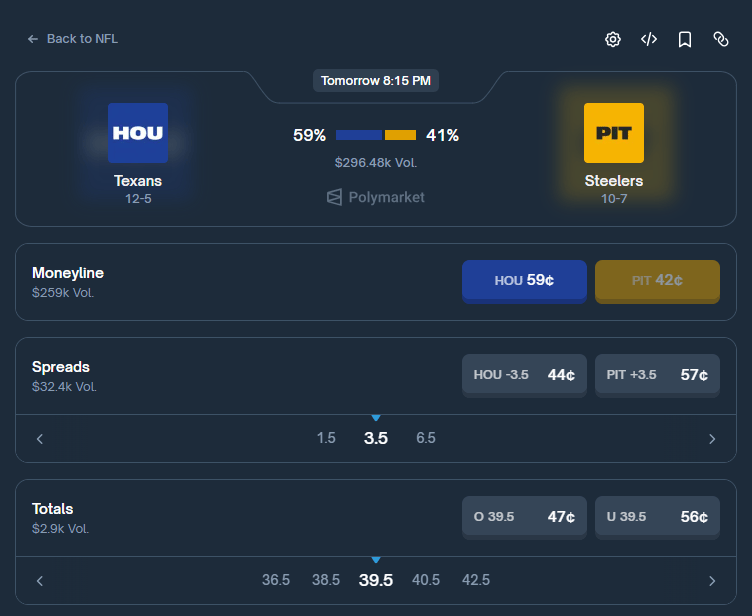

Odds of the Day 🍒

Polymarket traders are pricing in a 59% chance of the Houston Texas winning their Playoffs game.

Join our Referral Program and Gain WSR Investing Club Access ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Meme Cleanser 😆

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Upgrade to the WSR Investing Club: Wall Street Rollup readers get 40% off for their first 12 months. Receive high-conviction stock research & analysis to help you cut through the noise.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Polymarket