- The Wall Street Rollup

- Posts

- August 17th - The Week Ahead

August 17th - The Week Ahead

Happy Fed Week, Plus a Tuesday Newsletter Is Coming

The Week Ahead Of Us 🔍

Welcome back and Happy Fed week.

Two quick programming announcements: 1) We launched a YouTube channel: On the channel we are repurposing the headlines you need to know into easy to follow, interactive videos! Over time, we will do more long-form content. Subscribe here. 2) We have a surprise announcement coming on Tuesday….so keep your eyes open for an atypical Tuesday email from us.

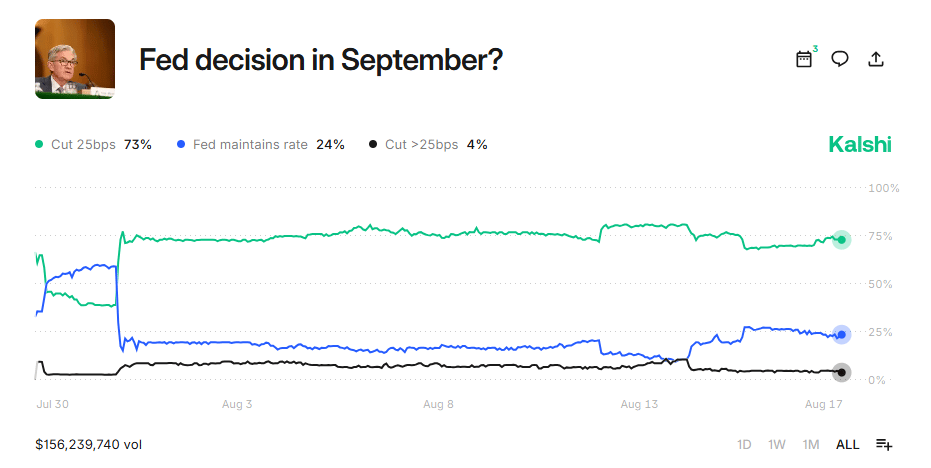

Futures are up slightly after last week was pretty solid due to the expectation of the rate cut cycle restarting. Jay Powell will speak at the Jackson Hole economic symposium this week. Kalshi has September rate cut odds at 74%. However, Bank of America’s leading strategist expects that a dovish tone could drive a “buy rumor, sell fact” response from the market.

Overall though, there’s still a lot of positive momentum in the market and there will continue to be until the effect of tariffs (if they stay in place at high rates) becomes more pronounced or if there’s an AI-related slowdown. That’s pretty much what we’re watching at this point, with the AI-related noise being much more consequential to market action in our opinion. We’re pretty excited about the innovation in AI will bring us…but worry that cocky AI founders and VCs may spell signs of a near-term top...

Let’s get into it. Here’s a look at earnings this week.

Monday: Palo Alto Networks, XP Inc.

Tuesday: Toll Brothers, Home Depot, Viking Holdings, Medtronic plc

Wednesday: TJX, Lowe's, Target, Estee Lauder,

Thursday: Walmart, Intuit, Ross, Workday, Zoom

Friday: BJ’s Wholesale Club

Here’s a look at economic data this week (estimates are in quotations).

Monday: Home builder confidence index (34)

Tuesday: Housing starts (1.30 million), Building permits (1.39 million)

Wednesday: 2:00 pm Minutes of Federal Reserve's July FOMC meeting

Thursday: Initial jobless claims (224,000), Philadelphia Fed manufacturing survey (5.0), S&P flash U.S. services PMI (55.7), S&P flash U.S. manufacturing PMI (49.8), Existing home sales (4.0 million), U.S. leading economic indicators (-0.1%)

Friday: None scheduled

Together With Shortcut

Born out of an MIT lab, Shortcut embeds Excel’s same exact look, feel, and interface into an agentic AI software.

Users can run prompts to automatically build models, as well as upload existing excel files into Shortcut.

The Internet has been flocking to the world’s first superhuman excel agent.

See what all the buzz is about:

Earnings Corner 📈 📉

Deere $DE ( ▼ 1.26% ) missed on revenue but delivered an EPS beat. Management pointed to ongoing weakness in the agricultural equipment cycle, with farmers pulling back on new tractor and machinery purchases and Deere cutting production to bring dealer inventories down. The company highlighted its new Operations Center PRO Service as a growth driver. Guidance was lowered for fiscal 2025, with net income expectations trimmed. The stock slid sharply on the report before recovering some ground the next day.

Tapestry $TPR ( ▲ 0.75% ) The Coach and Kate Spade parent reported a beat on both revenue and EPS, with Q4 revenue of $1.72B and EPS of $1.04. The company guided FY26 EPS, below expectations, citing $160M in tariff costs. Management emphasized that demand has remained strong and even accelerated early in the new quarter but said the loss of de minimis exemptions will weigh on margins.

Today’s Headlines 🍿

Trump and Putin meet: The two world leaders met in Alaska regarding a potential peace talk with Ukraine. This was the Russian President’s first time on American soil since 2015. Although the meeting ended without a concrete deal, Putin agreed that the U.S. could offer NATO-like protections to Ukraine. President Zelenskyy will be back in the White House on Monday for continued talks

Supernovas in AI: A TBPN interview drew immediate pushback from finance professionals. Look, there’s going to be a ton of AI-related winners coming out of this race for AGI - but an analogy calling fast-growing AI companies “supernovas” (which ironically blow up under their own weight) has investors concerned about sustainability

Where we have the most concern is that some of these AI darlings call revenue “recurring” when it’s not and most of these businesses have negative gross margins and low barriers to entry. Anyways, I would watch the video to get a look into how VC and Silicon Valley is thinking about deploying capital into AI

The U.S. is investing in Intel: The government is considering taking a stake in the company, which has struggled heavily in recent years but remains the only U.S. company capable of domestically manufacturing high-speed chips. The stock climbed over 7% on news of the investment, which would fund a new factory hub in Ohio

Wholesale prices rose 0.9% in July - much more than the 0.2% gain expected and the biggest monthly increase since June 2022. Services inflation, largely driven by a rise in machinery and equipment wholesale prices, was a main reason for the jump. The number being much higher than CPI is an indicator that businesses are absorbing tariff costs

Berkshire buys UnitedHealth Group: In what may be a post-Buffett trade, Berkshire has decided to buy the dip on the country’s largest health insurer, purchasing a stake worth $1.6B. The stock is down nearly 50% since mid-April as the company has struggled with rising healthcare costs and changes to government reimbursement plans

Meanwhile, Berkshire completely sold out of T-Mobile. They also sold over $4B in Apple in 2Q, although the company is still Berkshire’s largest position

U.S. Retail Sales rose in July, increasing 0.5% after a revised 0.9% gain in June. The number is not adjusted for inflation. Cars, online retail, and general merchandise accounted for the biggest gains, while spending at restaurants and bars declined

While the retail sales report was largely positive, a drop in consumer sentiment signals caution. The University of Michigan’s consumer sentiment index unexpectedly declined to 58.6, down from 61.7 in July. Year-ahead inflation expectations also increased to 4.9%, up from 4.5%

13-F News: Hedge funds added exposure to tech companies like Microsoft and Netflix in Q2. Holdings in Microsoft increased by $12 billion during the quarter, making technology the largest sector allocation at 23% of total fund assets. Financials followed at 17%, while energy saw the smallest increase in exposure among all sectors

Meanwhile, Michael Burry was quite bullish, scooping up shares in Meta, Alibaba, and UnitedHealth Group

Starboard is revisiting its activist stake in Salesforce, increasing its stake by nearly 50%. Salesforce stock has been a massive laggard as investors worry that AI workflows could eat into the company’s offerings. Salesforce was an activist hotel in 2023 with Third Point, ValueAct, Inclusive Capital, Elliot Management, and Starboard all initially involved

Centerbridge tapped the private credit market for its buyout of MeridianLink - the software company will receive a $960mm TL at S+475 from lenders such as GSAM, Blackstone, and Ares

IG Bond Spreads hit 27-year low: FOMO regarding rate cuts has driven IG corporate bonds to 73bps spreads

More Crypto IPOs: Gemini has filed for an IPO, with the Winklevoss twins seeking to cash in on other crypto exchanges having success in the public markets. In 2024, Gemini had $142mm of Revenue, but negative EBITDA of -$13mm

CoreWeave’s lock-up period ended - $CRWV ( ▲ 4.89% ) shares dramatically fell -32% from Tuesday after 80% of locked-up Class A investors and employees have started monetizing their gains

Circle could be next, with a 10 million shares secondary offering spooking the market, and with their lock-up period ending two days after their 3Q earnings get released

Mother with cerebral palsy struggles to hire aides after private equity takeover: Missing paychecks, fewer hours, and reduced benefits have led to 80k consumers leaving the nation’s largest assistance program, which is now solely administered by PE firms

Scotiabank layoffs: The Canadian bank has been downsizing its US and APAC teams to refocus on Canada and Wealth Management

M&A Transactions💭

Polytec, distributor of water and wastewater treatment chemicals, has reached a definitive agreement to be acquired for $150.0M by Chemtrade Logistics (TSE: CHE.UN).

National Grid Grain LNG, operator of a liquefied natural gas terminal, has reached a definitive agreement to be acquired for GBP 1.5B by Centrica (LON: CNA) and Energy Capital Partners. The potential transaction comprises an estimate GGBP 1.1B of new non-recourse project finance debt and will see Centrica and Energy Capital Partners acquire a 50% stake each in the company for an estimated GBP 400.0M. EV/EBITDA was 9.46x and EV/Revenue was 5.66x.

The Ethernet Business of Marvell Technology (NAS: MRVL) was acquired by Infineon Technologies (ETR: IFX) for $2.5B. EV/Revenue was 10.53x. Qatalyst Partners advised on the sale.

H&T Group, a non-trading holding company providing pawnbroking services, was acquired for GBP 289.0M by FirstCash Holding (NAS: FCFS). Shore Capital Group advised on the sale.

For J, provider of software development and information technology, has reached a definitive agreement to be acquired for $300.0M by Transaction Media (TKS: 5258).

Deribit, developer of a cryptocurrency derivatives exchange platform, was acquired for $2.9B by Coinbase Global (NAS: COIN). Financial Technology Partners advised on the sale.

CyberCX, provider of cybersecurity services, has entered into a definitive agreement to be acquired for AUD 1.0B by Accenture. Goldman Sachs advised on the sale.

APA Solar, provider of solar racking and foundation solutions, was acquired for $179.0M by Array Technologies (NAS: ARRY). Donnelly Penman & Partners advised on the sale.

Amedisys (NAS: AMED), a healthcare services company, was acquired for $3.3B by UnitedHealth Group (NYS: UNH). EV/EBITDA was 14.48x and EV/Revenue was 1.37x. FGS Global and Guggenheim Partners advised on the sale.

Private Placement Transactions💭

Mesh, developer of a global crypto payments network, raised $130.0M of venture funding led by PayPal Ventures and Coinbase Ventures.

Cohere, developer of a natural language processing software, raised $500.0M of venture funding led by Radical Ventures and Inovia Capital at a pre-money valuation of $6.3B.

Cognition AI, developer of an AI software engineer, raised $500.0M of Series C venture funding led by Founder Fund at a pre-money valuation of $9.3B.

Odds of the Day 🍒

Kalshi traders are pricing in a 73% chance of 25bps rate cut in September

*New Traders on Kalshi receive a $20 bonus of trading credit when depositing $100+ with the code “HYH”.

Noteworthy Chart 🧭

2Q Private Credit deployment nosedived y/y, likely due to more competition and tariff related uncertainty.

Blue Owl BDC volume was -67% y/y

Blackstone Secured Lending Fund was -51% y/y

Ares Capital Corp was -33% y/y

Meme Cleanser 😆

Me listening to the earnings call of a company I own 1 share in

— no context succession (@corporatedudes)

12:03 PM • Aug 16, 2025

Seeing one of your buddies getting to work 100% remote during the last 2 weeks of August

— High Yield Harry (@HighyieldHarry)

9:44 PM • Aug 14, 2025

Until next time!

Housekeeping Items:

Our Weekly Poll:

How are we doing?Tell us how we're doing and any feedback you have |

Finance Jobs: Looking for a job in Finance? Join Buyside Hub to access the Job Board for free.

Access our Market Data: Our market data is sponsored by Koyfin, the best free financial analysis and visualization platform out there. Need premium analytics? Koyfin is offering Wall Street Rollup readers 15% off on any new sign-ups.

Autopilot Portfolio Update: High Yield Harry recently launched 4 portfolios on Autopilot including The Golden Age of Private Credit portfolio and the Tariff Trade portfolio. You can autopilot my trades and strategies by signing up here.

Recruit for Investment Banking: High Yield Harry and a group of Investment Bankers put together a 248 page deck for those recruiting for Investment Banking - sign up for free here to learn more about our decks.

Join beehiiv: Looking to start your own newsletter? Join beehiiv through us and you’ll get 30 days free and 3 months of a 20% discount.

Finance Merch Referrals ☕️

Enjoyed the newsletter? Send it to a friend 🤝

Obviously, none of this constitutes financial or investment advice. *Today’s Odds of the Day is in paid partnership with Kalshi Inc.

Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.